Question

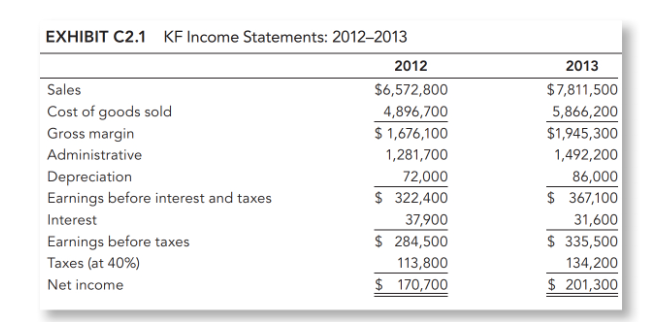

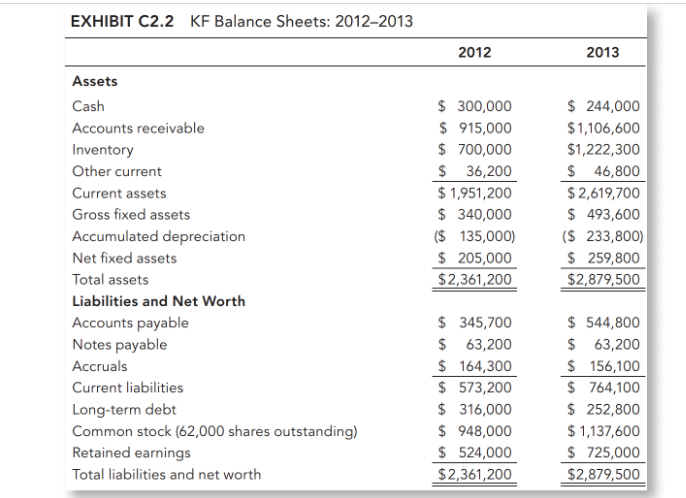

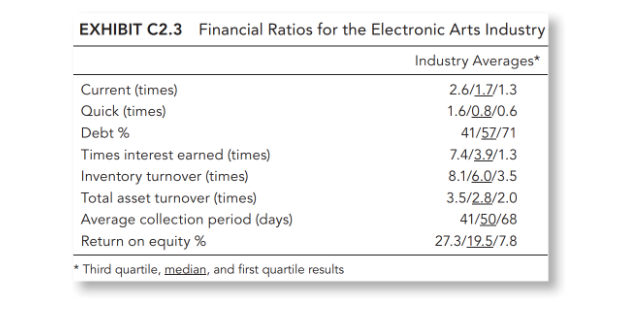

Using the data in exhibits C2.1 and C2.3, calculate and analyze the firms 2012 and 2013 ratios. Enter the ratios in the table below in

- Using the data in exhibits C2.1 and C2.3, calculate and analyze the firms 2012 and 2013 ratios. Enter the ratios in the table below in the 2012 and 2013 columns, respectively:

2. Part of Owens evaluation will consist of comparing the firms ratios to the industry as shown in Exhibit C2.3 of the text. Discuss the limitations of such a comparative financial analysis. In view of these limitations, why are such industry comparisons so frequently made? (Note: Sales are forecast to be $8.25 million in 2014).

3.Owen thinks that the profitability of the firm has been hurt by Tessas reluctance to use much interest-bearing debt. Is this a reasonable position? Explain.

4.The case mentions that Tessa rarely takes trade discounts, which are typically 1/10, net 30. Does this seem like a wise financial move? Explain.

5.Is the estimate of $35 to $40 for Owens shares a fair evaluation? Explain.

EXHIBIT C2.2 KF Balance Sheets: 2012-2013 \begin{tabular}{|c|c|c|c|} \hline & & 2012 & 2013 \\ \hline \multicolumn{4}{|l|}{ Assets } \\ \hline Cash & $ & 300,000 & $244,000 \\ \hline Accounts receivable & $ & 915,000 & $1,106,600 \\ \hline Inventory & $ & 700,000 & $1,222,300 \\ \hline Other current & $ & 36,200 & $46,800 \\ \hline Current assets & & 1,951,200 & $2,619,700 \\ \hline Gross fixed assets & $ & 340,000 & $493,600 \\ \hline Accumulated depreciation & ($ & 135,000) & ($233,800) \\ \hline Net fixed assets & $ & 205,000 & $259,800 \\ \hline Total assets & & 2,361,200 & $2,879,500 \\ \hline \multicolumn{4}{|l|}{ Liabilities and Net Worth } \\ \hline Accounts payable & $ & 345,700 & $544,800 \\ \hline Notes payable & $ & 63,200 & $63,200 \\ \hline Accruals & $ & 164,300 & $156,100 \\ \hline Current liabilities & $ & 573,200 & $764,100 \\ \hline Long-term debt & $ & 316,000 & $252,800 \\ \hline Common stock ( 62,000 shares outstanding) & $ & 948,000 & $1,137,600 \\ \hline Retained earnings & $ & 524,000 & $725,000 \\ \hline Total liabilities and net worth & & 2,361,200 & $2,879,500 \\ \hline \end{tabular} EXHIBIT C2.1 KF Income Statements: 2012-2013 \begin{tabular}{|c|c|c|} \hline & 2012 & 2013 \\ \hline Sales & $6,572,800 & $7,811,500 \\ \hline Cost of goods sold & 4,896,700 & 5,866,200 \\ \hline Gross margin & $1,676,100 & $1,945,300 \\ \hline Administrative & 1,281,700 & 1,492,200 \\ \hline Depreciation & 72,000 & 86,000 \\ \hline Earnings before interest and taxes & $322,400 & $367,100 \\ \hline Interest & 37,900 & 31,600 \\ \hline Earnings before taxes & $284,500 & $335,500 \\ \hline Taxes (at 40% ) & 113,800 & 134,200 \\ \hline Net income & $170,700 & $201,300 \\ \hline \end{tabular} EXHIBIT C2.3 Financial Ratios for the Electronic Arts Industry \begin{tabular}{lc} \hline & Industry Averages* \\ \hline Current (times) & 2.6/1.7/1.3 \\ Quick (times) & 1.6/0.8/0.6 \\ Debt \% & 41/57/71 \\ Times interest earned (times) & 7.4/3.9/1.3 \\ Inventory turnover (times) & 8.1/6.0/3.5 \\ Total asset turnover (times) & 3.5/2.8/2.0 \\ Average collection period (days) & 41/50/68 \\ Return on equity \% & 27.3/19.5/7.8 \\ \hline * Third quartile, median, and first quartile results & \end{tabular} EXHIBIT C2.2 KF Balance Sheets: 2012-2013 \begin{tabular}{|c|c|c|c|} \hline & & 2012 & 2013 \\ \hline \multicolumn{4}{|l|}{ Assets } \\ \hline Cash & $ & 300,000 & $244,000 \\ \hline Accounts receivable & $ & 915,000 & $1,106,600 \\ \hline Inventory & $ & 700,000 & $1,222,300 \\ \hline Other current & $ & 36,200 & $46,800 \\ \hline Current assets & & 1,951,200 & $2,619,700 \\ \hline Gross fixed assets & $ & 340,000 & $493,600 \\ \hline Accumulated depreciation & ($ & 135,000) & ($233,800) \\ \hline Net fixed assets & $ & 205,000 & $259,800 \\ \hline Total assets & & 2,361,200 & $2,879,500 \\ \hline \multicolumn{4}{|l|}{ Liabilities and Net Worth } \\ \hline Accounts payable & $ & 345,700 & $544,800 \\ \hline Notes payable & $ & 63,200 & $63,200 \\ \hline Accruals & $ & 164,300 & $156,100 \\ \hline Current liabilities & $ & 573,200 & $764,100 \\ \hline Long-term debt & $ & 316,000 & $252,800 \\ \hline Common stock ( 62,000 shares outstanding) & $ & 948,000 & $1,137,600 \\ \hline Retained earnings & $ & 524,000 & $725,000 \\ \hline Total liabilities and net worth & & 2,361,200 & $2,879,500 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline \multicolumn{1}{|c|}{ Ratio Type } & \multicolumn{1}{c|}{2012} & \\ \hline Current (times) & & \\ \hline Quick (times) & & \\ \hline Debt (\%) & & \\ \hline Times interest earned (times) & & \\ \hline Inventory turnover (times) & & \\ \hline Total asset turnover (times) & & \\ \hline Average collections period (days) & & \\ \hline Return on equity (\%) & & \\ \hline \end{tabular} EXHIBIT C2.3 Financial Ratios for the Electronic Arts Industry \begin{tabular}{lc} \hline & Industry Averages* \\ \hline Current (times) & 2.6/1.7/1.3 \\ Quick (times) & 1.6/0.8/0.6 \\ Debt \% & 41/57/71 \\ Times interest earned (times) & 7.4/3.9/1.3 \\ Inventory turnover (times) & 8.1/6.0/3.5 \\ Total asset turnover (times) & 3.5/2.8/2.0 \\ Average collection period (days) & 41/50/68 \\ Return on equity \% & 27.3/19.5/7.8 \\ \hline * Third quartile, median, and first quartile results & \end{tabular} EXHIBIT C2.1 KF Income Statements: 2012-2013 \begin{tabular}{|c|c|c|} \hline & 2012 & 2013 \\ \hline Sales & $6,572,800 & $7,811,500 \\ \hline Cost of goods sold & 4,896,700 & 5,866,200 \\ \hline Gross margin & $1,676,100 & $1,945,300 \\ \hline Administrative & 1,281,700 & 1,492,200 \\ \hline Depreciation & 72,000 & 86,000 \\ \hline Earnings before interest and taxes & $322,400 & $367,100 \\ \hline Interest & 37,900 & 31,600 \\ \hline Earnings before taxes & $284,500 & $335,500 \\ \hline Taxes (at 40% ) & 113,800 & 134,200 \\ \hline Net income & $170,700 & $201,300 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started