Using this info, I have to

1. Prepare a schedule of cost of goods manufactured for the quarter in good form.

2. Prepare a corrected income statement for the quarter in good form. (Should show in detail how the cost of goods sold is computed)

3. Do you agree that the insurance company owes Medical Technology, Inc $227,000 or a different amount? Give he amount that you think the insurance company should pay and explain your answer

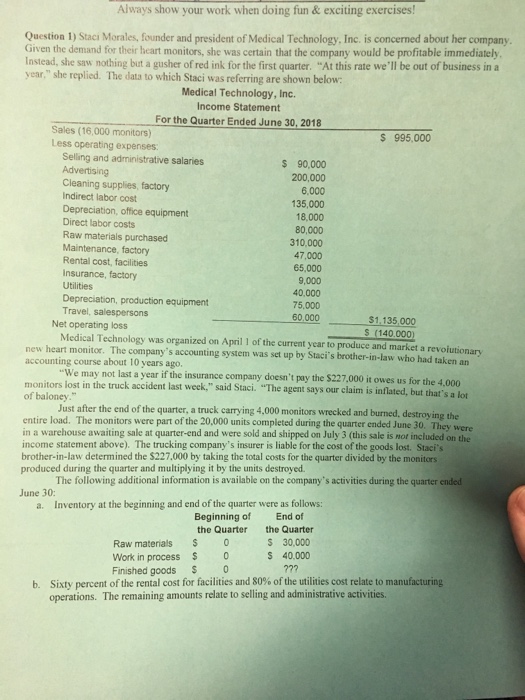

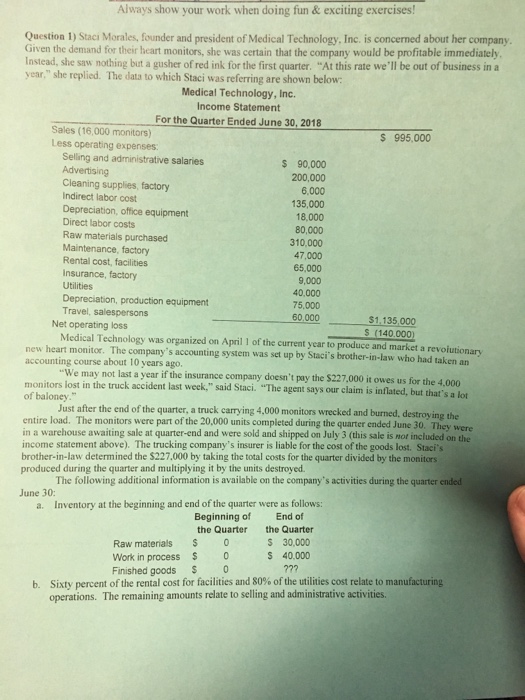

Always show your work when doing fun& exciting exercises! Question 1) Staci Morales, founder and president of Medical Technology, Inc. is concerned about her company. Given the demand for their heart monitors, she was certain that the company would be profitable immediately Instead, she saw nothing but a gusher of red ink for the first quarter. "At this rate we'll be out of business in a year," she replied. The data to which Staci was referring are shown below: Medical Technology, Inc. Income Statement For the Quarter Ended June 30, 2018 Sales (16,000 monitors) Less operating expenses S 995,000 Selling and administrative salaries Advertising Cleaning supplies, factory Indirect labor cost Depreciation, office equipment Direct labor costs Raw materials purchased Maintenance, factory Rental cost, facilities Insurance, factory Utilities s 90,000 200,000 6,000 135,000 18,000 80,000 310,000 47.000 65,000 9,000 40,000 75,000 Travel, salespersons $1.135 000 S (140.000) 60 Net operating loss Medical Technology was organized on April 1 of the current year to produce and market a revolutionary rt monitor. The company's accounting system was set up by Staci's brother-in-law who had taken an new hea accounting course about 10 years ago. We may not last a year if the insurance company doesn't pay the $227.000 it owes us for the 4,00 monitors lost in the truck accident last week," said Staci. "The agent says our claim is inflated, but that's a lot of baloney Just after the end of the quarter, a truck carrying 4,000 monitors wrecked and burned, destroy ing the entire load. The monitors were part of the 20,000 units completed during the quarter ended June 30. They wer in a warehouse awaiting sale at quarter-end and were sold and shipped on July 3 (this sale is not included on the income statement above). The trucking company's insurer is liable for the cost of the goods lost. Staci's brother-in-law determined the $227,000 by taking the total costs for the quarter divided by the monitors produced during the quarter and multiplying it by the units destroyed. The following additional information is available on the company's activities during the quarter ended Inventory at the beginning and end of the quarter were as follows: June 30: a. End of the Quarter S 30,000 S 40,000 Beginning of the Quarter Raw materials 0 Work in process 0 Finished goods 0 Sixty percent of the rental cost for facilities and 80% of the utilities cost relate to manufacturing operations. The remaining amounts relate to selling and administrative activities. b

Using this info, I have to

Using this info, I have to