Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Unicorn Berhad (UNB) is a Malaysian exporter of vehicle components. UNB has agreed to deliver 5,000 units of component at a unit price of

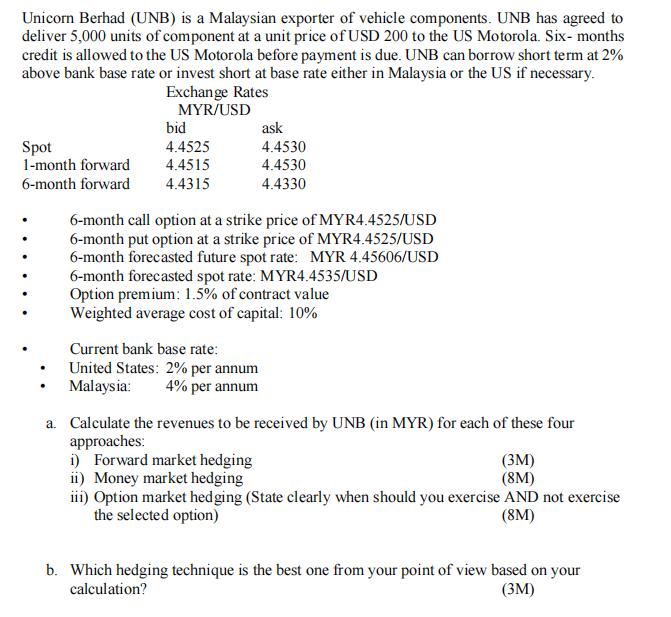

Unicorn Berhad (UNB) is a Malaysian exporter of vehicle components. UNB has agreed to deliver 5,000 units of component at a unit price of USD 200 to the US Motorola. Six-months credit is allowed to the US Motorola before payment is due. UNB can borrow short term at 2% above bank base rate or invest short at base rate either in Malaysia or the US if necessary. Exchange Rates MYR/USD Spot 1-month forward 6-month forward bid 4.4525 4.4515 4.4315 ask 4.4530 4.4530 4.4330 6-month call option at a strike price of MYR4.4525/USD 6-month put option at a strike price of MYR4.4525/USD 6-month forecasted future spot rate: MYR 4.45606/USD 6-month forecasted spot rate: MYR4.4535/USD Option premium: 1.5% of contract value Weighted average cost of capital: 10% Current bank base rate: United States: 2% per annum Malaysia: 4% per annum a. Calculate the revenues to be received by UNB (in MYR) for each of these four approaches: i) Forward market hedging (3M) (8M) ii) Money market hedging iii) Option market hedging (State clearly when should you exercise AND not exercise the selected option) (8M) b. Which hedging technique is the best one from your point of view based on your calculation? (3M)

Step by Step Solution

★★★★★

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Revenues to be received by UNB in MYR for each of the four approaches i Forward market hedging The forward exchange rate for 6 months is 4453044315 bidask Lets assume UNB locks in the forwa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started