Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Top management of Cabo company is considering two alternative capital structures for 2025. The first (the no debt structure) would be to have $1,000,000 in

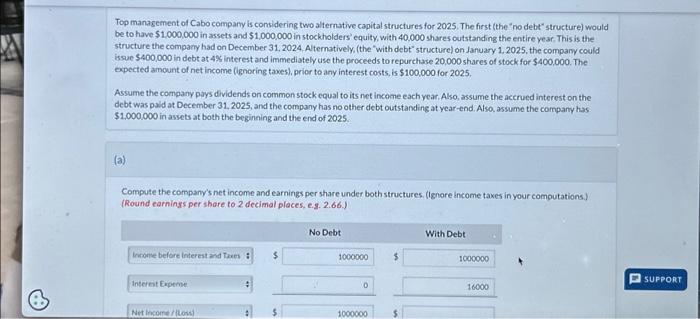

Top management of Cabo company is considering two alternative capital structures for 2025. The first (the "no debt" structure) would be to have $1,000,000 in assets and $1,000,000 in stockholders' equity, with 40,000 shares outstanding the entire year. This is the structure the company had on December 31, 2024. Alternatively, (the "with debt" structure) on January 1, 2025, the company could issue $400,000 in debt at 4% interest and immediately use the proceeds to repurchase 20,000 shares of stock for $400,000. The expected amount of net income (ignoring taxes), prior to any interest costs, is $100,000 for 2025. Assume the company pays dividends on common stock equal to its net income each year. Also, assume the accrued interest on the debt was paid at December 31, 2025, and the company has no other debt outstanding at year-end. Also, assume the company has $1,000,000 in assets at both the beginning and the end of 2025. (a) Compute the company's net income and earnings per share under both structures. (Ignore income taxes in your computations.) (Round earnings per share to 2 decimal places, e.g. 2.66.) Income before Interest and Taxes Interest Expense Net Income /(Loss) + + $ $ No Debt 1000000 0 1000000 $ LA With Debt 1000000 16000 SUPPORT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started