Answered step by step

Verified Expert Solution

Question

1 Approved Answer

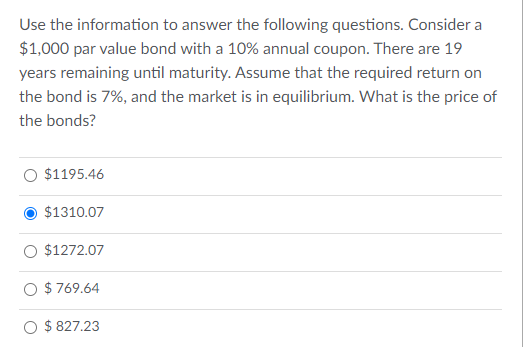

Use the information to answer the following questions. Consider a $1,000 par value bond with a 10% annual coupon. There are 19 years remaining until

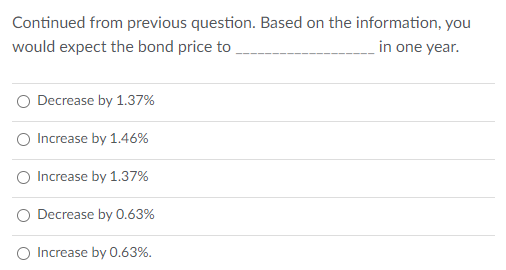

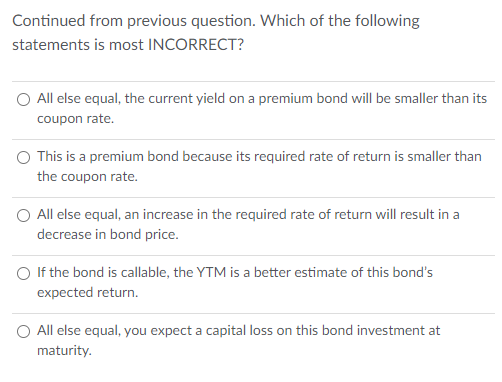

Use the information to answer the following questions. Consider a $1,000 par value bond with a 10% annual coupon. There are 19 years remaining until maturity. Assume that the required return on the bond is 7%, and the market is in equilibrium. What is the price of the bonds? $1195.46 $1310.07 $1272.07 $769.64 $827.23 Continued from previous question. Based on the information, you would expect the bond price to in one year. Decrease by 1.37% Increase by 1.46% Increase by 1.37% Decrease by 0.63% Increase by 0.63%. Continued from previous question. Which of the following statements is most INCORRECT? All else equal, the current yield on a premium bond will be smaller than its coupon rate. This is a premium bond because its required rate of return is smaller than the coupon rate. All else equal, an increase in the required rate of return will result in a decrease in bond price. If the bond is callable, the YTM is a better estimate of this bond's expected return. All else equal, you expect a capital loss on this bond investment at maturity. Use the information to answer the following questions. Consider a $1,000 par value bond with a 10% annual coupon. There are 19 years remaining until maturity. Assume that the required return on the bond is 7%, and the market is in equilibrium. What is the price of the bonds? $1195.46 $1310.07 $1272.07 $769.64 $827.23 Continued from previous question. Based on the information, you would expect the bond price to in one year. Decrease by 1.37% Increase by 1.46% Increase by 1.37% Decrease by 0.63% Increase by 0.63%. Continued from previous question. Which of the following statements is most INCORRECT? All else equal, the current yield on a premium bond will be smaller than its coupon rate. This is a premium bond because its required rate of return is smaller than the coupon rate. All else equal, an increase in the required rate of return will result in a decrease in bond price. If the bond is callable, the YTM is a better estimate of this bond's expected return. All else equal, you expect a capital loss on this bond investment at maturity

Use the information to answer the following questions. Consider a $1,000 par value bond with a 10% annual coupon. There are 19 years remaining until maturity. Assume that the required return on the bond is 7%, and the market is in equilibrium. What is the price of the bonds? $1195.46 $1310.07 $1272.07 $769.64 $827.23 Continued from previous question. Based on the information, you would expect the bond price to in one year. Decrease by 1.37% Increase by 1.46% Increase by 1.37% Decrease by 0.63% Increase by 0.63%. Continued from previous question. Which of the following statements is most INCORRECT? All else equal, the current yield on a premium bond will be smaller than its coupon rate. This is a premium bond because its required rate of return is smaller than the coupon rate. All else equal, an increase in the required rate of return will result in a decrease in bond price. If the bond is callable, the YTM is a better estimate of this bond's expected return. All else equal, you expect a capital loss on this bond investment at maturity. Use the information to answer the following questions. Consider a $1,000 par value bond with a 10% annual coupon. There are 19 years remaining until maturity. Assume that the required return on the bond is 7%, and the market is in equilibrium. What is the price of the bonds? $1195.46 $1310.07 $1272.07 $769.64 $827.23 Continued from previous question. Based on the information, you would expect the bond price to in one year. Decrease by 1.37% Increase by 1.46% Increase by 1.37% Decrease by 0.63% Increase by 0.63%. Continued from previous question. Which of the following statements is most INCORRECT? All else equal, the current yield on a premium bond will be smaller than its coupon rate. This is a premium bond because its required rate of return is smaller than the coupon rate. All else equal, an increase in the required rate of return will result in a decrease in bond price. If the bond is callable, the YTM is a better estimate of this bond's expected return. All else equal, you expect a capital loss on this bond investment at maturity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started