Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your friend is a Pharmacist and is trying to draw up his financial statements. The financial year- end of the business is 30 June

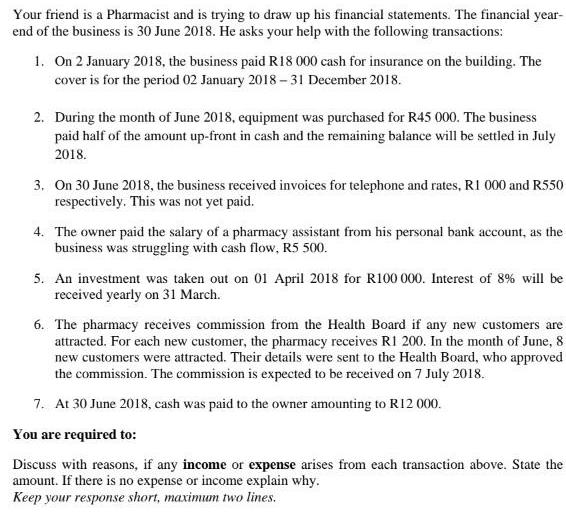

Your friend is a Pharmacist and is trying to draw up his financial statements. The financial year- end of the business is 30 June 2018. He asks your help with the following transactions: 1. On 2 January 2018, the business paid R18 000 cash for insurance on the building. The cover is for the period 02 January 2018 - 31 December 2018. 2. During the month of June 2018, equipment was purchased for R45 000. The business paid half of the amount up-front in cash and the remaining balance will be settled in July 2018. 3. On 30 June 2018, the business received invoices for telephone and rates, R1 000 and R550 respectively. This was not yet paid. 4. The owner paid the salary of a pharmacy assistant from his personal bank account, as the business was struggling with cash flow, R5 500. 5. An investment was taken out on 01 April 2018 for R100 000. Interest of 8% will be received yearly on 31 March. 6. The pharmacy receives commission from the Health Board if any new customers are attracted. For each new customer, the pharmacy receives R1 200. In the month of June, 8 new customers were attracted. Their details were sent to the Health Board, who approved the commission. The commission is expected to be received on 7 July 2018. 7. At 30 June 2018, cash was paid to the owner amounting to R12 000. You are required to: Discuss with reasons, if any income or expense arises from each transaction above. State the amount. If there is no expense or income explain why. Keep your response short, maximum two lines.

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Transaction 1 2 3 4 5 6 7 Treatment Recognized as Expense ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started