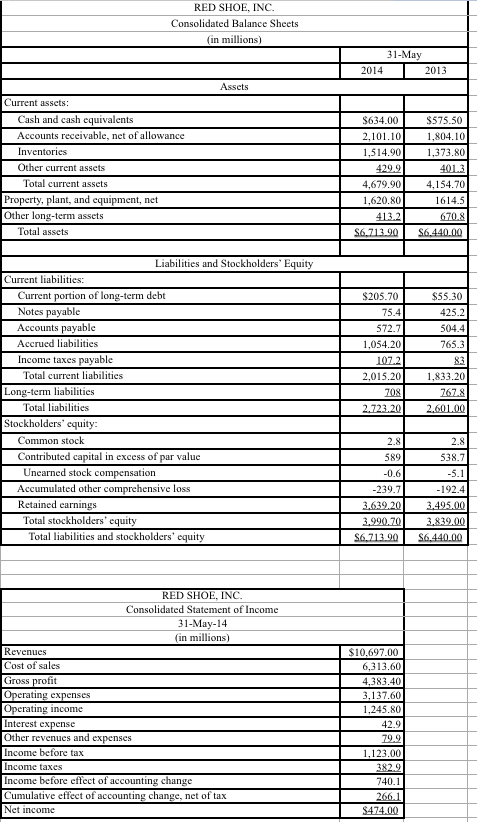

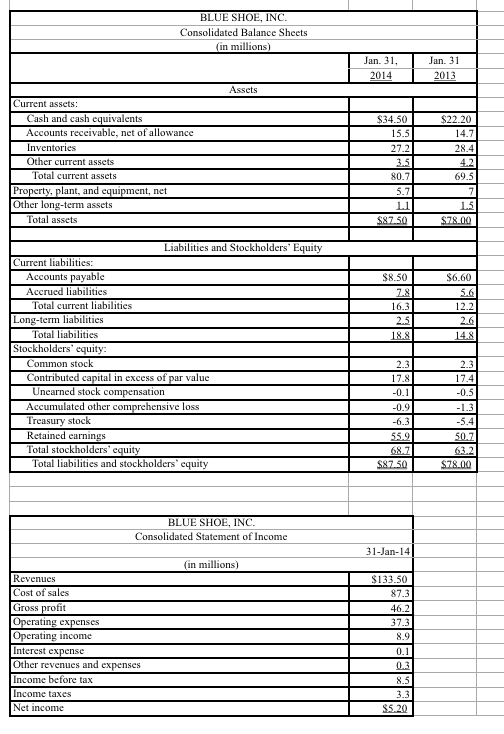

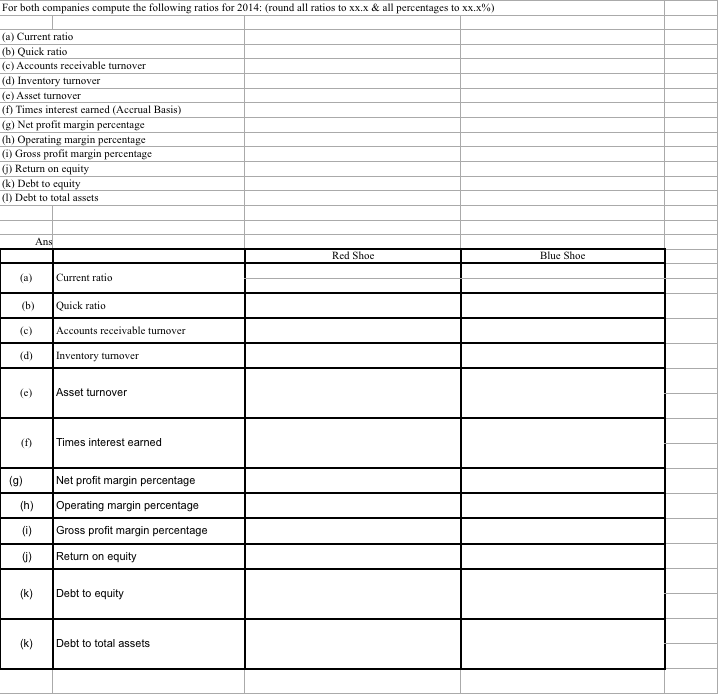

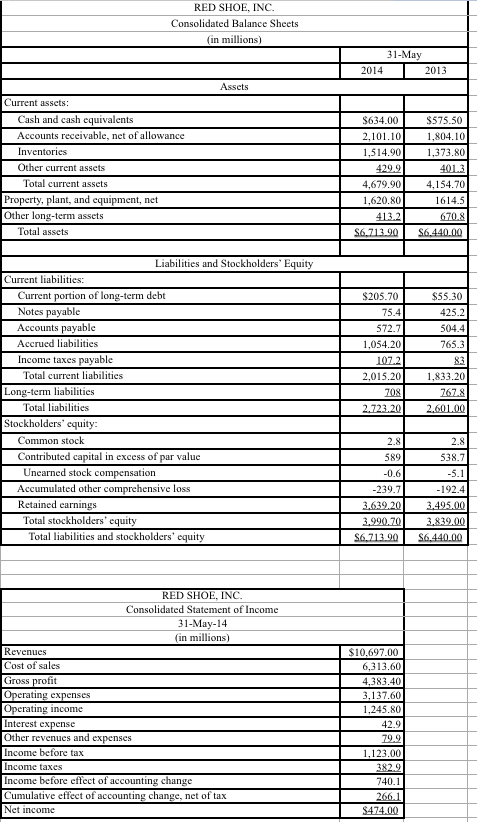

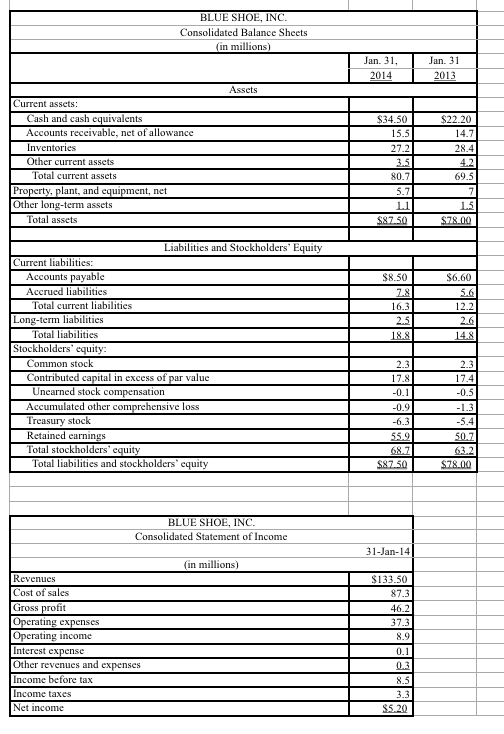

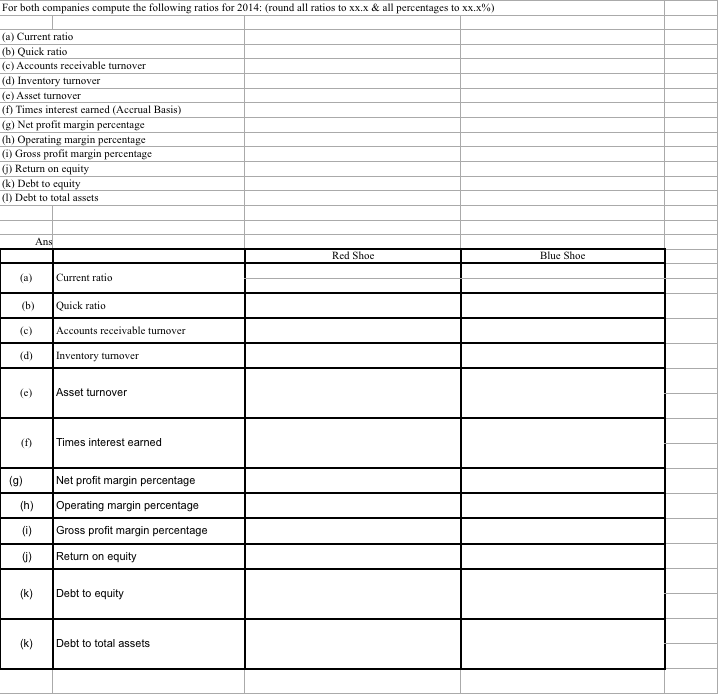

Using the information in the first two pictures, I must fill out the chart, that is the third picture.

RED SHOE, INC. Consolidated Balance Sheets (in millions) May 2014 2013 Assets Current assets: Cash and cash equivalents Accounts receivable, net of allowance Inventorics Other current assets 4013 $634.00 2.101.10 1.514.90 429.9 4,679.90 1,620.80 4132 S6.713.90 4.154.70 Total current assets Property, plant, and equipment, net Other long-term assets Total assets 1614.5 670.8 S6,440.00 Liabilities and Stockholders' Equity Current liabilities: Current portion of long-term debt S205.70 75.4 425.2 Notes payable Accounts payable Accrued liabilities Income taxes payable Total current liabilities 504.4 265.3 572.7 1,054.20 107.2 2.015.20 Long-term liabilities 208 1,833.20 767.8 2.601.00 2.723.20 28 589 Total liabilities Stockholders' equity: Common stock Contributed capital in excess of par value Unearned stock compensation Accumulated other comprehensive loss Retained earnings Total stockholders' equity Total liabilities and stockholders' equity -0.6 -239.7 538.7 -5.1 -192.4 3.495.00 3.839.00 $6.440.00 3.639.20 3.990.70 S6.713.90 RED SHOE, INC. Consolidated Statement of Income 31-May-14 (in millions) Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense Other revenues and expenses Income before tax Income taxes Income before effect of accounting change Cumulative effect of accounting change, net of tax Net income $10.697.00 6,313.60 4.383.40 3.137.60 1.245.80 42.9 29.2 1.123.00 382.9 740.1 266.1 $474.00 BLUE SHOE, INC. Consolidated Balance Sheets (in millions) Jan. 31. Jan. 31 2013 2014 Current assets 14 50 S2220 Cash and cash equivalents Accounts receivable, net of allowance IS. 27.2 35 Inventories Other current assets Total current assets Property, plant, and equipment, nct Other long-term assets Total assets 80.7 5.7 1.1 $87.50 1.5 S78.00 $6.60 $8.50 2.8 16.3 2.5 18.8 12.2 2.6 14.8 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities Total current liabilities Long-term liabilities Total liabilities Stockholders' cauty Common stock Contributed capital in excess of par value Unearned stock compensation Accumulated other comprehensive loss Treasury stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 17.4 2.3 17.8 -0.1 -0.9 -6.3 55.9 68.7 $87.50 -5.4 50.7 22 $78.00 BLUE SHOE, INC. Consolidated Statement of Income 31-Jan-141 (in millions) S133 50 873 46.2 37.3 8.9 Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense Other revenues and expenses Income before tax Income taxes Net income For both companies compute the following ratios for 2014: (round all ratios to xx.x & all percentages to xx.x%) (a) Current ratio (b) Quick ratio (c) Accounts receivable turnover (d) Inventory turnover (c) Asset turnover (f) Times interest earned (Accrual Basis) (g) Net profit margin percentage (h) Operating margin percentage (1) Gross profit margin percentage () Return on equity (k) Debt to equity (1) Debt to total assets Red Shoe Blue Shoe Current ratio (b) (c) Quick ratio Accounts receivable turnover Inventory tumover Asset turnover (1) Times interest earned Net profit margin percentage (h) Operating margin percentage Gross profit margin percentage 0) Return on equity (k) Debt to equity (k) Debt to total assets