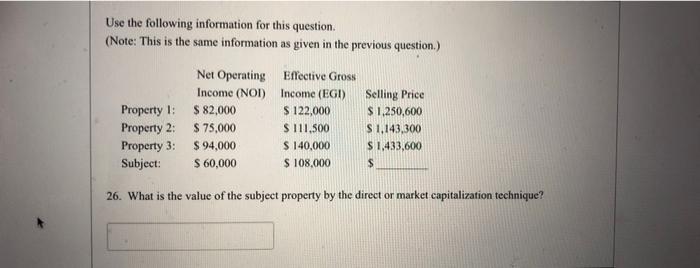

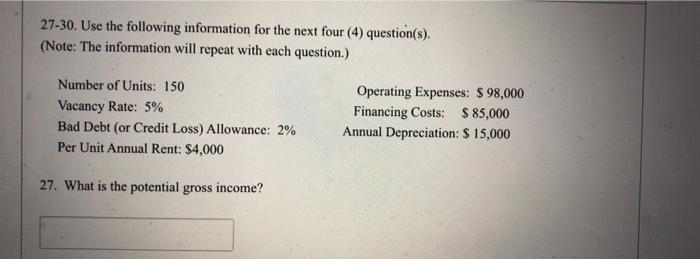

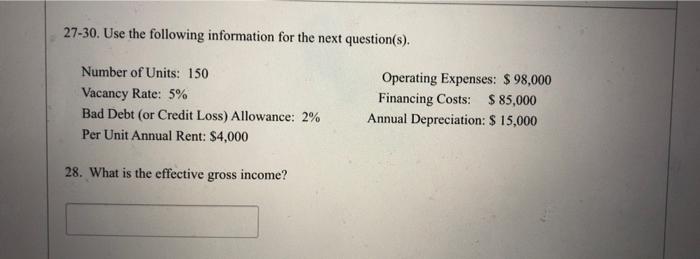

Use the following information for this question. (Note: This is the same information as given in the previous question.) Net Operating Effective Gross Income (NOT) Income (EGI) Property 1: $82,000 S 122,000 Property 2: $ 75,000 $111.500 Property 3: $ 94,000 $ 140,000 Subject: $ 60,000 $ 108,000 Selling Price $1,250,600 $ 1,143,300 $1,433,600 $ 26. What is the value of the subject property by the direct or market capitalization technique? 27-30. Use the following information for the next four (4) question(s). (Note: The information will repeat with each question.) Number of Units: 150 Vacancy Rate: 5% Bad Debt (or Credit Loss) Allowance: 2% Per Unit Annual Rent: $4,000 Operating Expenses: $ 98,000 Financing Costs: $ 85,000 Annual Depreciation: $ 15,000 27. What is the potential gross income? 27-30. Use the following information for the next question(s). Number of Units: 150 Vacancy Rate: 5% Bad Debt (or Credit Loss) Allowance: 2% Per Unit Annual Rent: $4,000 Operating Expenses: $ 98,000 Financing Costs: $ 85,000 Annual Depreciation: $ 15,000 28. What is the effective gross income? Use the following information for this question. (Note: This is the same information as given in the previous question.) Net Operating Effective Gross Income (NOT) Income (EGI) Property 1: $82,000 S 122,000 Property 2: $ 75,000 $111.500 Property 3: $ 94,000 $ 140,000 Subject: $ 60,000 $ 108,000 Selling Price $1,250,600 $ 1,143,300 $1,433,600 $ 26. What is the value of the subject property by the direct or market capitalization technique? 27-30. Use the following information for the next four (4) question(s). (Note: The information will repeat with each question.) Number of Units: 150 Vacancy Rate: 5% Bad Debt (or Credit Loss) Allowance: 2% Per Unit Annual Rent: $4,000 Operating Expenses: $ 98,000 Financing Costs: $ 85,000 Annual Depreciation: $ 15,000 27. What is the potential gross income? 27-30. Use the following information for the next question(s). Number of Units: 150 Vacancy Rate: 5% Bad Debt (or Credit Loss) Allowance: 2% Per Unit Annual Rent: $4,000 Operating Expenses: $ 98,000 Financing Costs: $ 85,000 Annual Depreciation: $ 15,000 28. What is the effective gross income