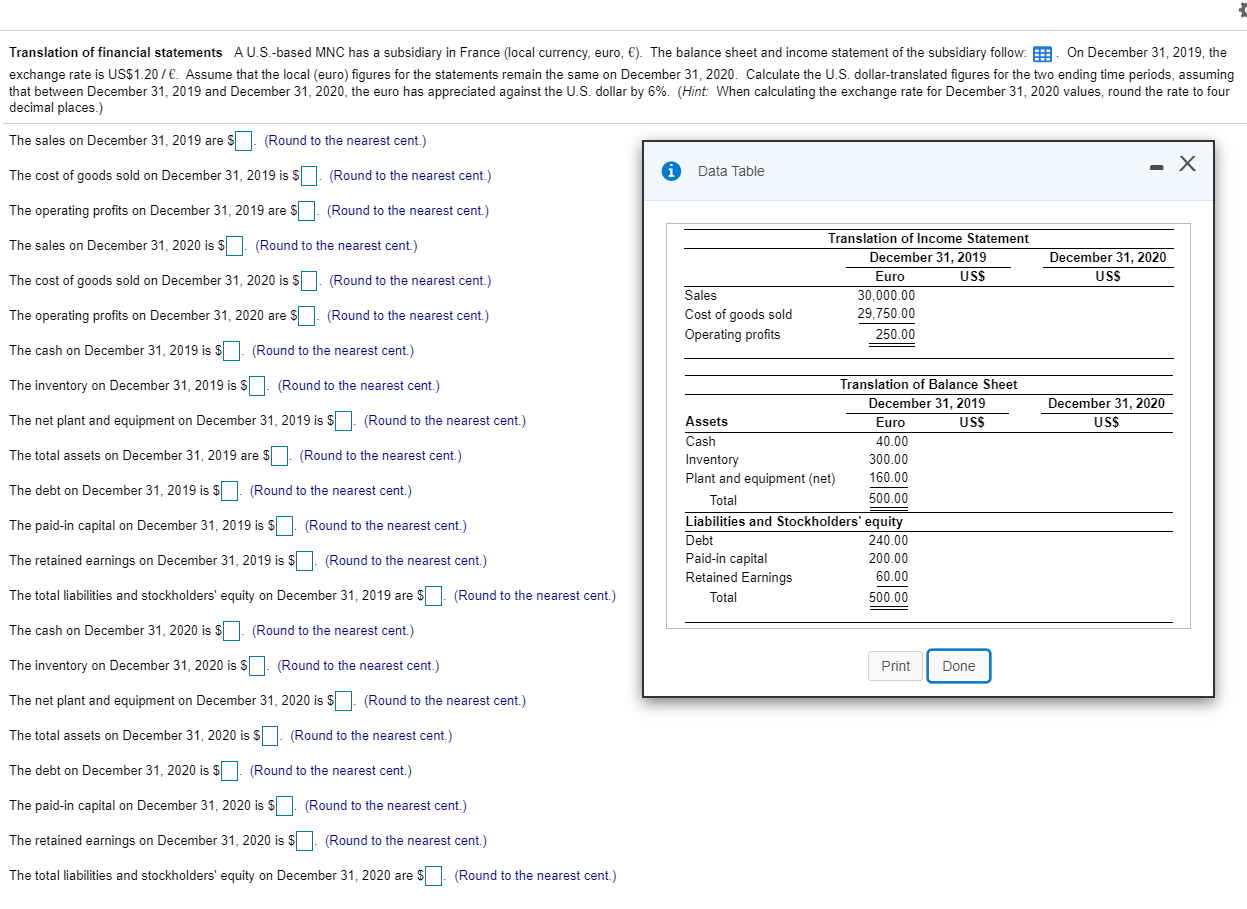

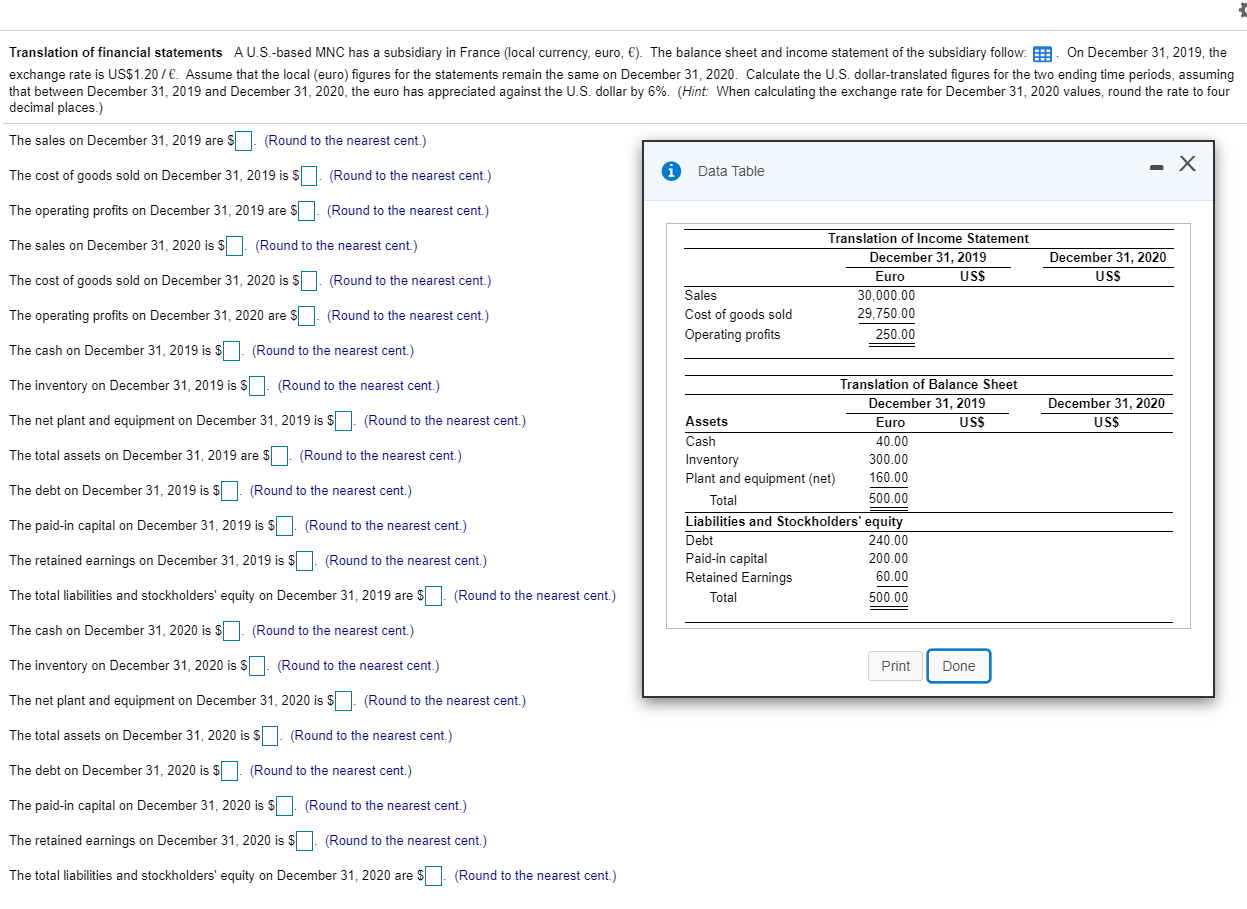

Translation of financial statements A U.S.-based MNC has a subsidiary in France (local currency, euro, ). The balance sheet and income statement of the subsidiary follow: On December 31, 2019, the exchange rate is US$1.20 / . Assume that the local (euro) figures for the statements remain the same on December 31, 2020. Calculate the U.S. dollar-translated figures for the two ending time periods, assuming that between December 31, 2019 and December 31, 2020, the euro has appreciated against the U.S. dollar by 6%. (Hint: When calculating the exchange rate for December 31, 2020 values, round the rate to four decimal places.) The sales on December 31, 2019 are $ (Round to the nearest cent.) The cost of goods sold on December 31, 2019 is $17. (Round to the nearest cent.) i Data Table The operating profits on December 31, 2019 are $ . (Round to the nearest cent) The sales on December 31, 2020 is $7. (Round to the nearest cent.) December 31, 2020 US$ The cost of goods sold on December 31, 2020 is $ . (Round to the nearest cent.) Translation of Income Statement December 31, 2019 Euro US$ 30,000.00 29,750.00 250.00 The operating profits on December 31, 2020 are 5 Sales Cost of goods sold Operating profits (Round to the nearest cent.) The cash on December 31, 2019 is $ . (Round to the nearest cent.) The inventory on December 31, 2019 is $ . (Round to the nearest cent.) The net plant and equipment on December 31, 2019 is $ . (Round to the nearest cent.) December 31, 2020 US$ The total assets on December 31, 2019 are $ . (Round to the nearest cent.) The debt on December 31, 2019 is $ . (Round to the nearest cent.) Translation of Balance Sheet December 31, 2019 Assets Euro US$ Cash 40.00 Inventory 300.00 Plant and equipment (net) 160.00 Total 500.00 Liabilities and Stockholders' equity Debt 240.00 Paid-in capital 200.00 Retained Earnings 60.00 Total 500.00 The paid-in capital on December 31, 2019 is $ . (Round to the nearest cent.) The retained earnings on December 31, 2019 is $ . (Round to the nearest cent.) The total liabilities and stockholders' equity on December 31, 2019 are $ - (Round to the nearest cent.) The cash on December 31, 2020 is $ . (Round to the nearest cent.) The inventory on December 31, 2020 is $ . (Round to the nearest cent.) Print Done The net plant and equipment on December 31, 2020 is $ . (Round to the nearest cent.) The total assets on December 31, 2020 is $17. (Round to the nearest cent.) The debt on December 31, 2020 is $ . (Round to the nearest cent.) The paid-in capital on December 31, 2020 is $ . (Round to the nearest cent.) The retained earnings on December 31, 2020 is $. (Round to the nearest cent) The total liabilities and stockholders' equity on December 31, 2020 are $ - (Round to the nearest cent.)