Answered step by step

Verified Expert Solution

Question

1 Approved Answer

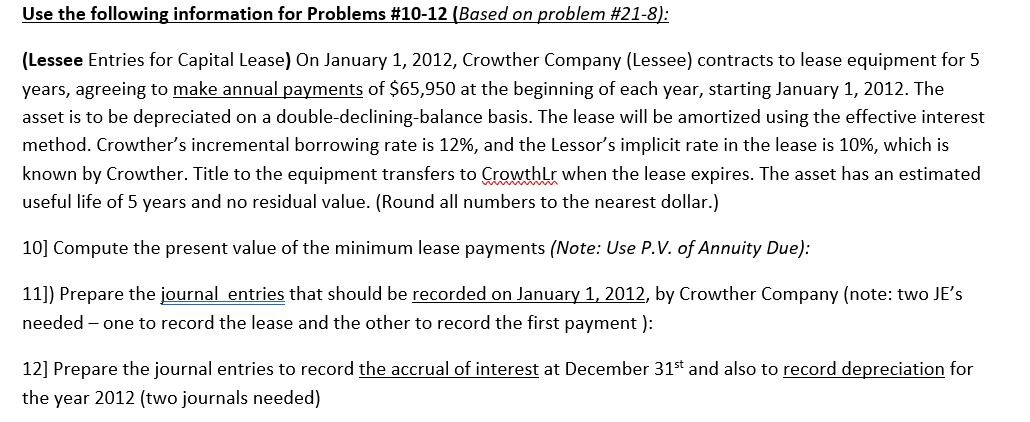

Use the following information for Problems # 1 0 - 1 2 ( Based on problem # 2 1 - 8 ) : ( Lessee

Use the following information for Problems #Based on problem #:

Lessee Entries for Capital Lease On January Crowther Company Lessee contracts to lease equipment for

years, agreeing to make annual payments of $ at the beginning of each year, starting January The

asset is to be depreciated on a doubledecliningbalance basis. The lease will be amortized using the effective interest

method. Crowther's incremental borrowing rate is and the Lessor's implicit rate in the lease is which is

known by Crowther. Title to the equipment transfers to CrowthLr when the lease expires. The asset has an estimated

useful life of years and no residual value. Round all numbers to the nearest dollar.

Compute the present value of the minimum lease payments Note: Use PV of Annuity Due:

Prepare the journal entries that should be recorded on January by Crowther Company note: two JE's

needed one to record the lease and the other to record the first payment :

Prepare the journal entries to record the accrual of interest at December and also to record depreciation for

the year two journals needed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started