Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ysom, Inc. was founded in 2015 by Professor Shin at Yonsei University and Professor Lee at Severance Hospital which is an affiliate institute of

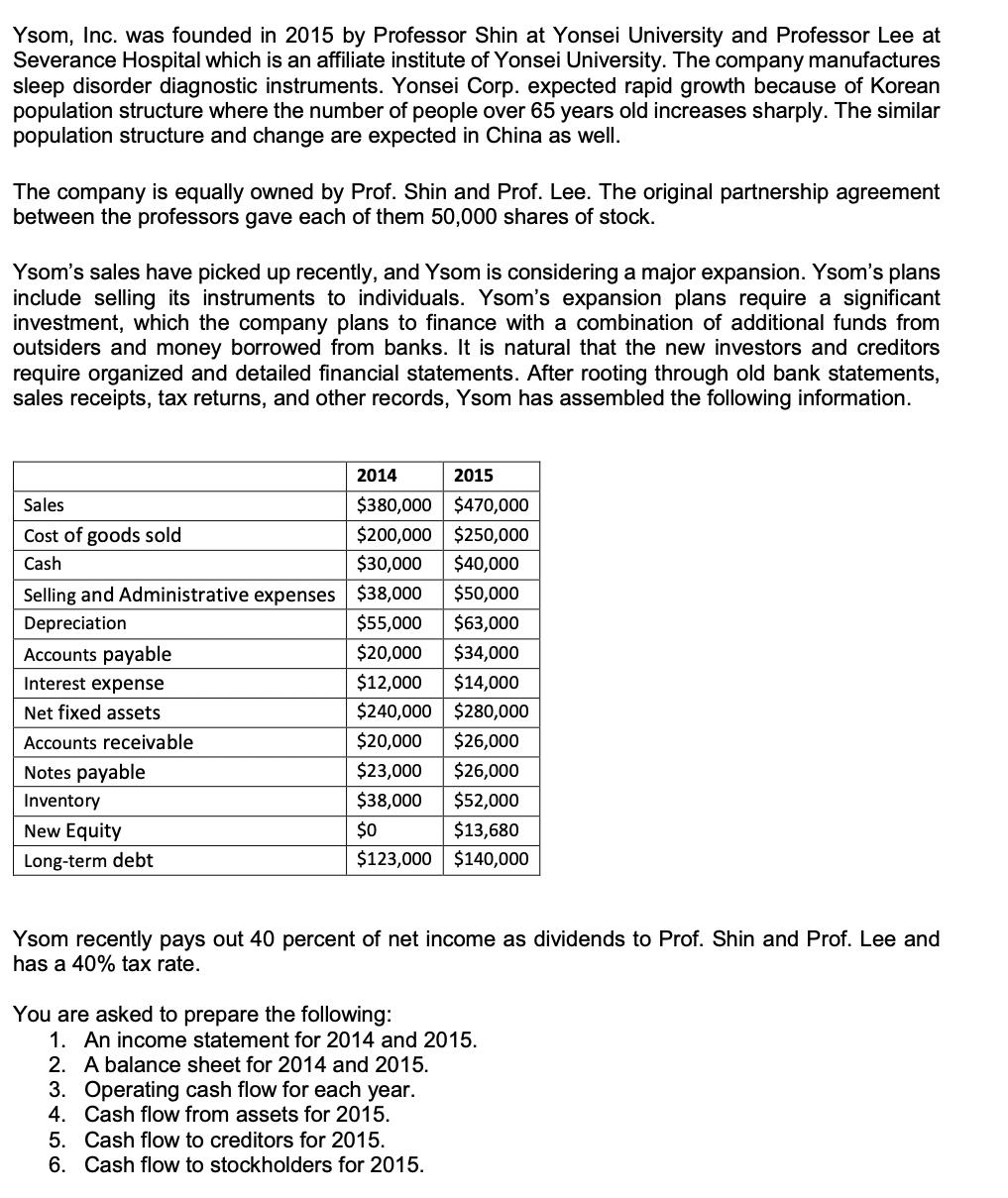

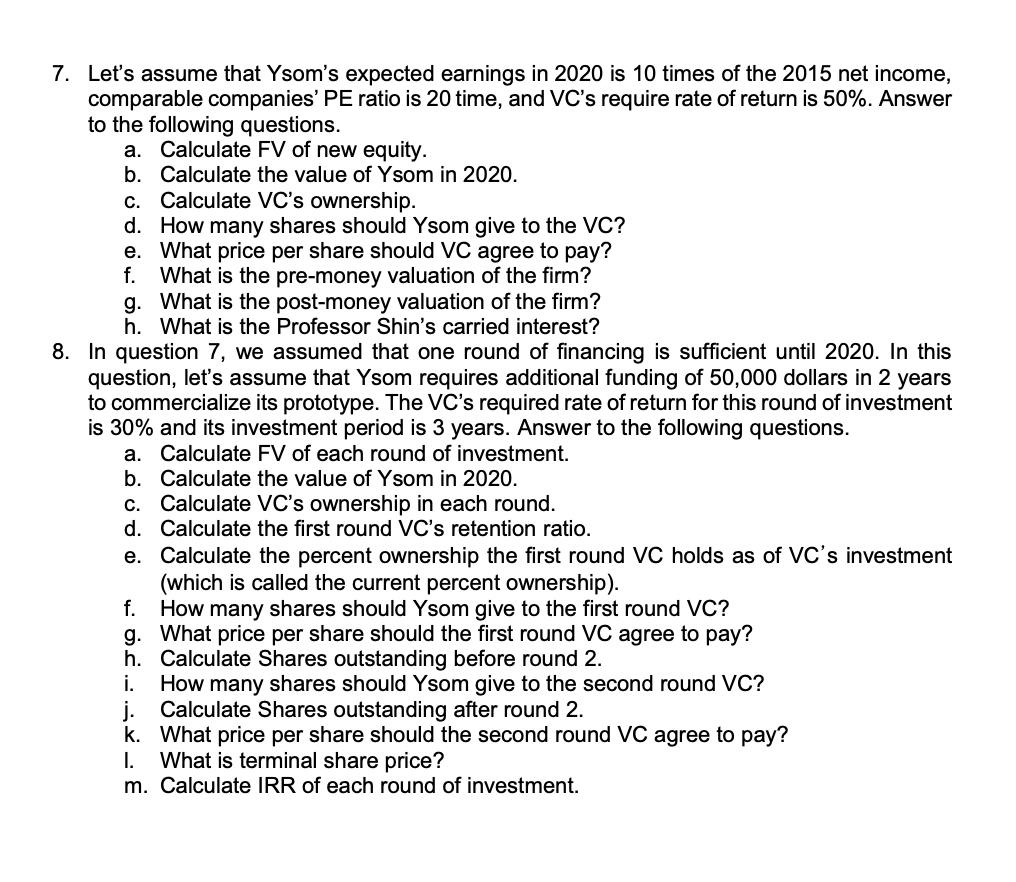

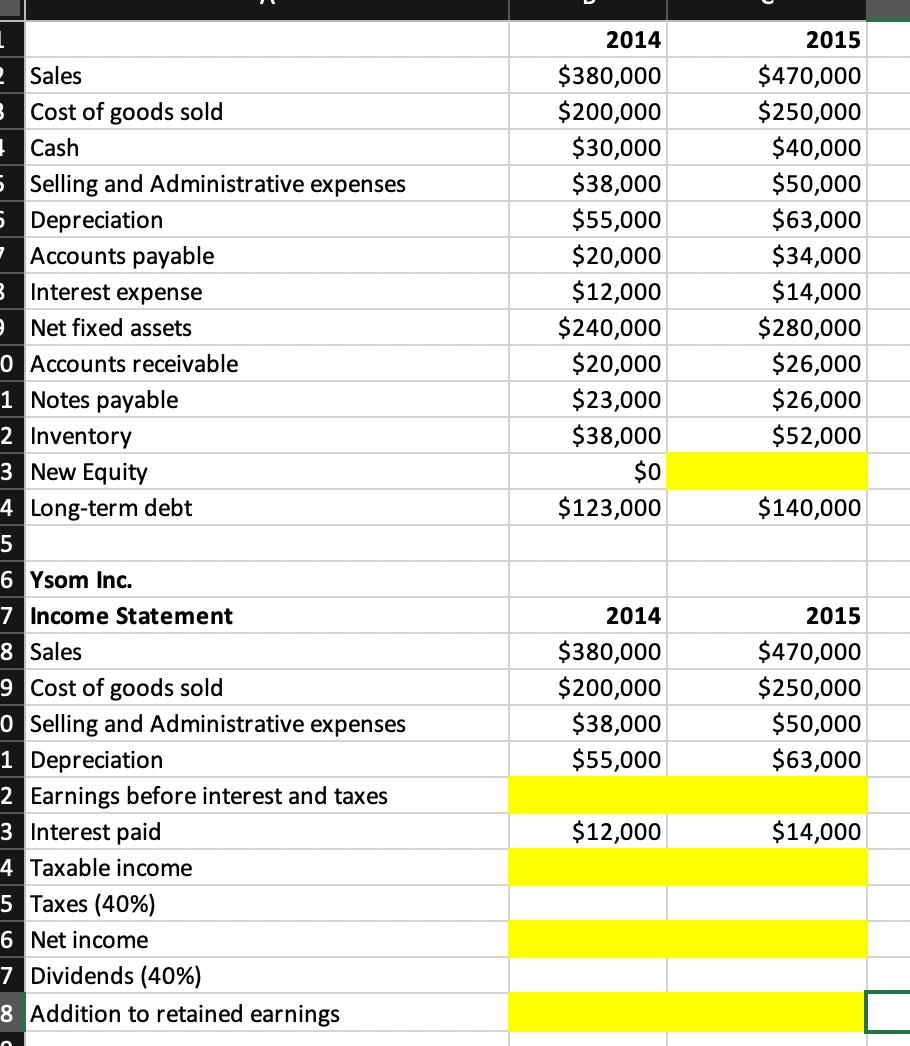

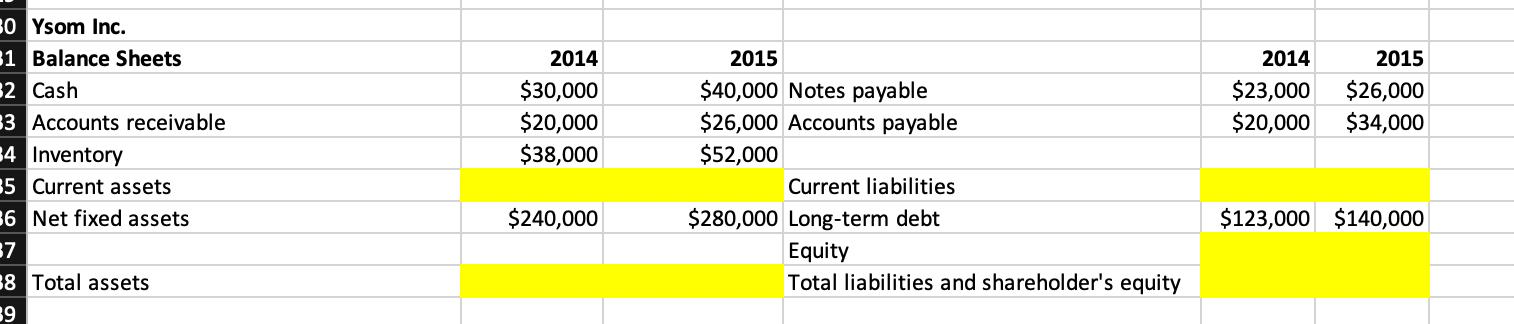

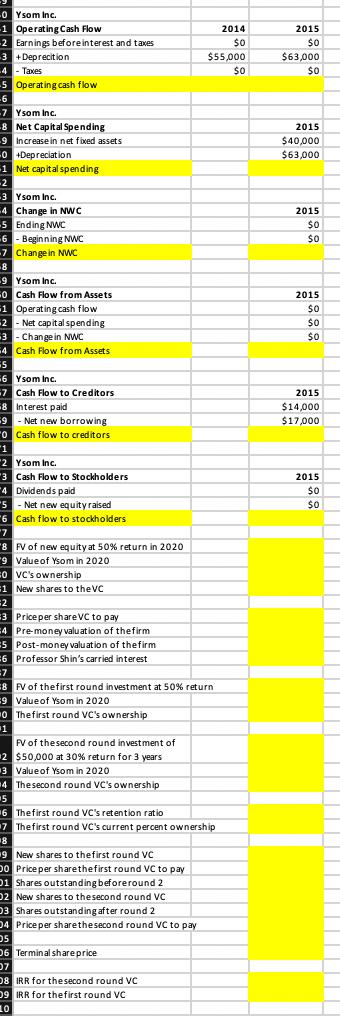

Ysom, Inc. was founded in 2015 by Professor Shin at Yonsei University and Professor Lee at Severance Hospital which is an affiliate institute of Yonsei University. The company manufactures sleep disorder diagnostic instruments. Yonsei Corp. expected rapid growth because of Korean population structure where the number of people over 65 years old increases sharply. The similar population structure and change are expected in China as well. The company is equally owned by Prof. Shin and Prof. Lee. The original partnership agreement between the professors gave each of them 50,000 shares of stock. Ysom's sales have picked up recently, and Ysom is considering a major expansion. Ysom's plans include selling its instruments to individuals. Ysom's expansion plans require a significant investment, which the company plans to finance with a combination of additional funds from outsiders and money borrowed from banks. It is natural that the new investors and creditors require organized and detailed financial statements. After rooting through old bank statements, sales receipts, tax returns, and other records, Ysom has assembled the following information. 2014 2015 $380,000 $470,000 $200,000 $250,000 $30,000 $40,000 Selling and Administrative expenses $38,000 $50,000 $55,000 $63,000 $20,000 $34,000 $12,000 $14,000 $240,000 $280,000 $20,000 $26,000 $23,000 $26,000 $38,000 $52,000 $0 $13,680 $123,000 $140,000 Sales Cost of goods sold Cash Depreciation Accounts payable Interest expense Net fixed assets Accounts receivable Notes payable Inventory New Equity Long-term debt Ysom recently pays out 40 percent of net income as dividends to Prof. Shin and Prof. Lee and has a 40% tax rate. You are asked to prepare the following: 1. An income statement for 2014 and 2015. 2. A balance sheet for 2014 and 2015. 3. Operating cash flow for each year. 4. Cash flow from assets for 2015. 5. Cash flow to creditors for 2015. 6. Cash flow to stockholders for 2015. 7. Let's assume that Ysom's expected earnings in 2020 is 10 times of the 2015 net income, comparable companies' PE ratio is 20 time, and VC's require rate of return is 50%. Answer to the following questions. a. Calculate FV of new equity. b. Calculate the value of Ysom in 2020. c. Calculate VC's ownership. d. How many shares should Ysom give to the VC? e. What price per share should VC agree to pay? f. What is the pre-money valuation of the firm? g. What is the post-money valuation of the firm? h. What is the Professor Shin's carried interest? 8. In question 7, we assumed that one round of financing is sufficient until 2020. In this question, let's assume that Ysom requires additional funding of 50,000 dollars in 2 years to commercialize its prototype. The VC's required rate of return for this round of investment is 30% and its investment period is 3 years. Answer to the following questions. a. Calculate FV of each round of investment. b. Calculate the value of Ysom in 2020. c. Calculate VC's ownership in each round. d. Calculate the first round VC's retention ratio. e. Calculate the percent ownership the first round VC holds as of VC's investment (which is called the current percent ownership). How many shares should Ysom give to the first round VC? f. g. What price per share should the first round VC agree to pay? h. Calculate Shares outstanding before round 2. i. How many shares should Ysom give to the second round VC? j. Calculate Shares outstanding after round 2. k. What price per share should the second round VC agree to pay? I. What is terminal share price? m. Calculate IRR of each round of investment. 2 Sales Cost of goods sold Cash 5 Selling and Administrative expenses 5 Depreciation Accounts payable Interest expense Net fixed assets 3 9 0 Accounts receivable 1 Notes payable 2 Inventory 3 New Equity 4 Long-term debt 5 6 Ysom Inc. 7 Income Statement 8 Sales 9 Cost of goods sold O Selling and Administrative expenses 1 Depreciation 2 Earnings before interest and taxes 3 Interest paid 4 Taxable income 5 Taxes (40%) 6 Net income 7 Dividends (40%) 8 Addition to retained earnings 2014 $380,000 $200,000 $30,000 $38,000 $55,000 $20,000 $12,000 $240,000 $20,000 $23,000 $38,000 $0 $123,000 2014 $380,000 $200,000 $38,000 $55,000 $12,000 2015 $470,000 $250,000 $40,000 $50,000 $63,000 $34,000 $14,000 $280,000 $26,000 $26,000 $52,000 $140,000 2015 $470,000 $250,000 $50,000 $63,000 $14,000 30 Ysom Inc. 31 Balance Sheets 32 Cash 33 Accounts receivable 34 Inventory 35 Current assets 36 Net fixed assets 37 38 Total assets 39 2014 $30,000 $20,000 $38,000 $240,000 2015 $40,000 Notes payable $26,000 Accounts payable $52,000 Current liabilities $280,000 Long-term debt Equity Total liabilities and shareholder's equity 2014 2015 $23,000 $26,000 $20,000 $34,000 $123,000 $140,000 -0 Ysom Inc. -1 Operating Cash Flow 2 Earnings before interest and taxes 3 +Deprecition 4- Taxes 5 Operating cash flow 6 -7 Ysom Inc. -8 Net Capital Spending 9 Increase in net fixed assets -0 +Depreciation 1 Net capital spending -2 3 Ysom Inc.. 4 -5 Ending NWC 6 - Beginning NWC 7 Change in NWC -8 Change in NWC 9 Ysom Inc. 50 Cash Flow from Assets 1 Operating cash flow 2- Net capital spending - Change in NWC 3 4 Cash Flow from Assets GS 6 Ysom Inc. 7 Cash Flow to Creditors 8 Interest paid 9- Net new borrowing "O Cash flow to creditors "1 2 Ysom Inc. 3 Cash Flow to Stockholders 4 Dividends paid 5-Net new equity raised 6 Cash flow to stockholders "7 8 FV of new equity at 50% return in 2020 9 Value of Ysom in 2020 0 VC's ownership 1 New shares to the VC =2 3 Price per share VC to pay 4 Pre-money valuation of the firm Post-money valuation of the firm Professor Shin's carried interest :5 :6 =7 8 FV of the first round investment at 50% return 9 Value of Ysom in 2020 0 The first round VC's ownership 1 2014 $0 $55,000 $0 FV of the second round investment of 2 $50,000 at 30% return for 3 years 3 Value of Ysom in 2020 4 The second round VC's ownership 5 16 The first round VC's retention ratio 7 The first round VC's current percent ownership 8 19 New shares to the first round VC 00 Price per share the first round VC to pay 01 Shares outstanding before round 2 02 New shares to the second round VC 03 Shares outstanding after round 2 04 Price per share the second round VC to pay 05 06 Terminal share price 07 IRR for the second round VC 09 IRR for the first round VC LO 2015 $0 $63,000 $0 2015 $40,000 $63,000 2015 $0 $0 2015 $0 $0 $0 2015 $14,000 $17,000 2015 $0 $0

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Income Statement for 2014 and 2015 2014 Sales 380000 Cost of goods sold 200000 Selling and Administrative expenses 38000 Depreciation 55000 Interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started