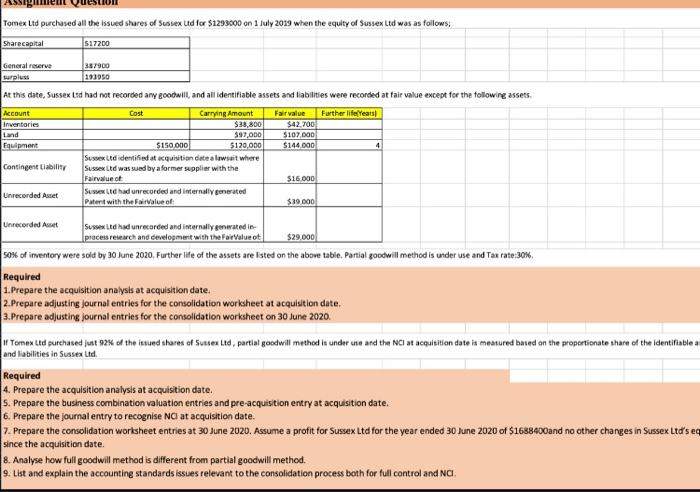

Tomex Ltd purchased all the issued shares of Sussex ud for $1293000 on 1 July 2019 when the equity of Sussex Ltd was as follows: Sharecapital 517200 General reserve 387900 wrplus 193950 At this date, Sussex Lad had not recorded any goodwilt, and all identifiable assets and liabilities were recorded at fair value except for the following assets. Account Cost Carrying Amount Fair value Further life Yeats! Inventories $38,800 $42.700 Land $97,000 $107.000 Equipment $150.000 $120,000 $144.000 Sussex Ltd identified acquisition date a lawsuit where Contingent Liability Sussex Ltd was sued by a former supplier with the Farwalue of $16000 Unrecorded At Sussex Ltd had recorded and internally generated Patent with the FaitValue of $39.000 $29.000 Unrecorded At Sussex Ltd had unrecorded and internally generated in process research and development with the FarValueot 50% of inventory were sold by 30 June 2020. Further life of the assets are listed on the above table. Partial goodwill method is under use and Tax rate:30% Required 1. Prepare the acquisition analysis at acquisition date. 2. Prepare adjusting journal entries for the consolidation worksheet at acquisition date. 3.Prepare adjusting journal entries for the consolidation worksheet on 30 June 2020. Tomex Ltd purchased just 92% of the issued shares of Sutter lid, partlat goodwill method is under une and the NCI at acquisition date is measured bated an the proportionate thare of the identifiable a and liabilities in Sussex Ltd Required 4. Prepare the acquisition analysis at acquisition date. 5. Prepare the business combination valuation entries and pre-acquisition entry at acquisition date. 6. Prepare the journal entry to recognise NC at acquisition date. 7. Prepare the consolidation worksheet entries at 30 June 2020. Assume a profit for Sussex Ltd for the year ended 30 June 2020 of $1688400and no other changes in Sussex Ltd's ea since the acquisition date. 8. Analyse how full goodwill method is different from partial goodwill method. 9. List and explain the accounting standards issues relevant to the consolidation process both for full control and NC Tomex Ltd purchased all the issued shares of Sussex ud for $1293000 on 1 July 2019 when the equity of Sussex Ltd was as follows: Sharecapital 517200 General reserve 387900 wrplus 193950 At this date, Sussex Lad had not recorded any goodwilt, and all identifiable assets and liabilities were recorded at fair value except for the following assets. Account Cost Carrying Amount Fair value Further life Yeats! Inventories $38,800 $42.700 Land $97,000 $107.000 Equipment $150.000 $120,000 $144.000 Sussex Ltd identified acquisition date a lawsuit where Contingent Liability Sussex Ltd was sued by a former supplier with the Farwalue of $16000 Unrecorded At Sussex Ltd had recorded and internally generated Patent with the FaitValue of $39.000 $29.000 Unrecorded At Sussex Ltd had unrecorded and internally generated in process research and development with the FarValueot 50% of inventory were sold by 30 June 2020. Further life of the assets are listed on the above table. Partial goodwill method is under use and Tax rate:30% Required 1. Prepare the acquisition analysis at acquisition date. 2. Prepare adjusting journal entries for the consolidation worksheet at acquisition date. 3.Prepare adjusting journal entries for the consolidation worksheet on 30 June 2020. Tomex Ltd purchased just 92% of the issued shares of Sutter lid, partlat goodwill method is under une and the NCI at acquisition date is measured bated an the proportionate thare of the identifiable a and liabilities in Sussex Ltd Required 4. Prepare the acquisition analysis at acquisition date. 5. Prepare the business combination valuation entries and pre-acquisition entry at acquisition date. 6. Prepare the journal entry to recognise NC at acquisition date. 7. Prepare the consolidation worksheet entries at 30 June 2020. Assume a profit for Sussex Ltd for the year ended 30 June 2020 of $1688400and no other changes in Sussex Ltd's ea since the acquisition date. 8. Analyse how full goodwill method is different from partial goodwill method. 9. List and explain the accounting standards issues relevant to the consolidation process both for full control and NC