Question

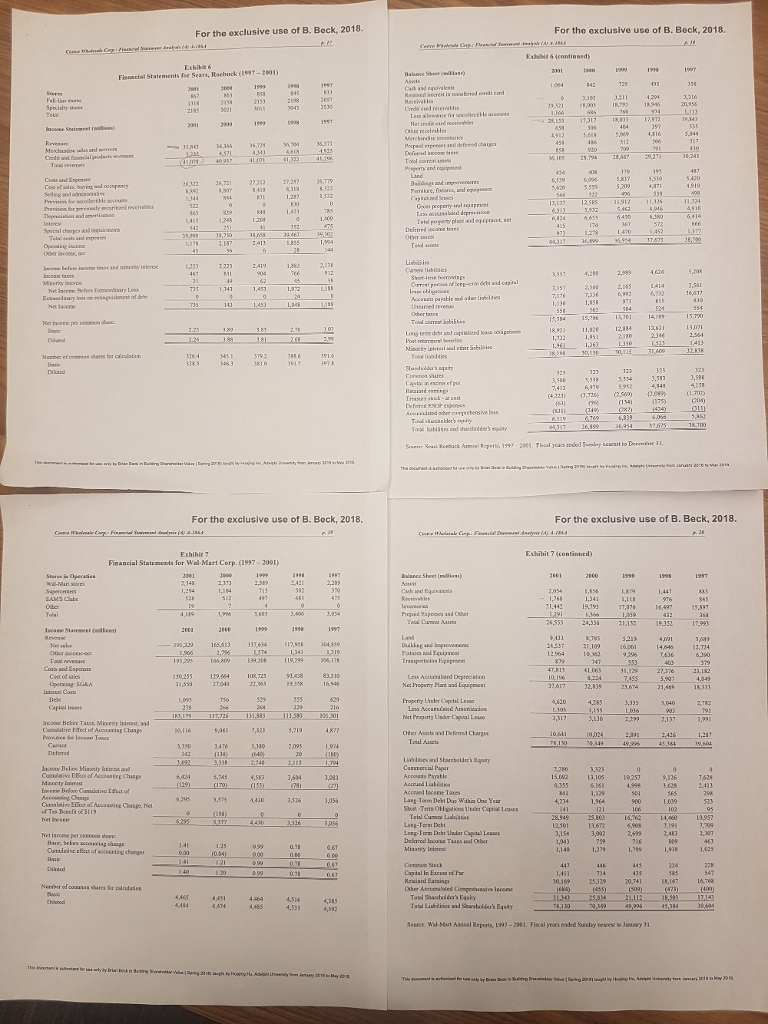

Use year 2001 in the Exhibit 6 and 7 from case Costco Wholesale Corporation Financial Analysis (A) to calculate the following financial ratios of Sears

Use year 2001 in the Exhibit 6 and 7 from case Costco Wholesale Corporation Financial Analysis (A) to calculate the following financial ratios of Sears and Wal-Mart and do some financial ratio analysis

Asset management ratios (Inventory ratios, Days in inventory, AR turnover, Days sale outstanding, fixed asset turnover, total asset turnover)

Liquidity and leverage ratios ( Current ratio, Debt ratio, Times interest earned ratio

Profitability ratios ( 3 margins, ROE, ROA)

Compare the performance of the two firms.

Do the DuPont Analysis of the two firms.

For the exclusive use of B. Beck, 2018 For the exclusive use of B. Beck, 2018. Exit6 (continsed) s fer Sears, Raebuck (I99T-2001) Specialty sh 530 3537 0 2,79 28,67 29 6,122 26,72127 27,25 577 1 433 631)--3932 Lililiire 4.22,99 2346 1363 350 331413 ef commas chares fer 3364 3,598 6119 6769 4,933 - For the exclusive use of B. Beck, 2018 For the exclusive use of B. Beck, 2018. w nak Corp.rc Exhibit 7 (continved) Fimancial Statcments for Wal- Mart Cerp. (1997-2001) Balunce Sbeet (millio) 6,555 24,355 21.133 291,29 166,013 24537 21.1 Cous and Eaperca 2973 3,1 129.4 10%,72 Les Accuasalwed Deprociation Net Iroperty Mant and Eqapmest Opening: SCEA 37,617 Property Uhder Copetal Le 4620 ,335 Camulitne Erect of Accomag aage 5,485 Oher owets and Deferned Charge 426 1,24 Carsrorcial Per 5,745 ,083 hiet iwee otal C Leeg- Iarn Debt Uadar Capital Lease 2,483 Rewiaed Eaniag 14 Te8 Searpe Wal-Mart AMAal Reports, l'-2001. Fiscal yeles er ed Sanay terest 10 Janury 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started