Answered step by step

Verified Expert Solution

Question

1 Approved Answer

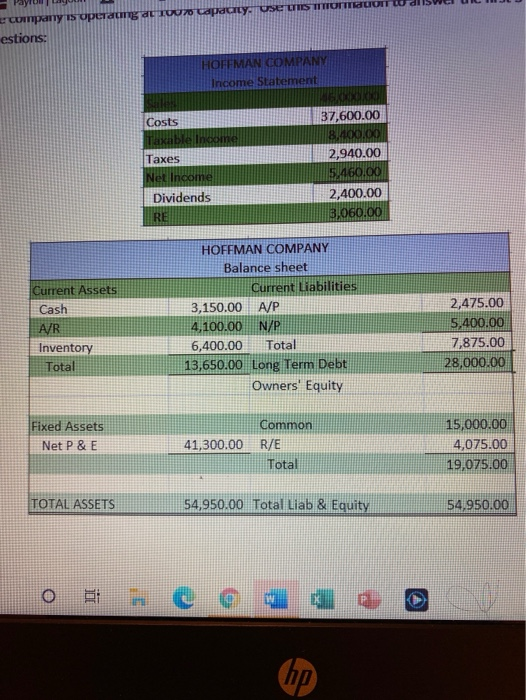

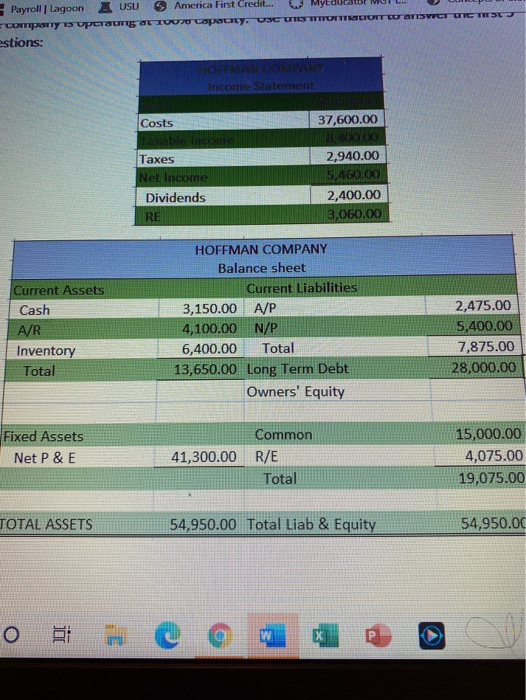

using the following income statement and balance sheet create a pro forma balance sheet as in the growth rate of 15% and that the tax

using the following income statement and balance sheet create a pro forma balance sheet as in the growth rate of 15% and that the tax rate in dividend payment remain constant cost assets in accounts payable vary with sales but the others do not in the company is operating at 100% capacity use this information to answer the first five questions.

1. what is the proforma value of retained earnings?( from the balance sheet)?

A. 7,594

B. 10,956

C. 8,184

D. 4,614

E. 5,406

2. what is the external financing needed?

A. 3,427

B. 5,919

C. 2,046

D. 3,863

E. 4,352

3. Based on proforma values, calculate the internal growth rate. the internal growth rate is? which is the amount of growth hoffman company can achieve?

4. Based on proforma values, calculate the sustainable growth rate. the sustainable growth rate is? which is the amount of growth Hoffman company can achieve?

5. suppose hoffman company is operating at 80%, rather than 100% capacity. in this situation, full capacity sales would be? and proforma value for net fixed assets would be?

company is operating at % capacity. Use TS TOTUOTT estions: HOFFMAN COMPANY Income Statement SEX Costs 37,600.00 Taxible Income 8,100.00 Taxes 2,940.00 Net Income 15.460.00 Dividends 2,400.00 RE 3,060.00 Current Assets Cash A/R Inventory Total HOFFMAN COMPANY Balance sheet Current Liabilities 3,150.00 A/P 4,100.00 N/P 6,400.00 Total 13,650.00 Long Term Debt Owners' Equity 2,475.00 5,400.00 7,875.00 28,000.00 Fixed Assets Net P & E Common 41,300.00 R/E Total 15,000.00 4,075.00 19,075.00 TOTAL ASSETS 54,950.00 Total Liab & Equity 54,950.00 WALA hp Payroll Lagoon A USU America First Credit... company suparang Lapalny. W US TOTIUT CU TUCTS estions: Income Statement 37,600.00 Costs benci Taxes Net Income Dividends RE 2,940.00 5,460.00 2,400.00 3,060.00 Current Assets Cash A/R Inventory Total HOFFMAN COMPANY Balance sheet Current Liabilities 3,150.00 A/P 4,100.00 N/P 6,400.00 Total 13,650.00 Long Term Debt Owners' Equity 2,475.00 5,400.00 7,875.00 28,000.00 Fixed Assets Net P & E Common 41,300.00 R/E Total 15,000.00 4,075.00 19,075.00 TOTAL ASSETS 54,950.00 Total Liab & Equity 54,950.00 O W Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started