Question

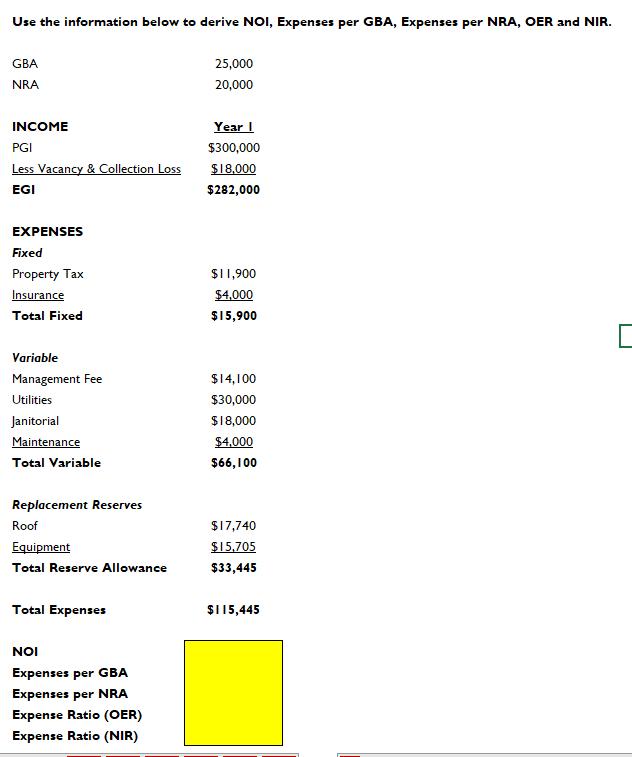

Use the information below to derive NOI, Expenses per GBA, Expenses per NRA, OER and NIR. GBA NRA INCOME PGI Less Vacancy & Collection

Use the information below to derive NOI, Expenses per GBA, Expenses per NRA, OER and NIR. GBA NRA INCOME PGI Less Vacancy & Collection Loss EGI EXPENSES Fixed Property Tax Insurance Total Fixed Variable Management Fee Utilities Janitorial Maintenance Total Variable Replacement Reserves Roof Equipment Total Reserve Allowance Total Expenses NOI Expenses per GBA Expenses per NRA Expense Ratio (OER) Expense Ratio (NIR) 25,000 20,000 Year I $300,000 $18,000 $282,000 $11,900 $4,000 $15,900 $14,100 $30,000 $18,000 $4,000 $66,100 $17,740 $15,705 $33,445 $115,445

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER NOI Net Operating Income EGI Total Expenses NOI 282000 115445 NOI 166555 Expenses per GBA Gr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: James D. Stice, Earl K. Stice, Fred Skousen

16th Edition

324376375, 0324375743I, 978-0324376371, 9780324375749, 978-0324312140

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App