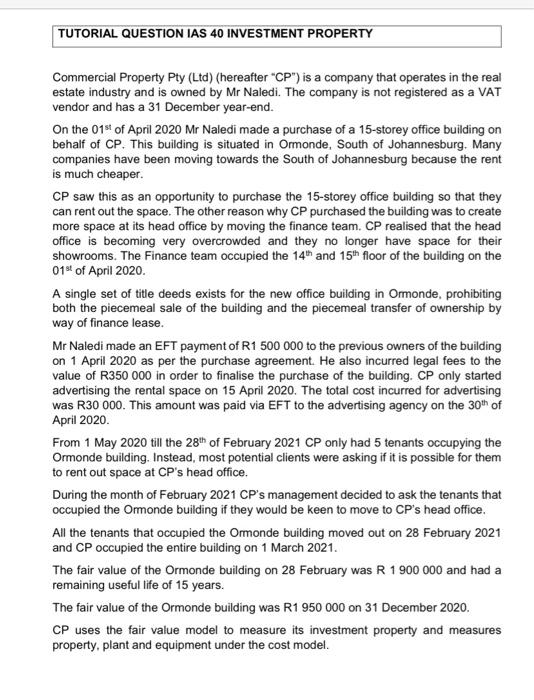

TUTORIAL QUESTION IAS 40 INVESTMENT PROPERTY Commercial Property Pty (Ltd) (hereafter "CP") is a company that operates in the real estate industry and is owned by Mr Naledi. The company is not registered as a VAT vendor and has a 31 December year-end. On the 01st of April 2020Mr Naledi made a purchase of a 15-storey office building on behalf of CP. This building is situated in Ormonde, South of Johannesburg. Many companies have been moving towards the South of Johannesburg because the rent is much cheaper. CP saw this as an opportunity to purchase the 15-storey office building so that they can rent out the space. The other reason why CP purchased the building was to create more space at its head office by moving the finance team. CP realised that the head office is becoming very overcrowded and they no longer have space for their showrooms. The Finance team occupied the 14th and 15th floor of the building on the 01st of April 2020. A single set of title deeds exists for the new office building in Ormonde, prohibiting both the piecemeal sale of the building and the piecemeal transfer of ownership by way of finance lease. Mr Naledi made an EFT payment of R1 500000 to the previous owners of the building on 1 April 2020 as per the purchase agreement. He also incurred legal fees to the value of R350 000 in order to finalise the purchase of the building. CP only started advertising the rental space on 15 April 2020. The total cost incurred for advertising was R30 000. This amount was paid via EFT to the advertising agency on the 30th of April 2020. From 1 May 2020 till the 28th of February 2021CP only had 5 tenants occupying the Ormonde building. Instead, most potential clients were asking if it is possible for them to rent out space at CP's head office. During the month of February 2021 CP's management decided to ask the tenants that occupied the Ormonde building if they would be keen to move to CP's head office. All the tenants that occupied the Ormonde building moved out on 28 February 2021 and CP occupied the entire building on 1 March 2021. The fair value of the Ormonde building on 28 February was R 1900000 and had a remaining useful life of 15 years. The fair value of the Ormonde building was R1 950000 on 31 December 2020. CP uses the fair value model to measure its investment property and measures property, plant and equipment under the cost model. B) [20] Prepare all the necessary journal entries from the 01st of April 2020 to the 31st of December 2021 in the books of CP. Assuming that the new building in Ormonde should be classified as investment property on the 01st of April 2020. Dates and narrations are required