Answered step by step

Verified Expert Solution

Question

1 Approved Answer

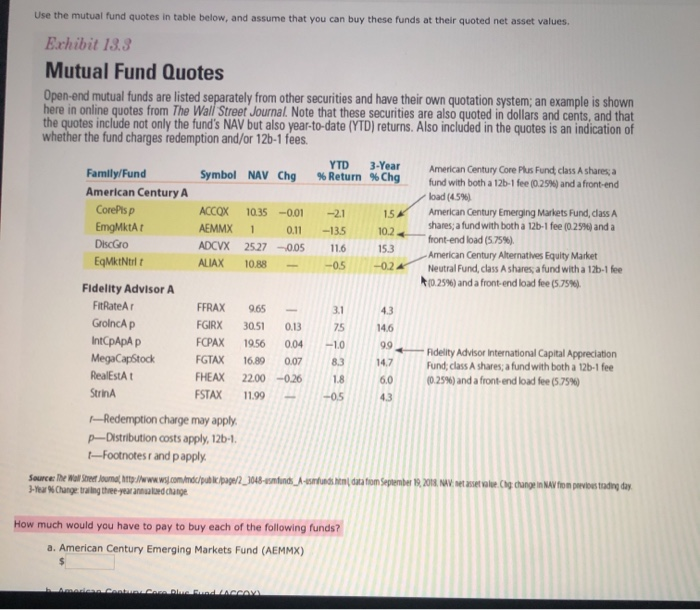

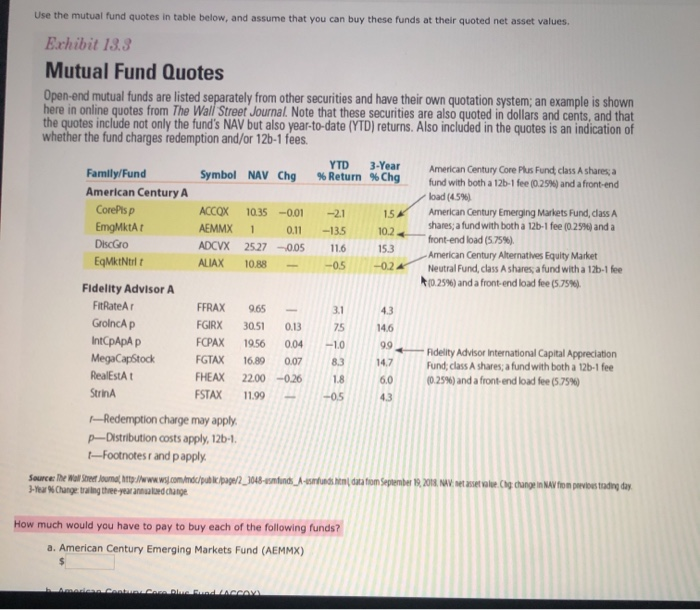

Use the mutual fund quotes in table below, and assume that you can buy these funds at their quoted net asset values Exhibit 13.3 Mutual

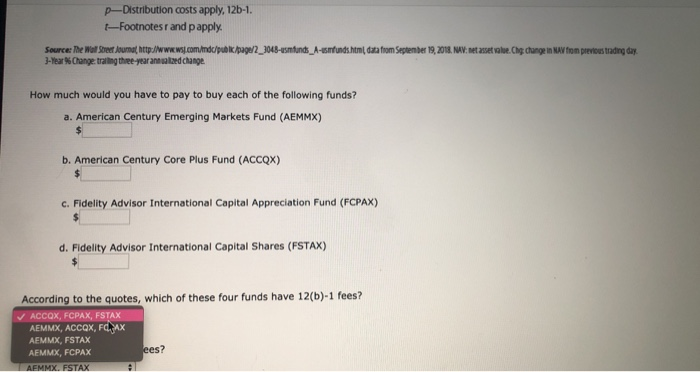

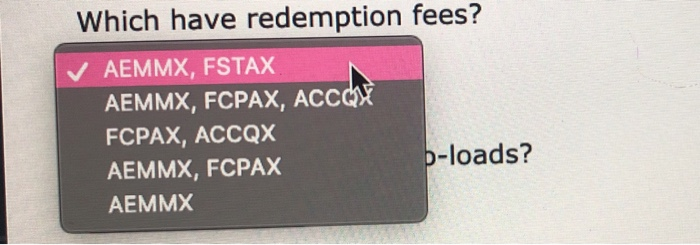

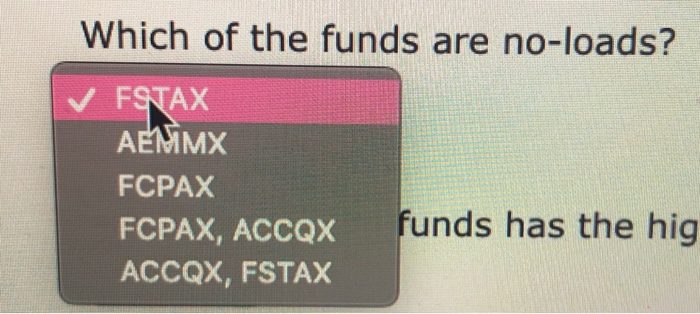

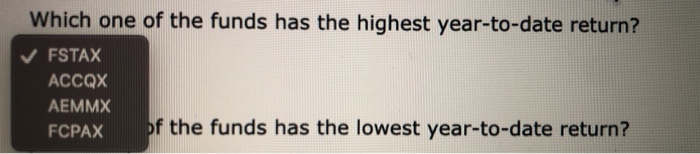

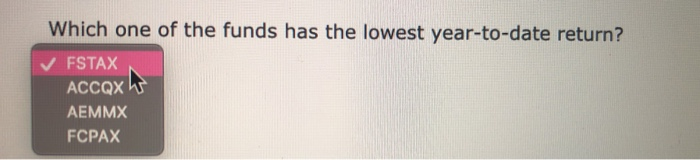

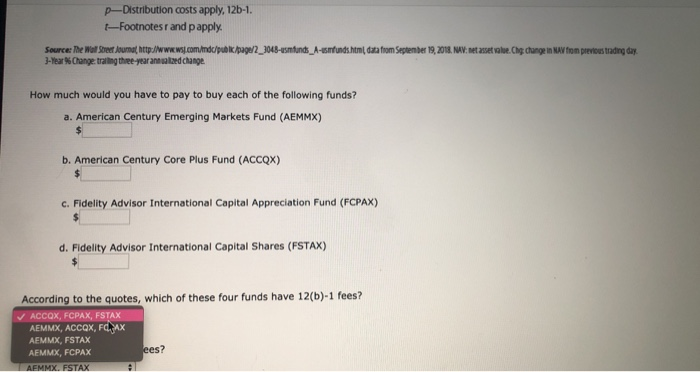

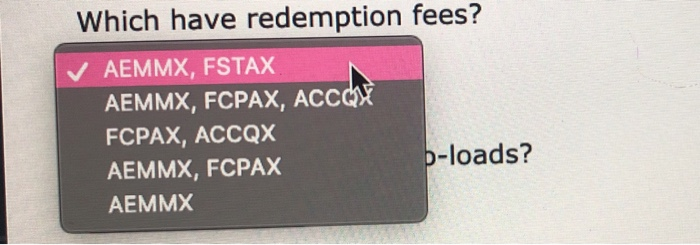

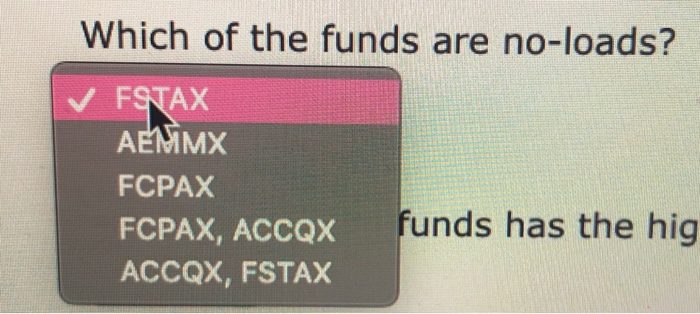

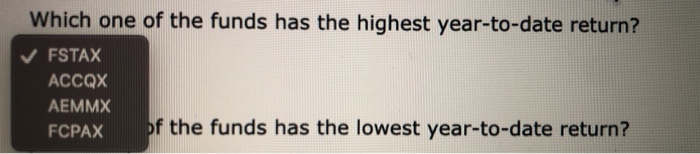

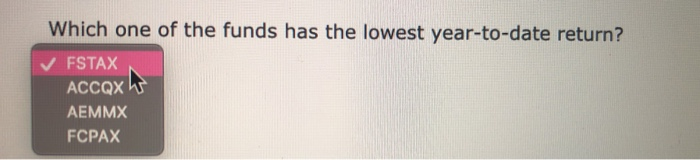

Use the mutual fund quotes in table below, and assume that you can buy these funds at their quoted net asset values Exhibit 13.3 Mutual Fund Quotes Open-end mutual funds are listed separately from other securities and have their own quotation system; an example is shown here in online quotes from The Wall Street Journal. Note that these securities are also quoted in dollars and cents, and that the quotes include not only the fund's NAV but also year-to-date (YTD) returns. Also included in the quotes is an indication of whether the fund charges redemption and/or 125-1 fees. YTD 3-Year American Century Core Plus Fund class A shares a Family/Fund Symbol NAV Chg Return %Chg fund with both a 126-1 fee (0.29%) and a front-end American Century A load (4.5% CorePisp ACCOX 10.35 -0.01 -21 154 American Century Emerging Markets Fund, class A EmgMkt! AEMMX 1 0.11 -135 shares; a fund with both a 125-1 fee (0.2596) and a 10.2 front-end load (5.75%) Disco ADCVX 2527 -0.05 11.6 American Century Alternatives Equity Market EqWktNtrit ALIAX 10.88 -- 05 -02 Neutral Fund, class Ashares a fund with a 12-1 fee 0.25%) and a front-end load fee (5.75%). Fidelity Advisor A FitRateAr FFRAX 9.65 Groincap FGIRX 30.51 0.13 IntCpApp FOPAX 1956 0.04 99 --Ridelity Advisor International Capital Appreciation MegaCapstock FGTAX 16.89 0.07 Fund; class A shares, a fund with both a 125-1 fee RealEstat FHEAX 22.00 -0.26 (0.25%) and a front-end load fee (5.75%) Strina FSTAX 11.99 - Redemption charge may apply. - Distribution costs apply, 126-1 Footnotes and p apply. Source: The Wall Street Joumahttp://www.wsj.com/mc/punk pag1/2_3048-asmunds_A-usunda hindata from September 19, 2018. NAV 3-Year Changing three-year and change .Chg change in May to previous trading day How much would you have to pay to buy each of the following funds? a. American Century Emerging Markets Fund (AEMMX) Coton ACCAYA P-Distribution costs apply, 125-1. E-Footnotes and p apply. Source: The Wol u mna http://www .com /pub//2_7048-umfunds_A-umfunds.html data from September 18, 2011. M. Mesele. Che change in 3-Year Change trailing three-year an d change ton previous trading day How much would you have to pay to buy each of the following funds? a. American Century Emerging Markets Fund (AEMMX) b. American Century Core Plus Fund (ACCQX) c. Fidelity Advisor International Capital Appreciation Fund (FCPAX) d. Fidelity Advisor International Capital Shares (FSTAX) According to the quotes, which of these four funds have 12(b)-1 fees? ACCOX, FCPAX, FSTAX AEMMX, ACCOX, FAX AEMMX, FSTAX AEMMX, FCPAX ees? AFMMX, FSTAX Which of the funds are no-loads? FSTAX AEMMX FCPAX FCPAX, ACCQX ACCQX, FSTAX funds has the hig Which one of the funds has the highest year-to-date return? FSTAX ACCQX AEMMX FCPAX of the funds has the lowest year-to-date return? Which one of the funds has the lowest year-to-date return? FSTAX ACCQX h AEMMX FCPAX

Use the mutual fund quotes in table below, and assume that you can buy these funds at their quoted net asset values Exhibit 13.3 Mutual Fund Quotes Open-end mutual funds are listed separately from other securities and have their own quotation system; an example is shown here in online quotes from The Wall Street Journal. Note that these securities are also quoted in dollars and cents, and that the quotes include not only the fund's NAV but also year-to-date (YTD) returns. Also included in the quotes is an indication of whether the fund charges redemption and/or 125-1 fees. YTD 3-Year American Century Core Plus Fund class A shares a Family/Fund Symbol NAV Chg Return %Chg fund with both a 126-1 fee (0.29%) and a front-end American Century A load (4.5% CorePisp ACCOX 10.35 -0.01 -21 154 American Century Emerging Markets Fund, class A EmgMkt! AEMMX 1 0.11 -135 shares; a fund with both a 125-1 fee (0.2596) and a 10.2 front-end load (5.75%) Disco ADCVX 2527 -0.05 11.6 American Century Alternatives Equity Market EqWktNtrit ALIAX 10.88 -- 05 -02 Neutral Fund, class Ashares a fund with a 12-1 fee 0.25%) and a front-end load fee (5.75%). Fidelity Advisor A FitRateAr FFRAX 9.65 Groincap FGIRX 30.51 0.13 IntCpApp FOPAX 1956 0.04 99 --Ridelity Advisor International Capital Appreciation MegaCapstock FGTAX 16.89 0.07 Fund; class A shares, a fund with both a 125-1 fee RealEstat FHEAX 22.00 -0.26 (0.25%) and a front-end load fee (5.75%) Strina FSTAX 11.99 - Redemption charge may apply. - Distribution costs apply, 126-1 Footnotes and p apply. Source: The Wall Street Joumahttp://www.wsj.com/mc/punk pag1/2_3048-asmunds_A-usunda hindata from September 19, 2018. NAV 3-Year Changing three-year and change .Chg change in May to previous trading day How much would you have to pay to buy each of the following funds? a. American Century Emerging Markets Fund (AEMMX) Coton ACCAYA P-Distribution costs apply, 125-1. E-Footnotes and p apply. Source: The Wol u mna http://www .com /pub//2_7048-umfunds_A-umfunds.html data from September 18, 2011. M. Mesele. Che change in 3-Year Change trailing three-year an d change ton previous trading day How much would you have to pay to buy each of the following funds? a. American Century Emerging Markets Fund (AEMMX) b. American Century Core Plus Fund (ACCQX) c. Fidelity Advisor International Capital Appreciation Fund (FCPAX) d. Fidelity Advisor International Capital Shares (FSTAX) According to the quotes, which of these four funds have 12(b)-1 fees? ACCOX, FCPAX, FSTAX AEMMX, ACCOX, FAX AEMMX, FSTAX AEMMX, FCPAX ees? AFMMX, FSTAX Which of the funds are no-loads? FSTAX AEMMX FCPAX FCPAX, ACCQX ACCQX, FSTAX funds has the hig Which one of the funds has the highest year-to-date return? FSTAX ACCQX AEMMX FCPAX of the funds has the lowest year-to-date return? Which one of the funds has the lowest year-to-date return? FSTAX ACCQX h AEMMX FCPAX

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started