Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Today you observe the following NYMEX Natural Gas (NG) futures prices, and discount factors associated with each payment date: 2.551 0.9962 2.713 0.9918 2.95

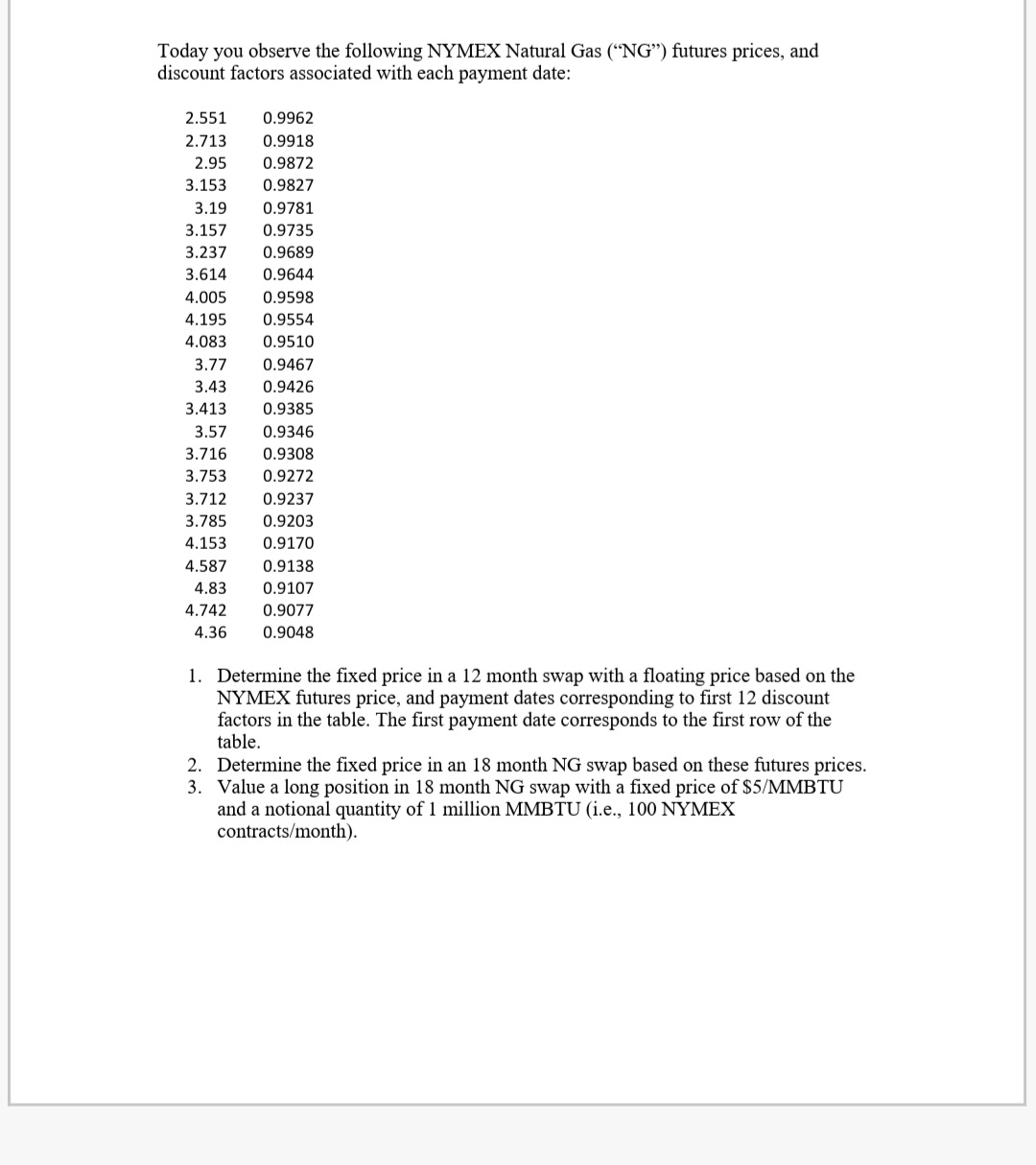

Today you observe the following NYMEX Natural Gas ("NG") futures prices, and discount factors associated with each payment date: 2.551 0.9962 2.713 0.9918 2.95 0.9872 3.153 0.9827 3.19 0.9781 3.157 0.9735 3.237 0.9689 3.614 0.9644 4.005 0.9598 4.195 0.9554 4.083 0.9510 3.77 0.9467 3.43 0.9426 3.413 0.9385 3.57 0.9346 3.716 0.9308 3.753 0.9272 3.712 0.9237 3.785 0.9203 4.153 0.9170 4.587 4.83 4.742 4.36 0.9138 0.9107 0.9077 0.9048 1. Determine the fixed price in a 12 month swap with a floating price based on the NYMEX futures price, and payment dates corresponding to first 12 discount factors in the table. The first payment date corresponds to the first row of the table. 2. Determine the fixed price in an 18 month NG swap based on these futures prices. 3. Value a long position in 18 month NG swap with a fixed price of $5/MMBTU and a notional quantity of 1 million MMBTU (i.e., 100 NYMEX contracts/month).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the fixed price for the swaps and value the long position well first need to calculate the forward prices implied by the given NYMEX Natu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started