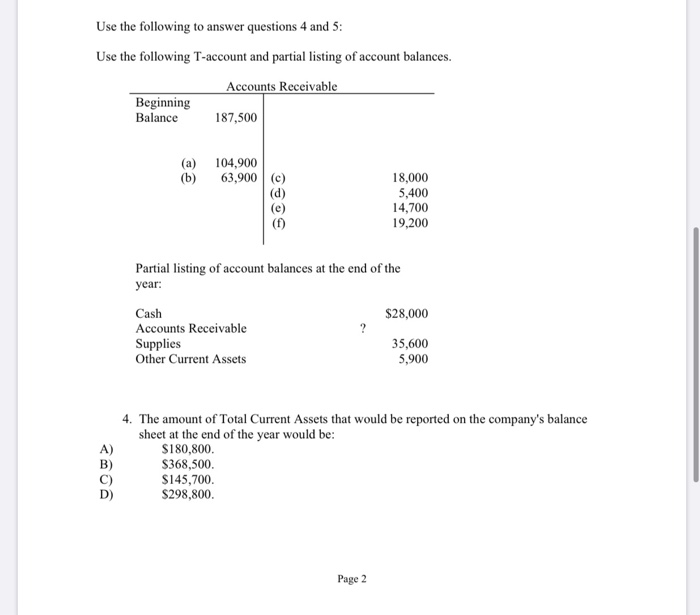

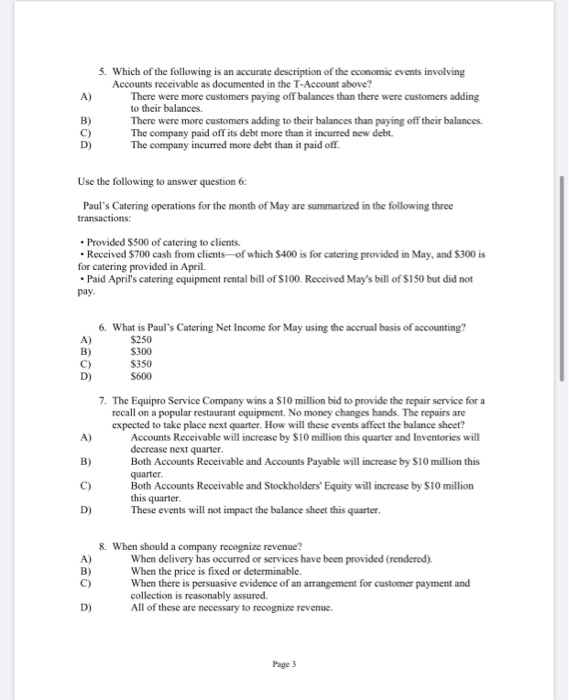

Use the following to answer questions 4 and 5: Use the following T-account and partial listing of account balances. Accounts Receivable Beginning Balance 187,500 (b) 104,900 63,900 (c) (d) (e) (1) 18,000 5,400 14,700 19,200 Partial listing of account balances at the end of the year: Cash $28,000 Accounts Receivable Supplies 35,600 Other Current Assets 5,900 4. The amount of Total Current Assets that would be reported on the company's balance sheet at the end of the year would be: $180,800. $368,500. $145,700. $298,800. Page 2 A) 5. Which of the following is an accurate description of the economie events involving Accounts receivable as documented in the T-Account above? There were more customers paying off balances than there were customers adding to their balances. There were more customers adding to their balances than paying off their balances. The company paid off its debt more than it incurred new debt. The company incurred more debt than it paid off. Use the following to answer question 6: Paul's Catering operations for the month of May are summarized in the following three transactions: Provided $500 of catering to clients. Received $700 cash from clients of which S400 is for catering provided in May, and $300 is for catering provided in April. Paid April's catering equipment rental bill of $100. Received May's bill of $150 but did not pay. A) B) C) 6. What is Paul's Catering Net Income for May using the accrual basis of accounting? $250 $300 S350 S600 7. The Equipro Service Company wins a $10 million bid to provide the repair service for a recall on a popular restaurant equipment. No money changes hands. The repairs are expected to take place next quarter. How will these events affect the balance sheet? Accounts Receivable will increase by $10 million this quarter and Inventories will decrease next quarter. Both Accounts Receivable and Accounts Payable will increase by $10 million this quarter Both Accounts Receivable and Stockholders' Equity will increase by $10 million this quarter These events will not impact the balance sheet this quarter. A) B) C) D) B) 8. When should a company recognize revenue? When delivery has occurred or services have been provided (rendered). When the price is fixed or determinable. When there is persuasive evidence of an arrangement for customer payment and collection is reasonably assured. All of these are necessary to recognize revenue. D) Page 3