Answered step by step

Verified Expert Solution

Question

1 Approved Answer

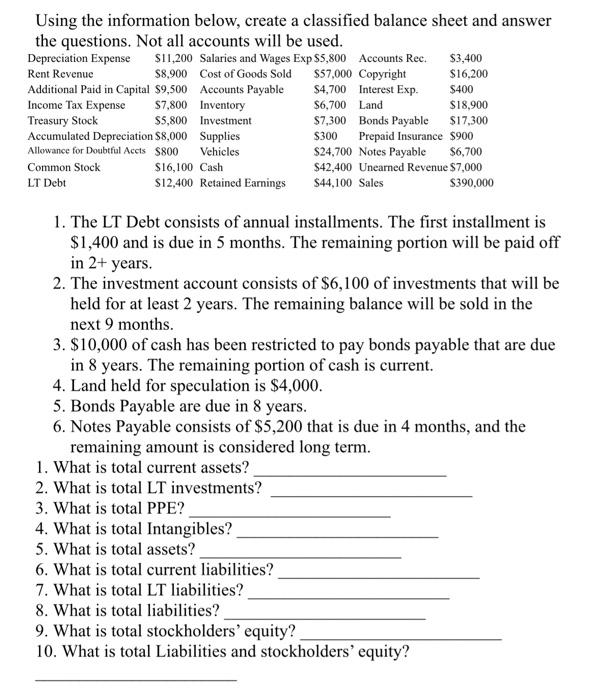

Using the information below, create a classified balance sheet and answer the questions. Not all accounts will be used. Depreciation Expense $11,200 Salaries and Wages

Using the information below, create a classified balance sheet and answer the questions. Not all accounts will be used. Depreciation Expense $11,200 Salaries and Wages Exp $5,800 Accounts Rec. Rent Revenue $57,000 Copyright $8,900 Cost of Goods Sold Accounts Payable Inventory $4,700 Interest Exp. $6,700 Land Investment $7,300 $300 Additional Paid in Capital $9,500 Income Tax Expense $7,800 Treasury Stock $5,800 Accumulated Depreciation $8,000 Allowance for Doubtful Accts $800 Common Stock LT Debt Supplies Vehicles $16,100 Cash $12,400 Retained Earnings $3,400 $16,200 $400 $18,900 $17,300 Bonds Payable Prepaid Insurance $900 $24,700 Notes Payable $6,700 $42,400 Unearned Revenue $7,000 $44,100 Sales $390,000 1. The LT Debt consists of annual installments. The first installment is $1,400 and is due in 5 months. The remaining portion will be paid off in 2+ years. 2. The investment account consists of $6,100 of investments that will be held for at least 2 years. The remaining balance will be sold in the next 9 months. 6. What is total current liabilities? 7. What is total LT liabilities? 8. What is total liabilities? 9. What is total stockholders' equity? 10. What is total Liabilities and stockholders' equity? 3. $10,000 of cash has been restricted to pay bonds payable that are due in 8 years. The remaining portion of cash is current. 4. Land held for speculation is $4,000. 5. Bonds Payable are due in 8 years. 6. Notes Payable consists of $5,200 that is due in 4 months, and the remaining amount is considered long term. 1. What is total current assets? 2. What is total LT investments? 3. What is total PPE? 4. What is total Intangibles? 5. What is total assets?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started