Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the spread for (a) a first-to-default CDS and (b) a second-to-default CD. Please show working Example 25.3 Consider a portfolio consisting of 10

What is the spread for (a) a first-to-default CDS and (b) a second-to-default CD. Please show working

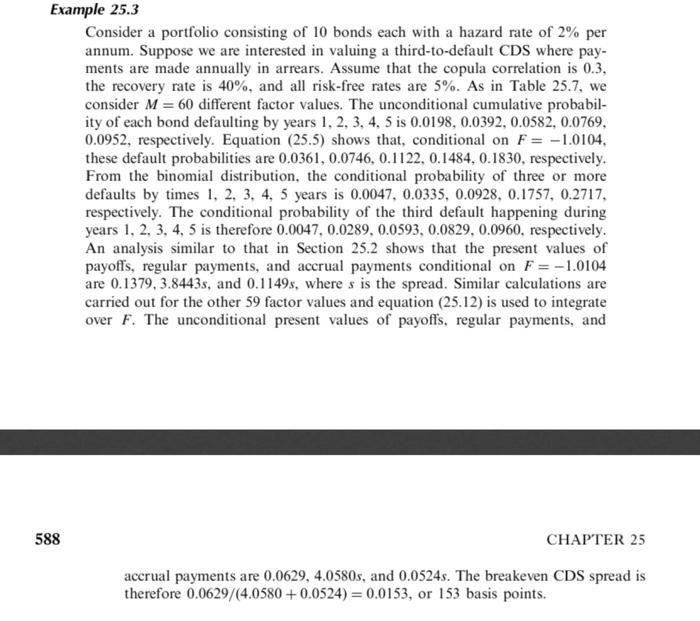

Example 25.3 Consider a portfolio consisting of 10 bonds each with a hazard rate of 2% per annum. Suppose we are interested in valuing a third-to-default CDS where pay- ments are made annually in arrears. Assume that the copula correlation is 0.3, the recovery rate is 40%, and all risk-free rates are 5%. As in Table 25.7, we consider M = 60 different factor values. The unconditional cumulative probabil- ity of each bond defaulting by years 1, 2, 3, 4, 5 is 0.0198, 0.0392, 0.0582, 0.0769, 0.0952, respectively. Equation (25.5) shows that, conditional on F= -1.0104, these default probabilities are 0.0361, 0.0746, 0.1122, 0.1484, 0.1830, respectively. From the binomial distribution, the conditional probability of three or more defaults by times 1, 2, 3, 4, 5 years is 0.0047, 0.0335, 0.0928, 0.1757, 0.2717, respectively. The conditional probability of the third default happening during years 1, 2, 3, 4, 5 is therefore 0.0047, 0.0289, 0.0593, 0.0829, 0.0960, respectively. An analysis similar to that in Section 25.2 shows that the present values of payoffs, regular payments, and accrual payments conditional on F= -1.0104 are 0.1379, 3.8443s, and 0.1149s, where s is the spread. Similar calculations are carried out for the other 59 factor values and equation (25.12) is used to integrate over F. The unconditional present values of payoffs, regular payments, and 588 CHAPTER 25 accrual payments are 0.0629, 4.0580s, and 0.0524s. The breakeven CDS spread is therefore 0.0629/(4.0580+ 0.0524) = 0.0153, or 153 basis points.

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started