undefined

undefined

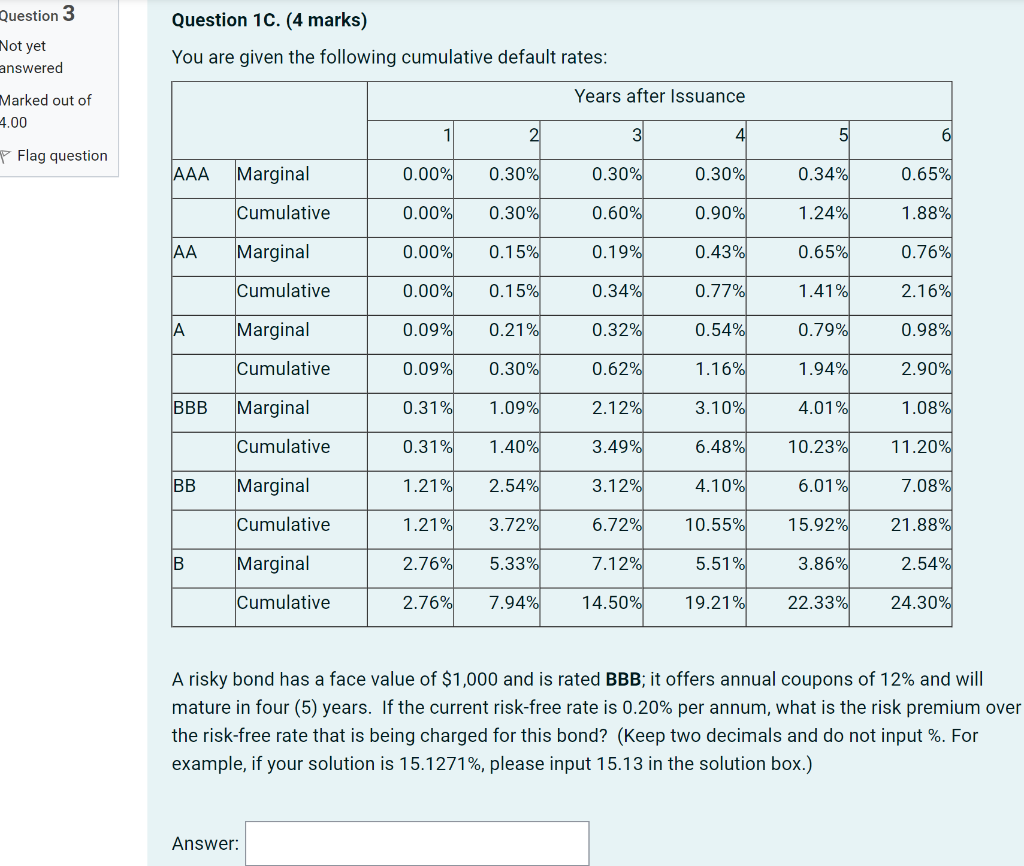

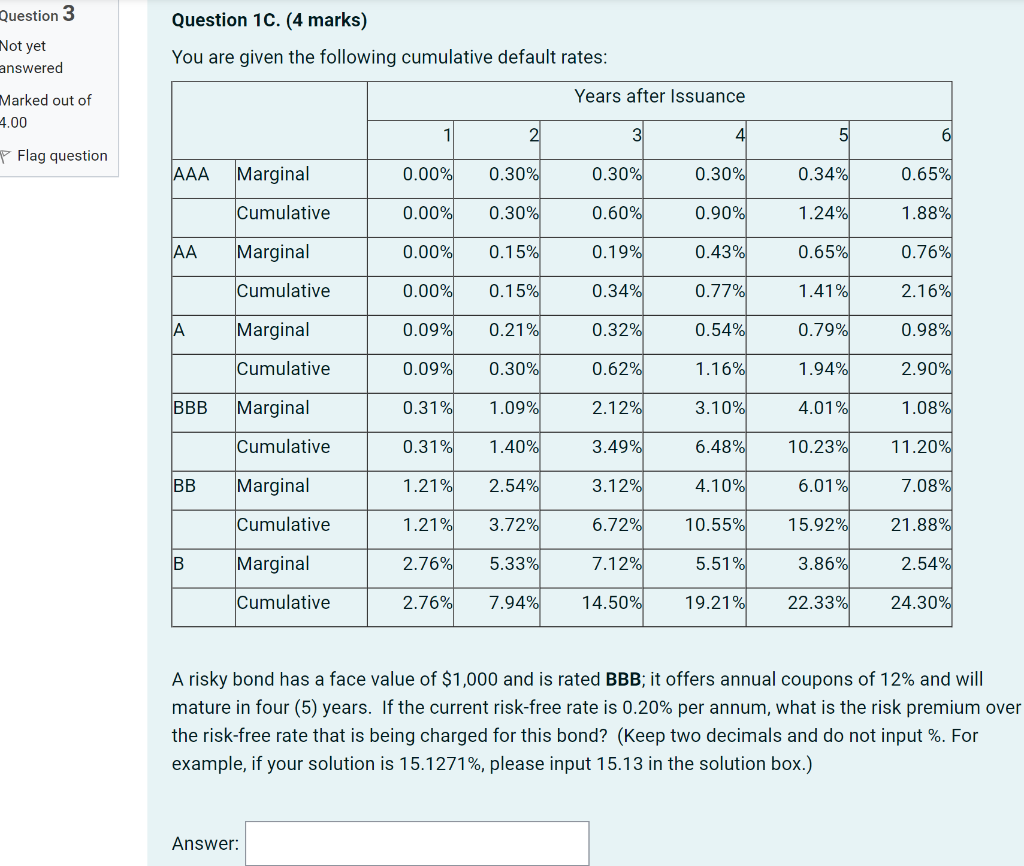

Question 3 Not yet answered Question 1c. (4 marks) You are given the following cumulative default rates: Years after Issuance Marked out of 4.00 1 2 3 4 5 6 Flag question AAA Marginal 0.00% 0.30% 0.30% 0.30% 0.34% 0.65% Cumulative 0.00% 0.30% 0.60% 0.90% 1.24% 1.88% AA Marginal 0.00% 0.15% 0.19% 0.43% 0.65% 0.76% Cumulative 0.00% 0.15% 0.34% 0.77% 1.41% 2.16% Marginal 0.09% 0.21% 0.32% 0.54% 0.79% 0.98% Cumulative 0.09% 0.30% 0.62% 1.16% 1.94% 2.90% BBB Marginal 0.31% 1.09% 2.12% 3.10% 4.01% 1.08% Cumulative 0.31% 1.40% 3.49% 6.48% 10.23% 11.20% BB Marginal 1.21% 2.54% 3.12% 4.10% 6.01% 7.08% Cumulative 1.21% 3.72% 6.72% 10.55% 15.92% 21.88% B Marginal 2.76% 5.33% 7.12% 5.51% 3.86% 2.54% Cumulative 2.76% 7.94% 14.50% 19.21% 22.33% 24.30% A risky bond has a face value of $1,000 and is rated BBB; it offers annual coupons of 12% and will mature in four (5) years. If the current risk-free rate is 0.20% per annum, what is the risk premium over the risk-free rate that is being charged for this bond? (Keep two decimals and do not input %. For example, if your solution is 15.1271%, please input 15.13 in the solution box.) Answer: Question 3 Not yet answered Question 1c. (4 marks) You are given the following cumulative default rates: Years after Issuance Marked out of 4.00 1 2 3 4 5 6 Flag question AAA Marginal 0.00% 0.30% 0.30% 0.30% 0.34% 0.65% Cumulative 0.00% 0.30% 0.60% 0.90% 1.24% 1.88% AA Marginal 0.00% 0.15% 0.19% 0.43% 0.65% 0.76% Cumulative 0.00% 0.15% 0.34% 0.77% 1.41% 2.16% Marginal 0.09% 0.21% 0.32% 0.54% 0.79% 0.98% Cumulative 0.09% 0.30% 0.62% 1.16% 1.94% 2.90% BBB Marginal 0.31% 1.09% 2.12% 3.10% 4.01% 1.08% Cumulative 0.31% 1.40% 3.49% 6.48% 10.23% 11.20% BB Marginal 1.21% 2.54% 3.12% 4.10% 6.01% 7.08% Cumulative 1.21% 3.72% 6.72% 10.55% 15.92% 21.88% B Marginal 2.76% 5.33% 7.12% 5.51% 3.86% 2.54% Cumulative 2.76% 7.94% 14.50% 19.21% 22.33% 24.30% A risky bond has a face value of $1,000 and is rated BBB; it offers annual coupons of 12% and will mature in four (5) years. If the current risk-free rate is 0.20% per annum, what is the risk premium over the risk-free rate that is being charged for this bond? (Keep two decimals and do not input %. For example, if your solution is 15.1271%, please input 15.13 in the solution box.)

undefined

undefined