Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TPT is a Canadian public company founded in 2007 that manufactures solar panels and has a December 31, 2023 year end. TPT sells solar

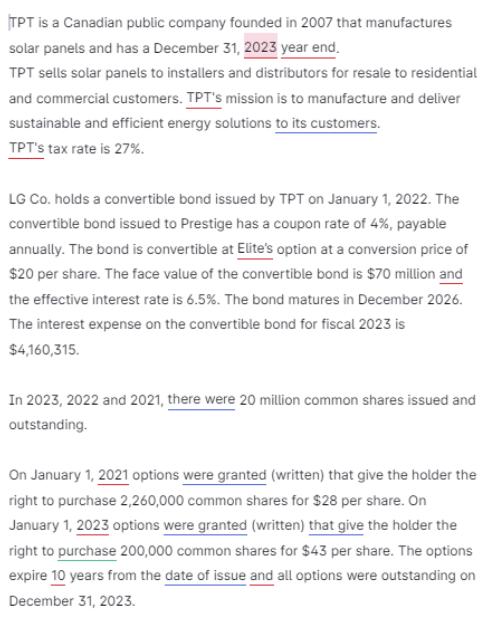

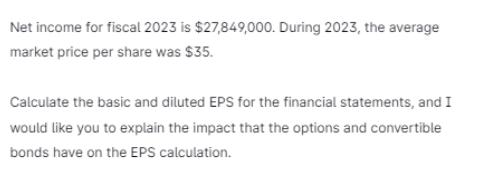

TPT is a Canadian public company founded in 2007 that manufactures solar panels and has a December 31, 2023 year end. TPT sells solar panels to installers and distributors for resale to residential and commercial customers. TPT's mission is to manufacture and deliver sustainable and efficient energy solutions to its customers. TPT's tax rate is 27%. LG Co. holds a convertible bond issued by TPT on January 1, 2022. The convertible bond issued to Prestige has a coupon rate of 4%, payable annually. The bond is convertible at Elite's option at a conversion price of $20 per share. The face value of the convertible bond is $70 million and the effective interest rate is 6.5%. The bond matures in December 2026. The interest expense on the convertible bond for fiscal 2023 is $4,160,315. In 2023, 2022 and 2021, there were 20 million common shares issued and outstanding. On January 1, 2021 options were granted (written) that give the holder the right to purchase 2,260,000 common shares for $28 per share. On January 1, 2023 options were granted (written) that give the holder the right to purchase 200,000 common shares for $43 per share. The options expire 10 years from the date of issue and all options were outstanding on December 31, 2023. Net income for fiscal 2023 is $27,849,000. During 2023, the average market price per share was $35. Calculate the basic and diluted EPS for the financial statements, and I would like you to explain the impact that the options and convertible bonds have on the EPS calculation.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate both basic and diluted Earnings Per Share EPS we need to consider the impact of options and convertible bonds on the number of common sha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started