Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tonya and Philip are married, Philip has designated Tonya as his power of attorney for personal care. Both Tonya and Philip are in great health,

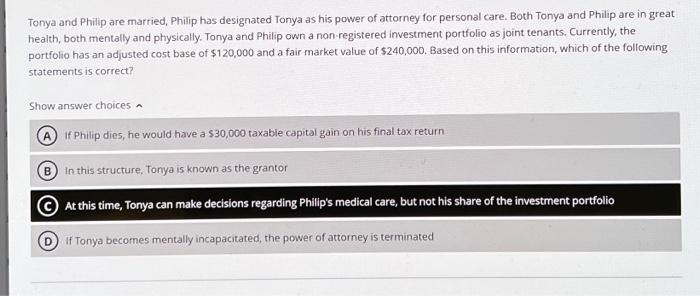

Tonya and Philip are married, Philip has designated Tonya as his power of attorney for personal care. Both Tonya and Philip are in great health, both mentally and physically. Tonya and Philip own a non-registered investment portfolio as joint tenants. Currently, the portfolio has an adjusted cost base of $120,000 and a fair market value of $240,000. Based on this information, which of the following statements is correct?

A. If Philip dies, he would have a $30,000 taxable capital gain on his final tax return

B. In this structure, Tonya is known as the grantor

c. At this time, Tonya can make decisions regarding Philip's medical care, but not his share of the investment portfolio

d. If Tonya becomes mentally incapacitated, the power of attorney is terminated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started