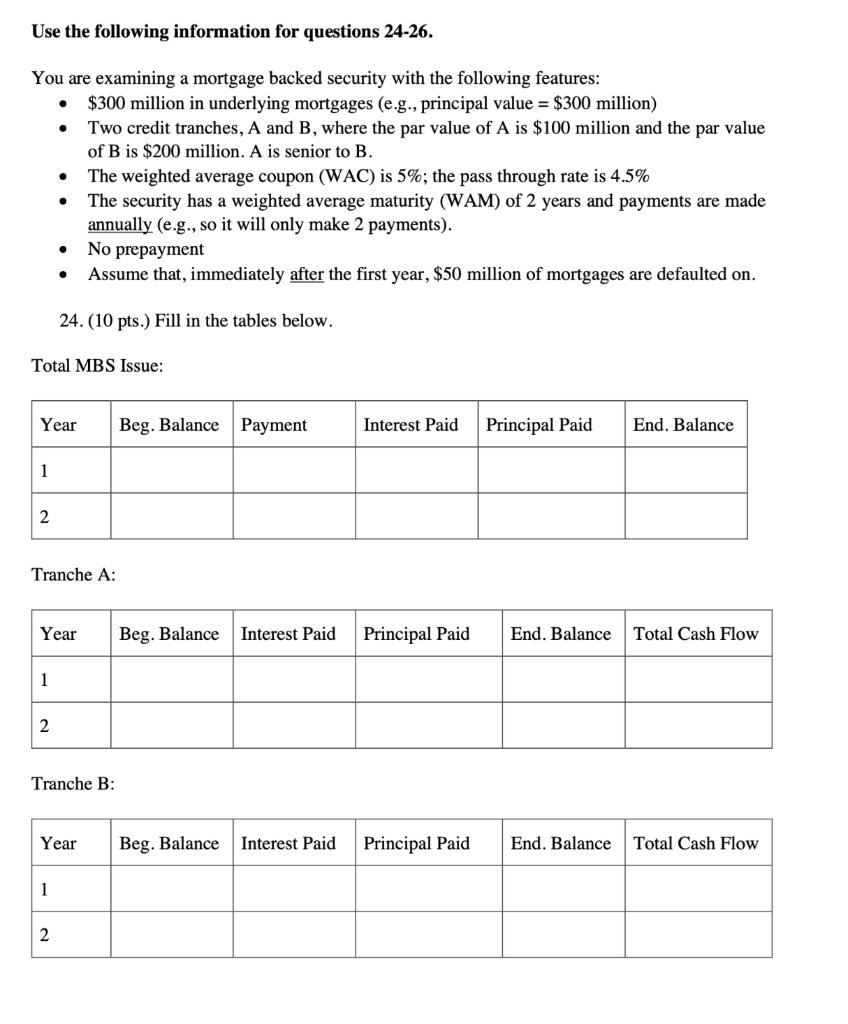

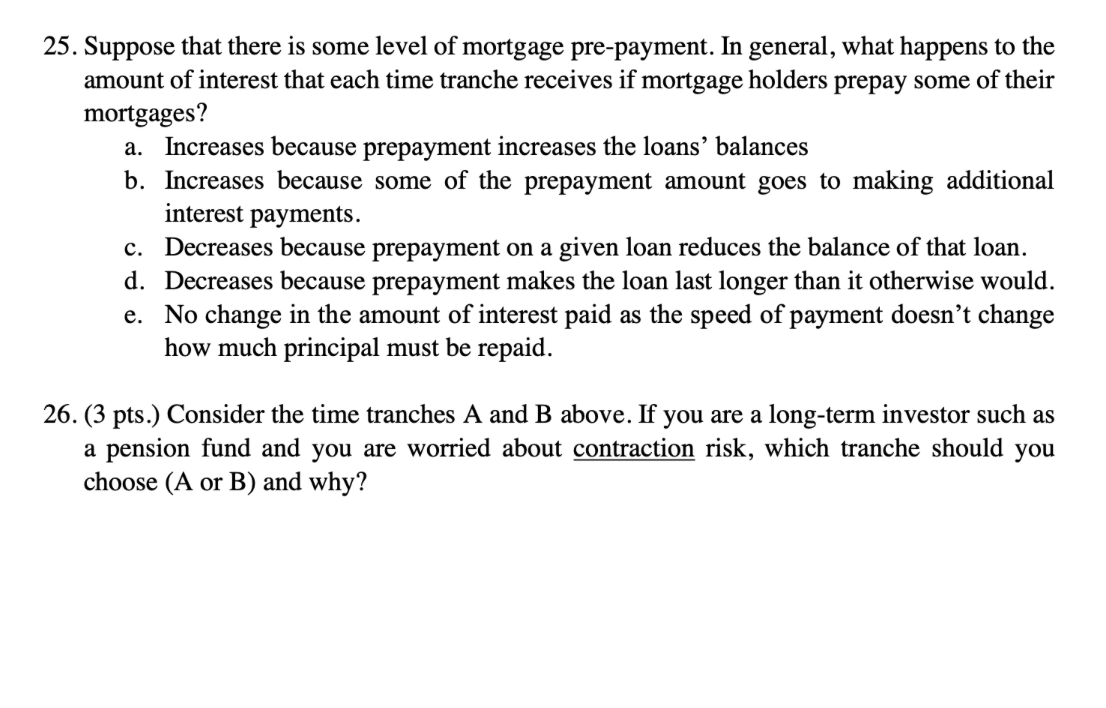

Use the following information for questions 24-26. You are examining a mortgage backed security with the following features: $300 million in underlying mortgages (e.g., principal value = $300 million) Two credit tranches, A and B, where the par value of A is $100 million and the par value of B is $200 million. A is senior to B. The weighted average coupon (WAC) is 5%; the pass through rate is 4.5% The security has a weighted average maturity (WAM) of 2 years and payments are made annually (e.g., so it will only make 2 payments). No prepayment Assume that, immediately after the first year, $50 million of mortgages are defaulted on. 24. (10 pts.) Fill in the tables below. Total MBS Issue: Year Beg. Balance Payment Interest Paid Principal Paid End. Balance Tranche A: Year Beg. Balance Interest Paid Principal Paid End. Balance Total Cash Flow Tranche B: Year Beg. Balance Interest Paid Principal Paid End. Balance Total Cash Flow 25. Suppose that there is some level of mortgage pre-payment. In general, what happens to the amount of interest that each time tranche receives if mortgage holders prepay some of their mortgages? a. Increases because prepayment increases the loans' balances b. Increases because some of the prepayment amount goes to making additional interest payments. c. Decreases because prepayment on a given loan reduces the balance of that loan. d. Decreases because prepayment makes the loan last longer than it otherwise would. e. No change in the amount of interest paid as the speed of payment doesn't change how much principal must be repaid. 26. (3 pts.) Consider the time tranches A and B above. If you are a long-term investor such as a pension fund and you are worried about contraction risk, which tranche should you choose (A or B) and why? Use the following information for questions 24-26. You are examining a mortgage backed security with the following features: $300 million in underlying mortgages (e.g., principal value = $300 million) Two credit tranches, A and B, where the par value of A is $100 million and the par value of B is $200 million. A is senior to B. The weighted average coupon (WAC) is 5%; the pass through rate is 4.5% The security has a weighted average maturity (WAM) of 2 years and payments are made annually (e.g., so it will only make 2 payments). No prepayment Assume that, immediately after the first year, $50 million of mortgages are defaulted on. 24. (10 pts.) Fill in the tables below. Total MBS Issue: Year Beg. Balance Payment Interest Paid Principal Paid End. Balance Tranche A: Year Beg. Balance Interest Paid Principal Paid End. Balance Total Cash Flow Tranche B: Year Beg. Balance Interest Paid Principal Paid End. Balance Total Cash Flow 25. Suppose that there is some level of mortgage pre-payment. In general, what happens to the amount of interest that each time tranche receives if mortgage holders prepay some of their mortgages? a. Increases because prepayment increases the loans' balances b. Increases because some of the prepayment amount goes to making additional interest payments. c. Decreases because prepayment on a given loan reduces the balance of that loan. d. Decreases because prepayment makes the loan last longer than it otherwise would. e. No change in the amount of interest paid as the speed of payment doesn't change how much principal must be repaid. 26. (3 pts.) Consider the time tranches A and B above. If you are a long-term investor such as a pension fund and you are worried about contraction risk, which tranche should you choose (A or B) and why