Urgent !

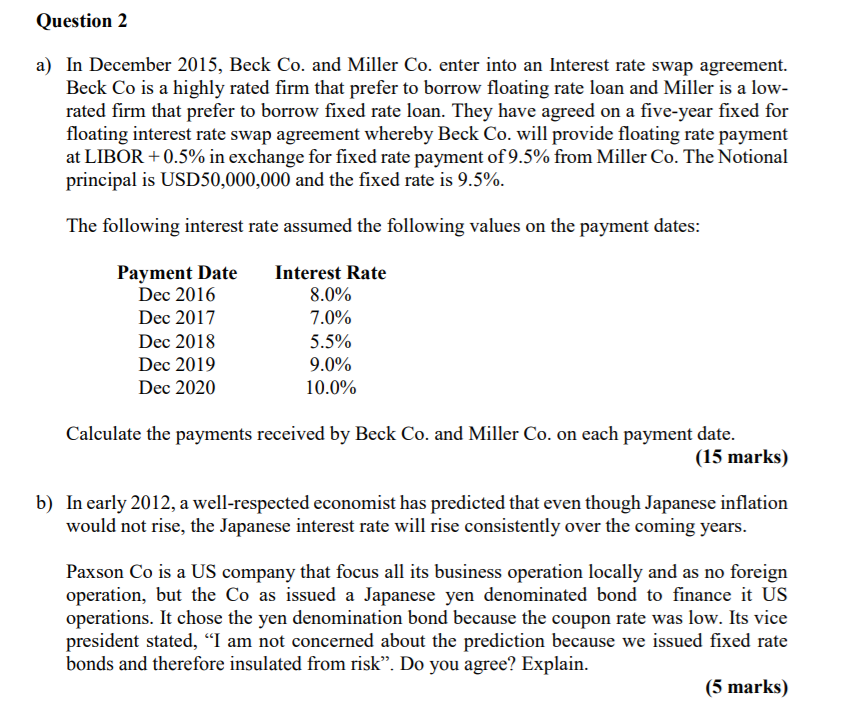

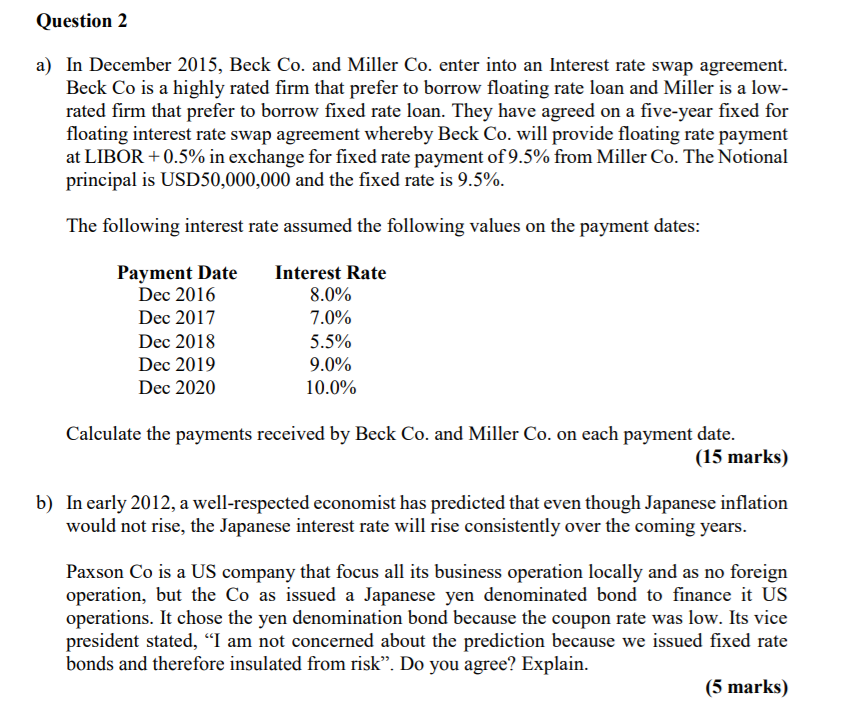

Question 2 a) In December 2015, Beck Co. and Miller Co. enter into an Interest rate swap agreement. Beck Co is a highly rated firm that prefer to borrow floating rate loan and Miller is a low- rated firm that prefer to borrow fixed rate loan. They have agreed on a five-year fixed for floating interest rate swap agreement whereby Beck Co. will provide floating rate payment at LIBOR +0.5% in exchange for fixed rate payment of 9.5% from Miller Co. The Notional principal is USD50,000,000 and the fixed rate is 9.5%. R The following interest rate assumed the following values on the payment dates: Payment Date Dec 2016 Dec 2017 Dec 2018 Dec 2019 Dec 2020 Interest Rate 8.0% 7.0% 5.5% 9.0% 10.0% Calculate the payments received by Beck Co. and Miller Co. on each payment date. (15 marks) b) In early 2012, a well-respected economist has predicted that even though Japanese inflation would not rise, the Japanese interest rate will rise consistently over the coming years. Paxson Co is a US company that focus all its business operation locally and as no foreign operation, but the Co as issued a Japanese yen denominated bond to finance it US operations. It chose the yen denomination bond because the coupon rate was low. Its vice president stated, I am not concerned about the prediction because we issued fixed rate bonds and therefore insulated from risk. Do you agree? Explain. (5 marks) Question 2 a) In December 2015, Beck Co. and Miller Co. enter into an Interest rate swap agreement. Beck Co is a highly rated firm that prefer to borrow floating rate loan and Miller is a low- rated firm that prefer to borrow fixed rate loan. They have agreed on a five-year fixed for floating interest rate swap agreement whereby Beck Co. will provide floating rate payment at LIBOR +0.5% in exchange for fixed rate payment of 9.5% from Miller Co. The Notional principal is USD50,000,000 and the fixed rate is 9.5%. R The following interest rate assumed the following values on the payment dates: Payment Date Dec 2016 Dec 2017 Dec 2018 Dec 2019 Dec 2020 Interest Rate 8.0% 7.0% 5.5% 9.0% 10.0% Calculate the payments received by Beck Co. and Miller Co. on each payment date. (15 marks) b) In early 2012, a well-respected economist has predicted that even though Japanese inflation would not rise, the Japanese interest rate will rise consistently over the coming years. Paxson Co is a US company that focus all its business operation locally and as no foreign operation, but the Co as issued a Japanese yen denominated bond to finance it US operations. It chose the yen denomination bond because the coupon rate was low. Its vice president stated, I am not concerned about the prediction because we issued fixed rate bonds and therefore insulated from risk. Do you agree? Explain