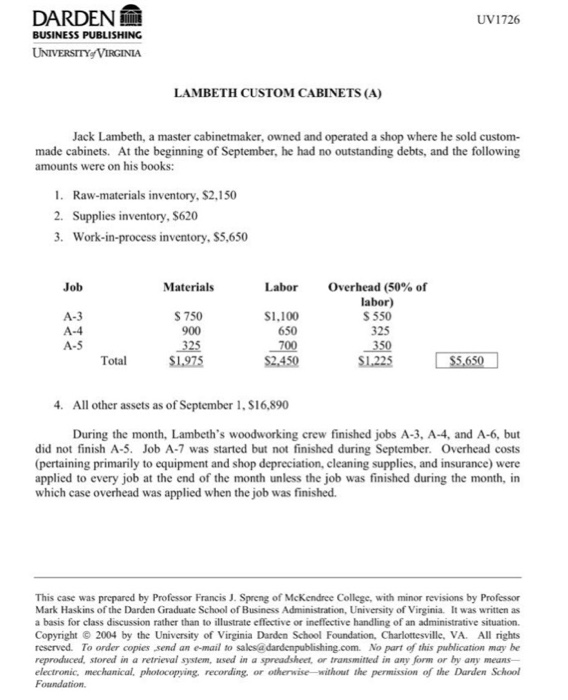

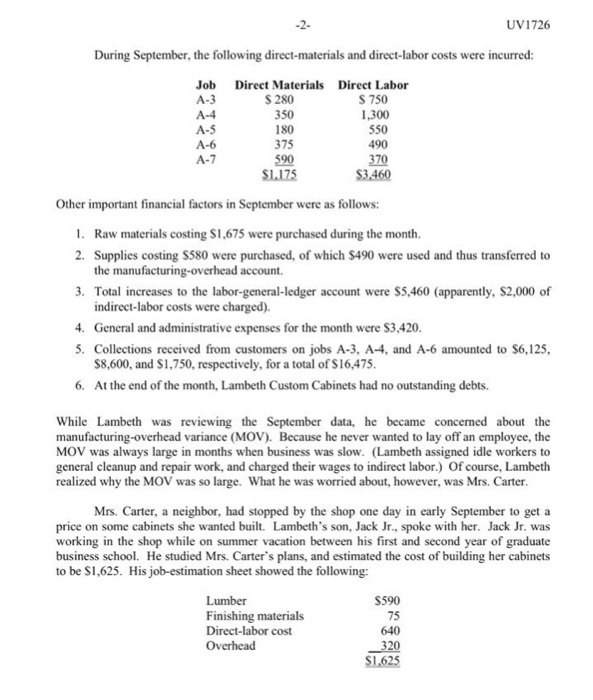

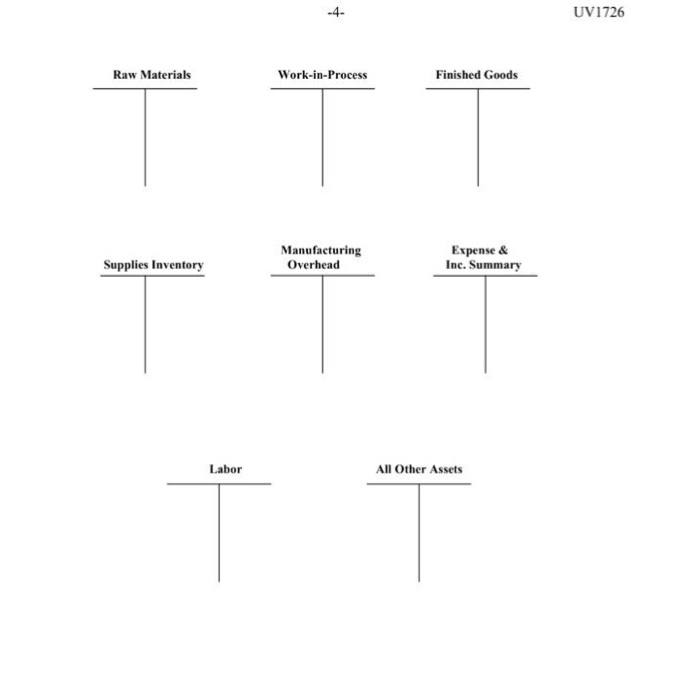

UV1726 BUSINESS PUBLISHING UNIVERSITY VIRGINIA LAMBETH CUSTOM CABINETS (A) Jack Lambeth, a master cabinetmaker, owned and operated a shop where he sold custom- made cabinets. At the beginning of September, he had no outstanding debts, and the following amounts were on his books: I. Raw materials inventory, S2,150 2. Supplies inventory, S620 3. Work-in-process inventory, S5.650 Labor Overhead (50% of Job Materials labor) A-3 S 750 S1.100 S 550 650 900 325 A-5 Total 4. All other assets as of September 1.S16,890 During the month, Lambeth's woodworking crew finished jobs A-3, A-4, and A-6, but did not finish A-5. Job A-7 was started but not finished during September. Overhead costs (pertaining primarily to equipment and shop depreciation, cleaning supplies, and insurance) were applied to every job at the end of the month unless the job was finished during the month, in which case overhead was applied when the job was finished. This case was prepared by Professor Francis J. Spreng of McKendree College, with minor revisions by Professor Mark Haskins of the Darden Graduate School of Business Administration, University of Virginia. It was written as a basis for class discussion rather than to illustrate effective or ineffective handling of an administrative situation. Copyright 2004 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved. To order copies send an e-mail to salesadardenpublishing.com. No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means- electronic mechanical photocopying, recording, or otherwise without the permission of the Darden School UV1726 BUSINESS PUBLISHING UNIVERSITY VIRGINIA LAMBETH CUSTOM CABINETS (A) Jack Lambeth, a master cabinetmaker, owned and operated a shop where he sold custom- made cabinets. At the beginning of September, he had no outstanding debts, and the following amounts were on his books: I. Raw materials inventory, S2,150 2. Supplies inventory, S620 3. Work-in-process inventory, S5.650 Labor Overhead (50% of Job Materials labor) A-3 S 750 S1.100 S 550 650 900 325 A-5 Total 4. All other assets as of September 1.S16,890 During the month, Lambeth's woodworking crew finished jobs A-3, A-4, and A-6, but did not finish A-5. Job A-7 was started but not finished during September. Overhead costs (pertaining primarily to equipment and shop depreciation, cleaning supplies, and insurance) were applied to every job at the end of the month unless the job was finished during the month, in which case overhead was applied when the job was finished. This case was prepared by Professor Francis J. Spreng of McKendree College, with minor revisions by Professor Mark Haskins of the Darden Graduate School of Business Administration, University of Virginia. It was written as a basis for class discussion rather than to illustrate effective or ineffective handling of an administrative situation. Copyright 2004 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved. To order copies send an e-mail to salesadardenpublishing.com. No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means- electronic mechanical photocopying, recording, or otherwise without the permission of the Darden School