Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To hedge your company's risk exposure, you are buying reinsurance from another Insurance company just in case some of your policy holders die early.

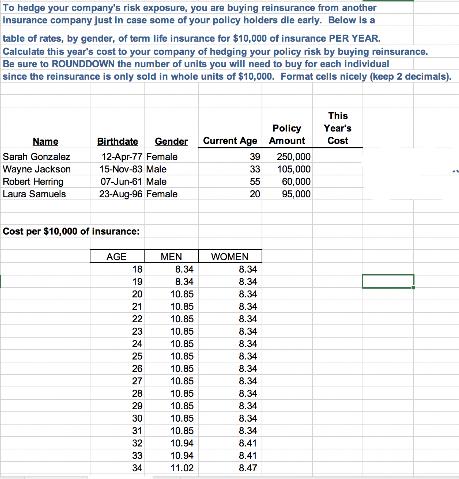

To hedge your company's risk exposure, you are buying reinsurance from another Insurance company just in case some of your policy holders die early. Below is a table of rates, by gender, of term life insurance for $10,000 of insurance PER YEAR. Calculate this year's cost to your company of hedging your policy risk by buying reinsurance. Be sure to ROUNDDOWN the number of units you will need to buy for each individual since the reinsurance is only sold in whole units of $10,000. Format cells nicely (keep 2 decimals). Name Sarah Gonzalez Wayne Jackson Robert Herring Laura Samuels Birthdate Gender 12-Apr-77 Female 15-Nov-83 Male 07-Jun-61 Male 23-Aug-96 Female Cost per $10,000 of insurance: AGE 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 MEN 8.34 8.34 10.85 10.85 10.85 10.85 10.85 10.85 10.85 10.85 10.85 10.85 10.85 10.85 10.94 10.94 11.02 Current Age 39 33 WOMEN 55 20 8.34 8.34 8.34 8.34 8.34 8.34 8.34 8.34 8.34 8.34 8.34 8.34 8.34 8.34 8.41 8.41 8.47 Policy Amount 250,000 105,000 60,000 95,000 This Year's Cost

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the cost of hedging the policy risk by buying reinsurance we need to determine ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started