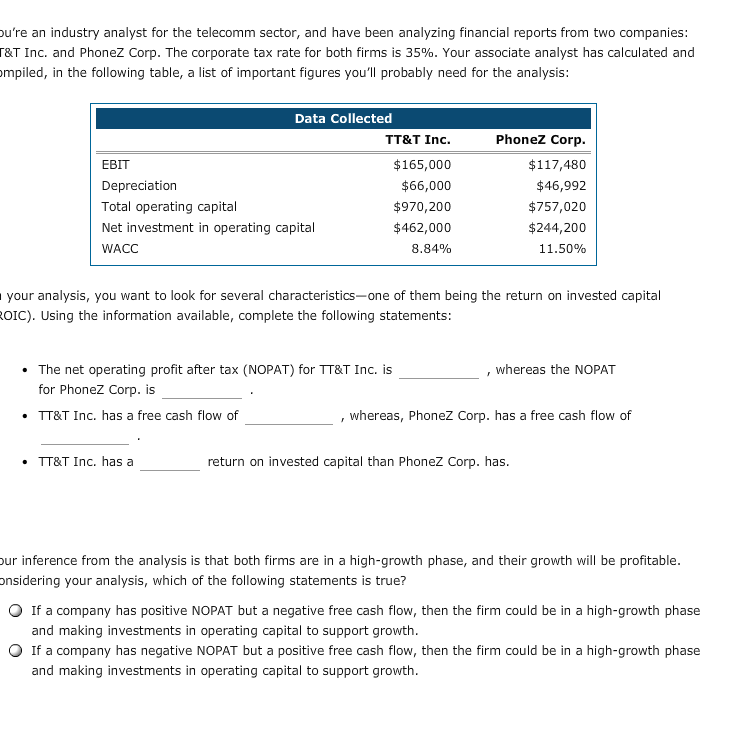

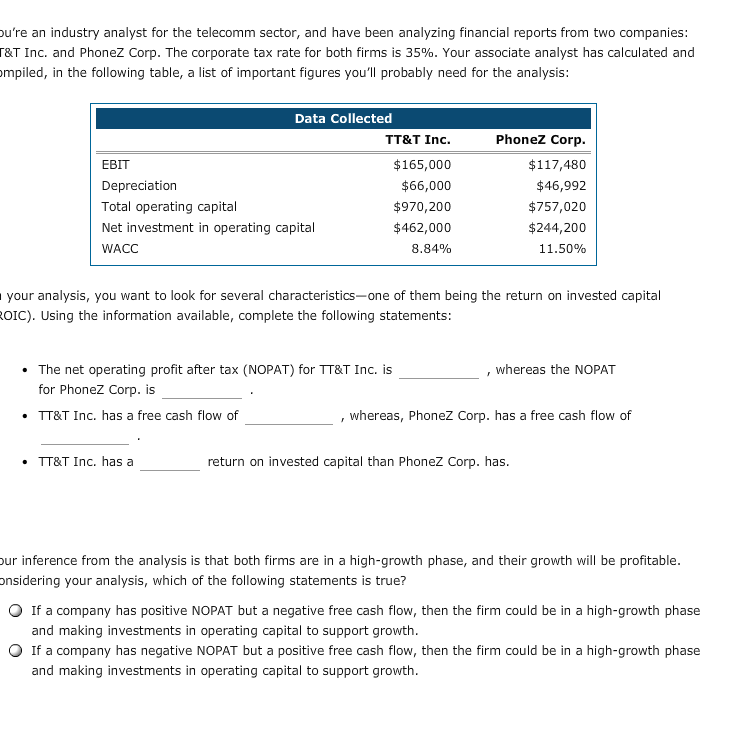

u're an industry analyst for the telecomm sector, and have been analyzing financial reports from two companies: T&T Inc. and PhoneZ Corp. The corporate tax rate for both firms is 35%. Your associate analyst has calculated and mpiled, in the following table, a list of important figures you'll probably need for the analysis: Data Collected EBIT Depreciation Total operating capital Net investment in operating capital WACC TT&T Inc. $165,000 $66,000 $970,200 $462,000 8.84% Phonez Corp $117,480 $46,992 $757,020 $244,200 11.50% your analysis, you want to look for several characteristics-one of them being the return on invested capital OIC). Using the information available, complete the following statements . The net operating profit after tax (NOPAT) for TT&T Inc. is , whereas the NOPAT for PhoneZ Corp. is TT&T Inc. has a free cash flow of , whereas, PhoneZ Corp. has a free cash flow of TT&T Inc. has a return on invested capital than PhoneZ Corp. has ur inference from the analysis is that both firms are in a high-growth phase, and their growth will be profitable nsidering your analysis, which of the following statements is true? O If a company has positive NOPAT but a negative free cash flow, then the firm could be in a high-growth phase and making investments in operating capital to support growth O If a company has negative NOPAT but a positive free cash flow, then the firm could be in a high-growth phase and making investments in operating capital to support growth u're an industry analyst for the telecomm sector, and have been analyzing financial reports from two companies: T&T Inc. and PhoneZ Corp. The corporate tax rate for both firms is 35%. Your associate analyst has calculated and mpiled, in the following table, a list of important figures you'll probably need for the analysis: Data Collected EBIT Depreciation Total operating capital Net investment in operating capital WACC TT&T Inc. $165,000 $66,000 $970,200 $462,000 8.84% Phonez Corp $117,480 $46,992 $757,020 $244,200 11.50% your analysis, you want to look for several characteristics-one of them being the return on invested capital OIC). Using the information available, complete the following statements . The net operating profit after tax (NOPAT) for TT&T Inc. is , whereas the NOPAT for PhoneZ Corp. is TT&T Inc. has a free cash flow of , whereas, PhoneZ Corp. has a free cash flow of TT&T Inc. has a return on invested capital than PhoneZ Corp. has ur inference from the analysis is that both firms are in a high-growth phase, and their growth will be profitable nsidering your analysis, which of the following statements is true? O If a company has positive NOPAT but a negative free cash flow, then the firm could be in a high-growth phase and making investments in operating capital to support growth O If a company has negative NOPAT but a positive free cash flow, then the firm could be in a high-growth phase and making investments in operating capital to support growth