Answered step by step

Verified Expert Solution

Question

1 Approved Answer

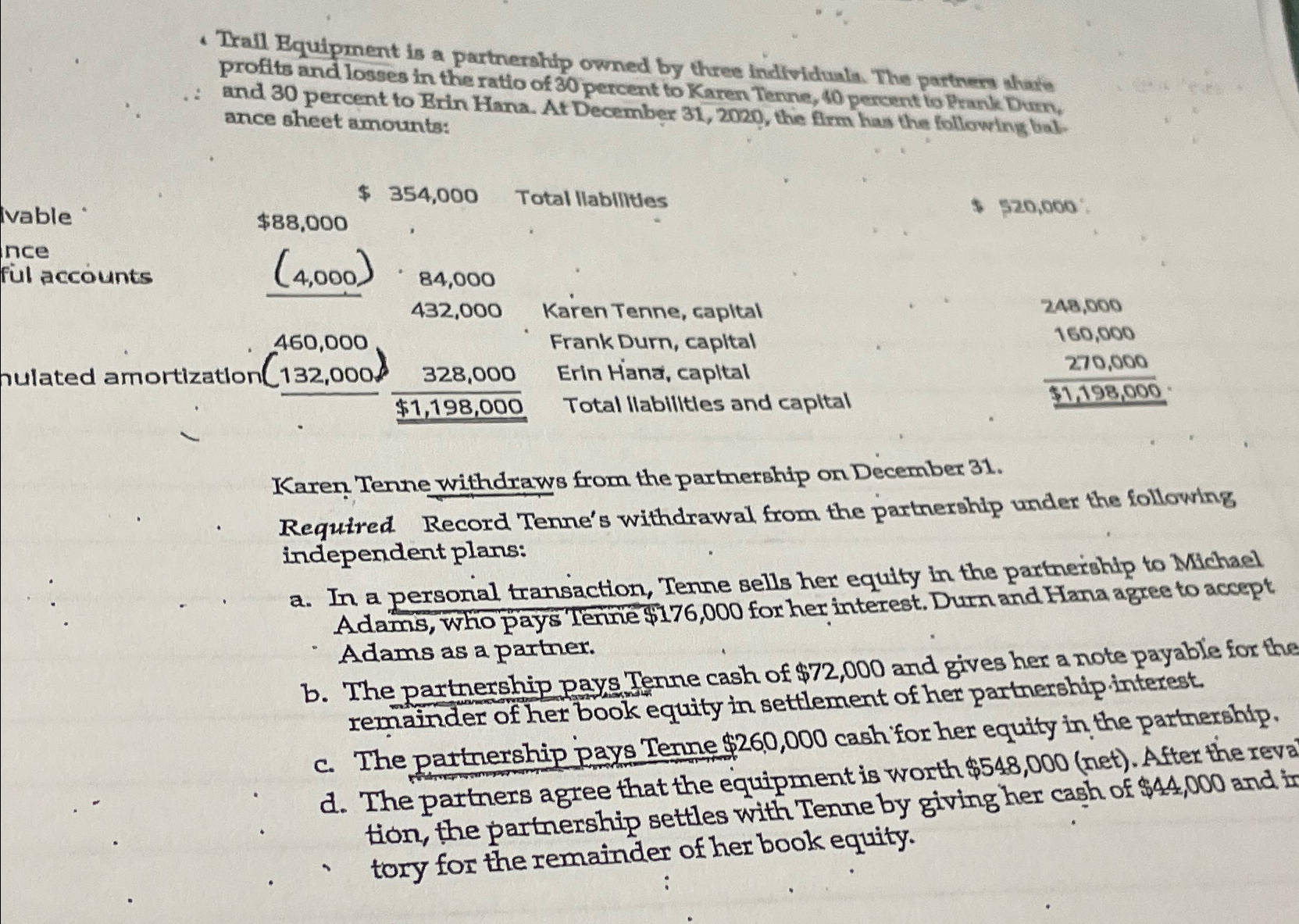

Trail equipment is a Trall Equipment is a partnership owned by three individuala. The partners ahate profits and losses in the ratio of 3 0

Trail equipment is a Trall Equipment is a partnership owned by three individuala. The partners ahate profits and losses in the ratio of percent to Karen Tenne, percent to Prank Dum, : and percent to Brin Hana. At December the firm has the following bal. ance sheet amounts:

Karen Tenne withdraws from the partnership on December

Required Record Tenne's withdrawal from the partnership under the following independent plans:

a In a personal transaction, Tenne sells her equity in the partnership to Michael Adams, who pays Tenne $ for her interest. Dum and Hana agree to accept Adams as a partner.

b The partnership pays Tenre cash of $ and gives her a note payable for the remainder of her book equity in settlement of her partnership. interest.

c The patmership pays Tenne $ cash for her equity in the partnership.

d The partners agree that the equipment is worth $net After the reva tion, the partnership settles with Tenne by giving her cash of $ and in tory for the remainder of her book equity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started