Answered step by step

Verified Expert Solution

Question

1 Approved Answer

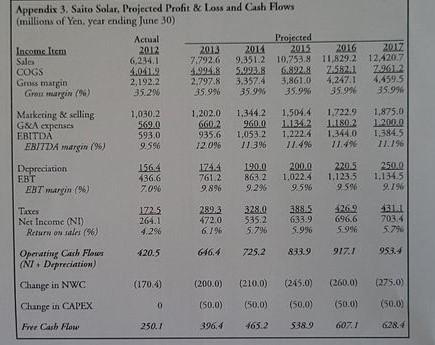

Use the following assumptions to value Saito Solar based on the discounted cash flow method. Assume the Actual 2012 numbers given in Appendix 3. Numbers

Use the following assumptions to value Saito Solar based on the discounted cash flow method. Assume the Actual 2012 numbers given in Appendix 3.

Numbers 1 and 2 please please show work Thank you Excel if possible

- For the next 5 years (2013-2017), the companys sales is expected to grow by 25% per year.

- All expenses (except depreciation) are expected to grow by 20% per year.

-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started