Answered step by step

Verified Expert Solution

Question

1 Approved Answer

U.S. Fertilizers (USF) is a fertilizer company specializing in developing fertilizers for small farms and households, e.g., yards and gardens. USF management has ordered manufacturing

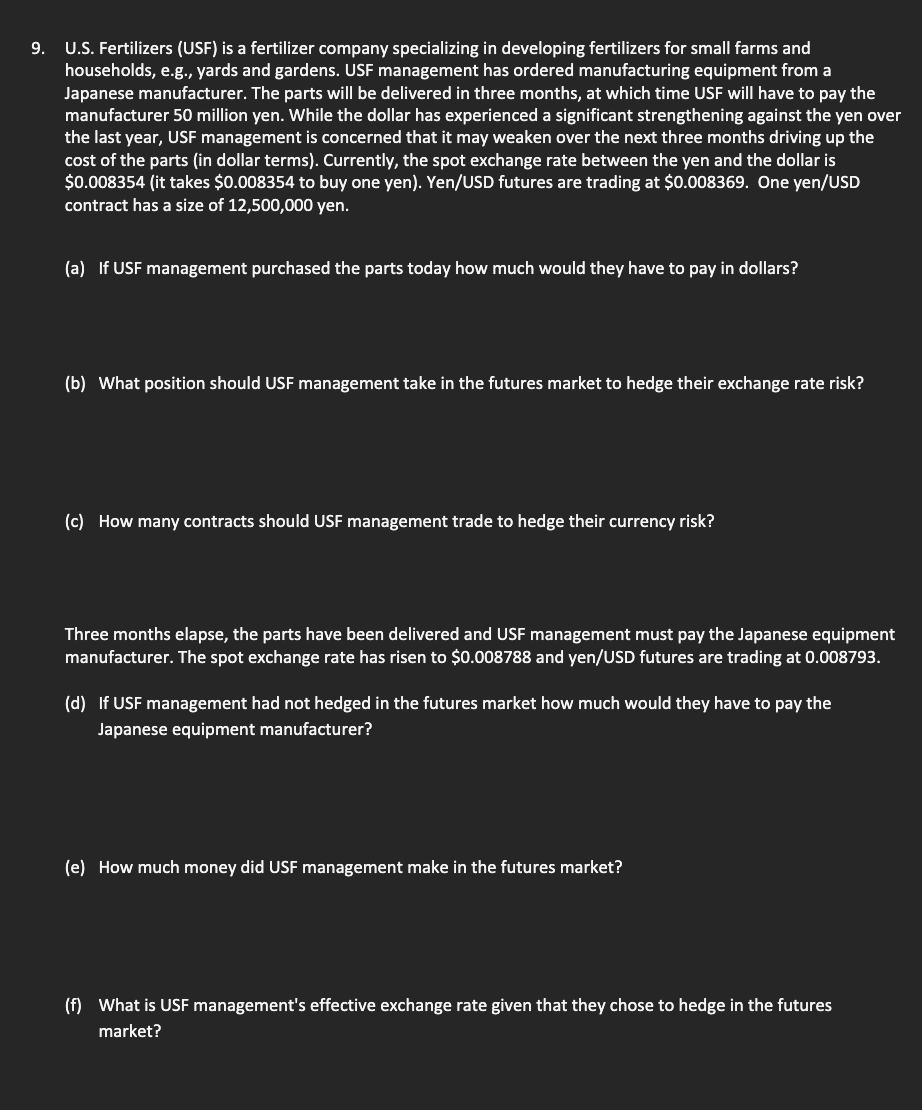

U.S. Fertilizers (USF) is a fertilizer company specializing in developing fertilizers for small farms and households, e.g., yards and gardens. USF management has ordered manufacturing equipment from a Japanese manufacturer. The parts will be delivered in three months, at which time USF will have to pay the manufacturer 50 million yen. While the dollar has experienced a significant strengthening against the yen over the last year, USF management is concerned that it may weaken over the next three months driving up the cost of the parts (in dollar terms). Currently, the spot exchange rate between the yen and the dollar is $0.008354 (it takes $0.008354 to buy one yen). Yen/USD futures are trading at $0.008369. One yen/USD contract has a size of 12,500,000 yen. (a) If USF management purchased the parts today how much would they have to pay in dollars? (b) What position should USF management take in the futures market to hedge their exchange rate risk? (c) How many contracts should USF management trade to hedge their currency risk? Three months elapse, the parts have been delivered and USF management must pay the Japanese equipment manufacturer. The spot exchange rate has risen to $0.008788 and yen/USD futures are trading at 0.008793 . (d) If USF management had not hedged in the futures market how much would they have to pay the Japanese equipment manufacturer? (e) How much money did USF management make in the futures market? (f) What is USF management's effective exchange rate given that they chose to hedge in the futures market

U.S. Fertilizers (USF) is a fertilizer company specializing in developing fertilizers for small farms and households, e.g., yards and gardens. USF management has ordered manufacturing equipment from a Japanese manufacturer. The parts will be delivered in three months, at which time USF will have to pay the manufacturer 50 million yen. While the dollar has experienced a significant strengthening against the yen over the last year, USF management is concerned that it may weaken over the next three months driving up the cost of the parts (in dollar terms). Currently, the spot exchange rate between the yen and the dollar is $0.008354 (it takes $0.008354 to buy one yen). Yen/USD futures are trading at $0.008369. One yen/USD contract has a size of 12,500,000 yen. (a) If USF management purchased the parts today how much would they have to pay in dollars? (b) What position should USF management take in the futures market to hedge their exchange rate risk? (c) How many contracts should USF management trade to hedge their currency risk? Three months elapse, the parts have been delivered and USF management must pay the Japanese equipment manufacturer. The spot exchange rate has risen to $0.008788 and yen/USD futures are trading at 0.008793 . (d) If USF management had not hedged in the futures market how much would they have to pay the Japanese equipment manufacturer? (e) How much money did USF management make in the futures market? (f) What is USF management's effective exchange rate given that they chose to hedge in the futures market Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started