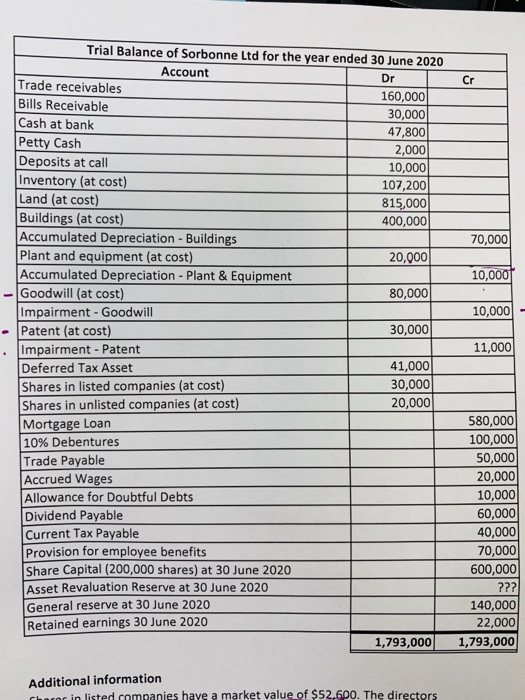

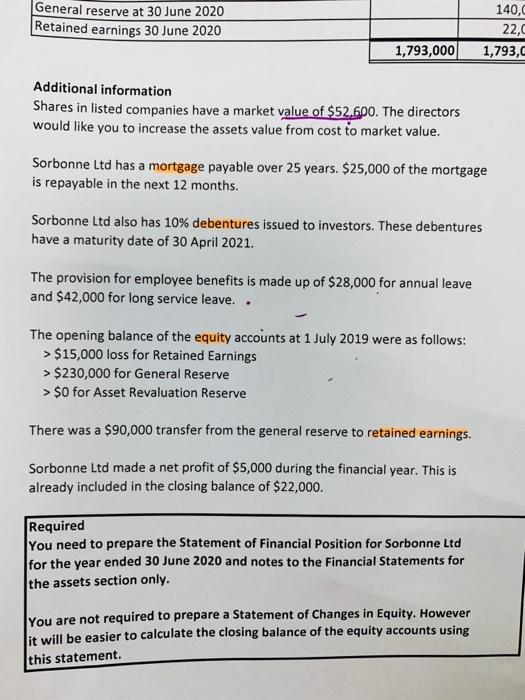

Trial Balance of Sorbonne Ltd for the year ended 30 June 2020 Account Dr Cr Trade receivables 160,000 30,000 Bills Receivable Cash at bank Petty Cash Deposits at call Inventory (at cost) Land (at cost) Buildings (at cost) Accumulated Depreciation-Buildings Plant and equipment (at cost) Accumulated Depreciation Plant & Equipment Goodwill (at cost) Impairment -Goodwill Patent (at cost) 47,800 2,000 10,000 107,200 815,000 400,000 70,000 20,000 10,000 80,000 10,000 30,000 Impairment- Patent Deferred Tax Asset Shares in listed companies (at cost) Shares in unlisted companies (at cost) Mortgage Loan 10% Debentures Trade Payable Accrued Wages 11,000 41,000 30,000 20,000 580,000 100,000 50,000 20,000 10,000 Allowance for Doubtful Debts 60,000 Dividend Payable Current Tax Payable Provision for employee benefits Share Capital (200,000 shares) at 30 June 2020 Asset Revaluation Reserve at 30 June 2020 General reserve at 30 June 2020 Retained earnings 30 June 2020 40,000 70,000 600,000 ??? 140,000 22,000 1,793,000 1,793,000 Additional information Charoc in listed companies have a market value of $52,600. The directors General reserve at 30 June 2020 Retained earnings 30 June 2020 140,C 22,0 1,793,000 1,793, Additional information Shares in listed companies have a market value of $52,600. The directo rs would like you to increase the assets value from cost to market value. Sorbonne Ltd has a mortgage payable over 25 years. $25,000 of the mortgage is repayable in the next 12 months. Sorbonne Ltd also has 10 % debentures issued to investors. These debentures have a maturity date of 30 April 2021 The provision for employee benefits is made up of $28,000 for annual leave and $42,000 for long service leave. The opening balance of the equity accounts at 1 July 2019 were as follows: > $15,000 loss for Retained Earnings > $230,000 for General Reserve >$0 for Asset Revaluation Reserve There was a $90,000 transfer from the general reserve to retained earnings. Sorbonne Ltd made a net profit of $5,000 during the financial year. This is already included in the closing balance of $22,000. Required You need to prepare the Statement of Financial Position for Sorbonne Ltd for the year ended 30 June 2020 and notes to the Financial Statements for the assets section only. You are not required to prepare a Statement of Changes in Equity. However it will be easier to calculate the closing balance of the equity accounts using this statement. Trial Balance of Sorbonne Ltd for the year ended 30 June 2020 Account Dr Cr Trade receivables 160,000 30,000 Bills Receivable Cash at bank Petty Cash Deposits at call Inventory (at cost) Land (at cost) Buildings (at cost) Accumulated Depreciation-Buildings Plant and equipment (at cost) Accumulated Depreciation Plant & Equipment Goodwill (at cost) Impairment -Goodwill Patent (at cost) 47,800 2,000 10,000 107,200 815,000 400,000 70,000 20,000 10,000 80,000 10,000 30,000 Impairment- Patent Deferred Tax Asset Shares in listed companies (at cost) Shares in unlisted companies (at cost) Mortgage Loan 10% Debentures Trade Payable Accrued Wages 11,000 41,000 30,000 20,000 580,000 100,000 50,000 20,000 10,000 Allowance for Doubtful Debts 60,000 Dividend Payable Current Tax Payable Provision for employee benefits Share Capital (200,000 shares) at 30 June 2020 Asset Revaluation Reserve at 30 June 2020 General reserve at 30 June 2020 Retained earnings 30 June 2020 40,000 70,000 600,000 ??? 140,000 22,000 1,793,000 1,793,000 Additional information Charoc in listed companies have a market value of $52,600. The directors General reserve at 30 June 2020 Retained earnings 30 June 2020 140,C 22,0 1,793,000 1,793, Additional information Shares in listed companies have a market value of $52,600. The directo rs would like you to increase the assets value from cost to market value. Sorbonne Ltd has a mortgage payable over 25 years. $25,000 of the mortgage is repayable in the next 12 months. Sorbonne Ltd also has 10 % debentures issued to investors. These debentures have a maturity date of 30 April 2021 The provision for employee benefits is made up of $28,000 for annual leave and $42,000 for long service leave. The opening balance of the equity accounts at 1 July 2019 were as follows: > $15,000 loss for Retained Earnings > $230,000 for General Reserve >$0 for Asset Revaluation Reserve There was a $90,000 transfer from the general reserve to retained earnings. Sorbonne Ltd made a net profit of $5,000 during the financial year. This is already included in the closing balance of $22,000. Required You need to prepare the Statement of Financial Position for Sorbonne Ltd for the year ended 30 June 2020 and notes to the Financial Statements for the assets section only. You are not required to prepare a Statement of Changes in Equity. However it will be easier to calculate the closing balance of the equity accounts using this statement