Answered step by step

Verified Expert Solution

Question

1 Approved Answer

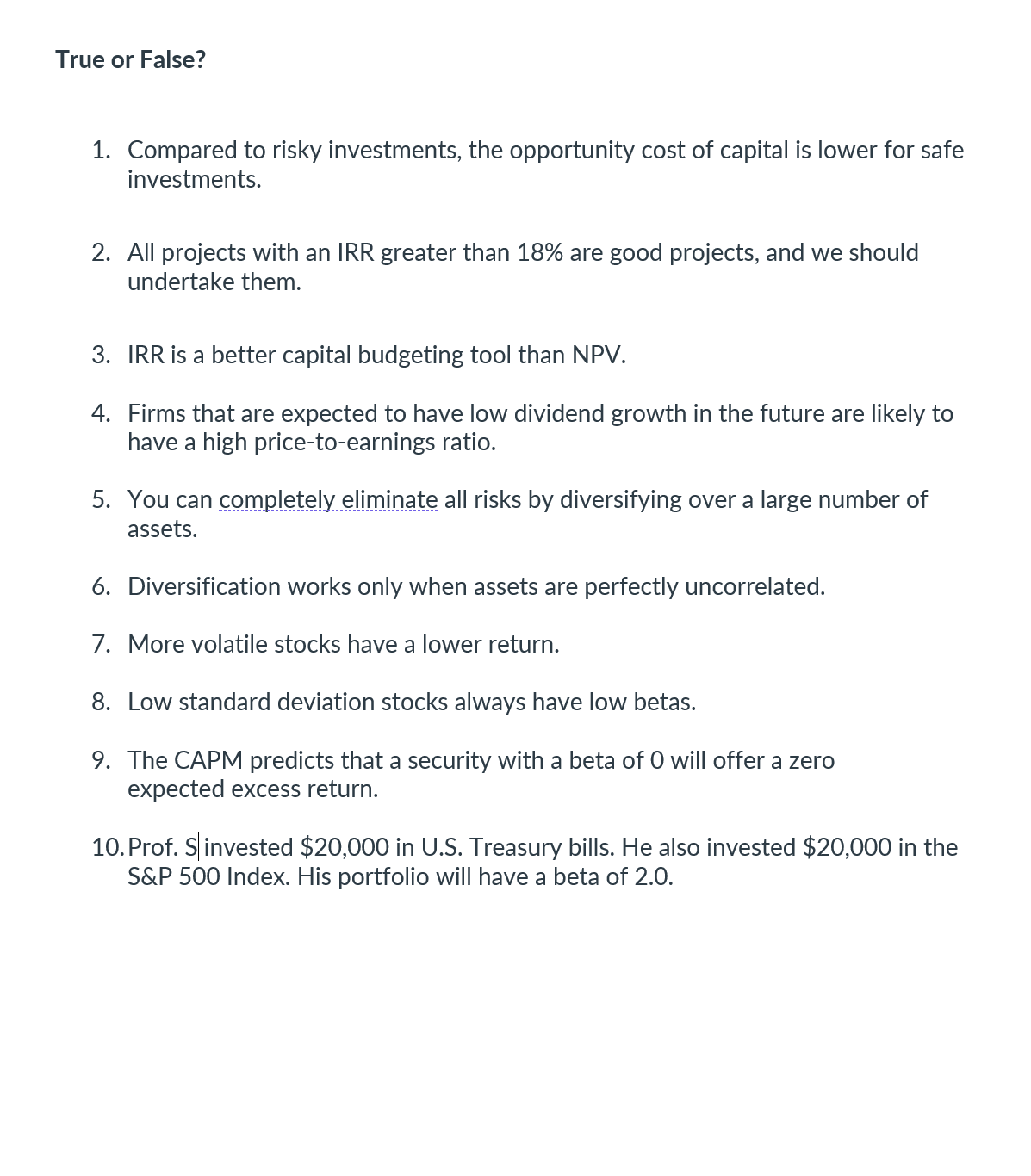

True or False? 1. Compared to risky investments, the opportunity cost of capital is lower for safe investments. 2. All projects with an IRR

True or False? 1. Compared to risky investments, the opportunity cost of capital is lower for safe investments. 2. All projects with an IRR greater than 18% are good projects, and we should undertake them. 3. IRR is a better capital budgeting tool than NPV. 4. Firms that are expected to have low dividend growth in the future are likely to have a high price-to-earnings ratio. 5. You can completely eliminate all risks by diversifying over a large number of assets. 6. Diversification works only when assets are perfectly uncorrelated. 7. More volatile stocks have a lower return. 8. Low standard deviation stocks always have low betas. 9. The CAPM predicts that a security with a beta of 0 will offer a zero expected excess return. 10. Prof. Sinvested $20,000 in U.S. Treasury bills. He also invested $20,000 in the S&P 500 Index. His portfolio will have a beta of 2.0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 False Generally the opportunity cost of capital is higher for safe investments compared to risky i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started