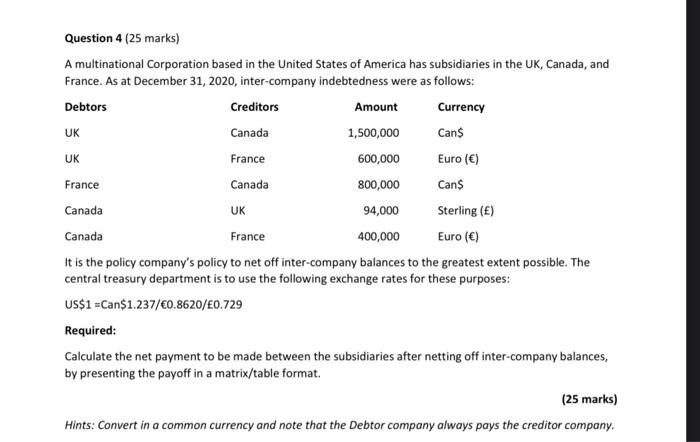

Question: UK UK Question 4 (25 marks) A multinational Corporation based in the United States of America has subsidiaries in the UK, Canada, and France. As

UK UK Question 4 (25 marks) A multinational Corporation based in the United States of America has subsidiaries in the UK, Canada, and France. As at December 31, 2020, inter-company indebtedness were as follows: Debtors Creditors Amount Currency UK Canada 1,500,000 Cans France 600,000 Euro () France Canada 800,000 Cans Canada 94,000 Sterling () Canada France 400,000 Euro () It is the policy company's policy to net off inter-company balances to the greatest extent possible. The central treasury department is to use the following exchange rates for these purposes: US$1 =Can$1.237/0.8620/0.729 Required: Calculate the net payment to be made between the subsidiaries after netting off inter-company balances, by presenting the payoff in a matrix/table format (25 marks) Hints: Convert in a common currency and note that the Debtor company always pays the creditor company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts