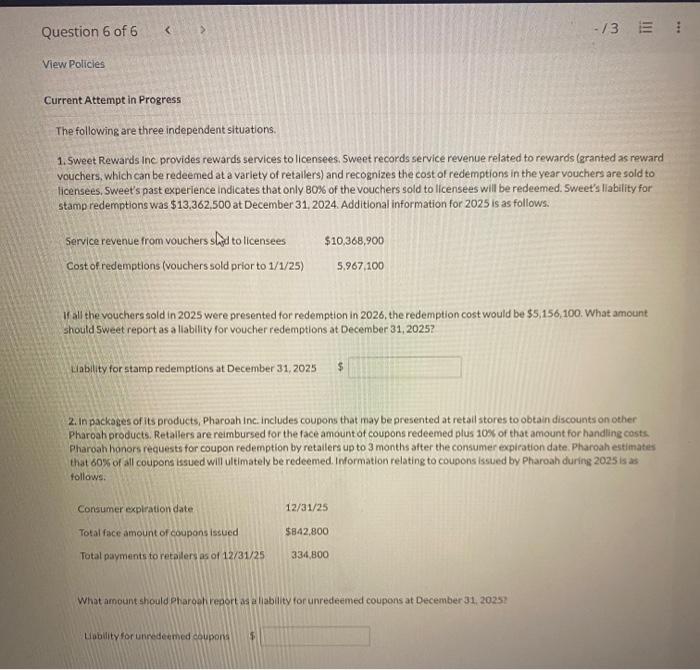

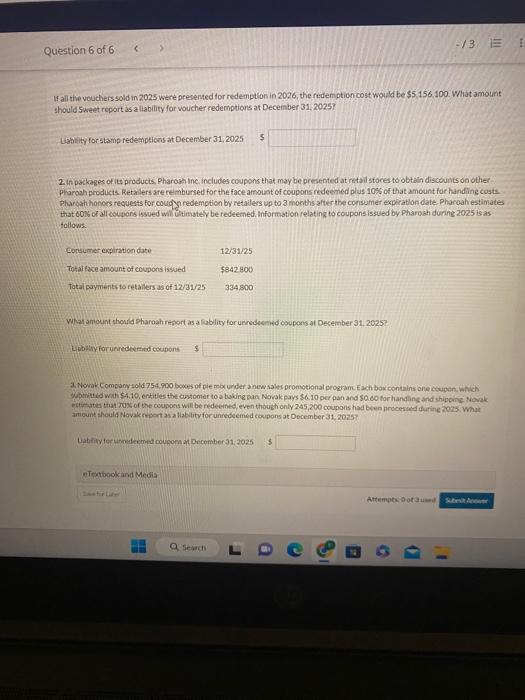

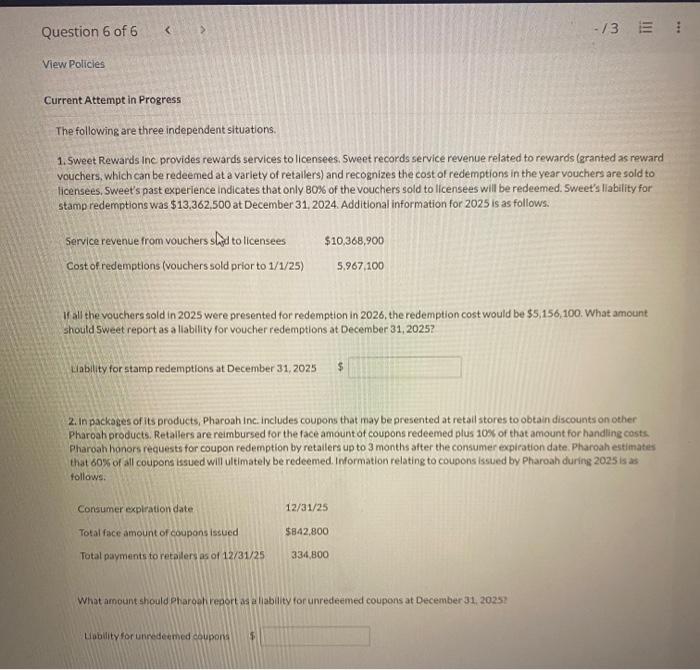

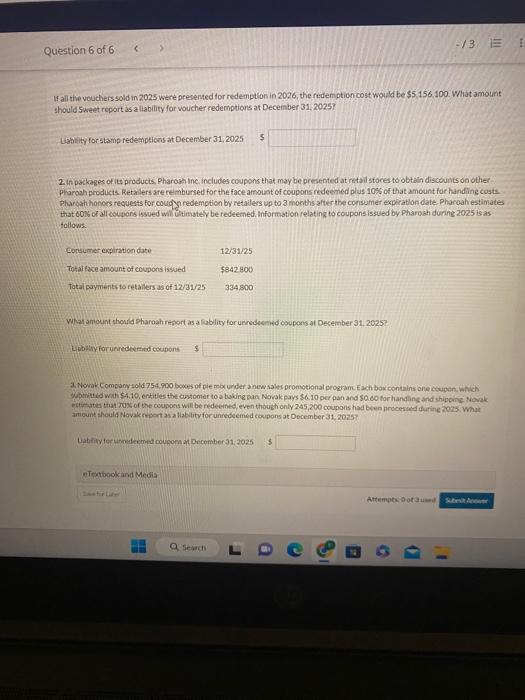

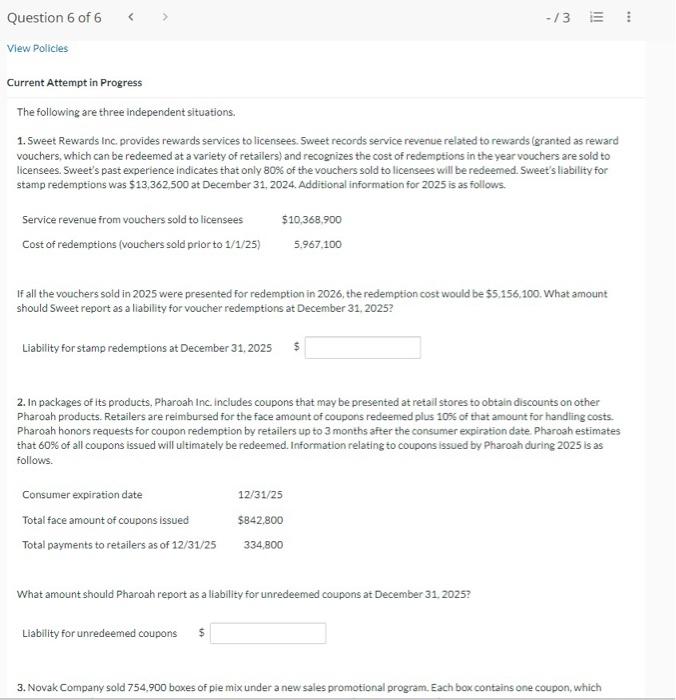

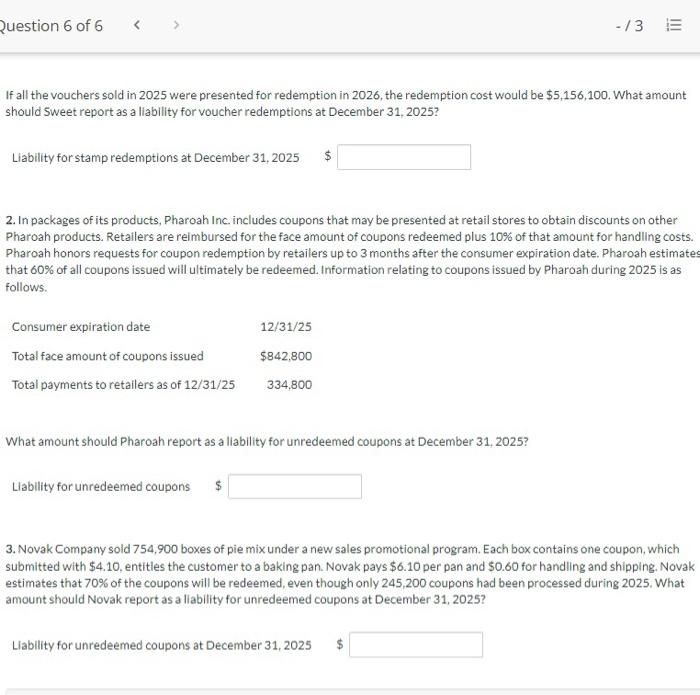

The following are three independent situations. 1.S weet Rewards inc provides rewards services to licensees. Sweet records service revenue related to rewards (granted as reward vouchers, which can be redeemed at a variety of retallers) and recognizes the cost of redemptions in the year vouchers are sold to licensees, Sweet's past experience indicates that only 80% of the vouchers sold to licensees will be redeemed. Sweet's liability for stamp redemptions was $13,362,500 at December 31,2024 . Additional information for 2025 is as follows. If all the vouchers sold in 2025 were presented for redemption in 2026, the redemption cost would be $5,156,100. What amount should 5 weet report as a liability for voucher redemptions at December 31, 2025? Lability for stamp redemptions at December 31,2025 2. In packages of its products, Pharoah inc. includes coupons that may be presented at retail stores to obtain discounts on other Pharoah products. Retailers are reimbursed for the face amount of coupons redeemed plus 108 of that amount for handling costs. Pharoah honors requests for coupon redemption by retallers up to 3 months after the consumer expieation date. Pharoah estimates that 60% of all coupons issued will ultimately be redeemed. Information relating to coupons issued by Pharoah during 2025 is as follows. What amount should pharotiregort as allability for unredeemed coupons at December 31,2025 ? Liobility for unnedeemed coupons If all the vouchers sold in 2025 were presented for redemption in 2026 , the redemptioncost would be $5,156,100. What amount should sweet report as a liability for voucher redemptions at Deceinber 31, 2025? Labhity forstamp redemptions at December 31,2025 2 in packages of ite products, Pharoghinc. includes coupons that may be presented at retail stores to obtain discounts on other praroah products. Retalers are rembursed for the face arnouat of coupons redeemed plus 10%6 of that amcunt for handing coste. Pharoah honors requests for coup y g redemption by retailers up to 3 months after the consumer expirationdate. Pharcah estimate that 608 of all coupons issued willitimately be redeemed. Information relating to coupons issced by Pharosh during 2025 is as follaws. What amount should pharoahresort as a fablity for unredesend coupons at December 31,2025?. Lpbiniy for yaredederiad cocupons 1. Norak Company sold 7 54.900 bous of pie mox under a new sales promotional proeram Each bex contains one ceupen, which. Whatitid wat $4,10, entities the costomer to a toking pan Norak pays $6.10 per pan and 50.00 for hancing and shipoine Wovak ectinate that Jux of the coupons will be redeened, even thoughionly 245,200 couponis had been nrocessud gurine 2025 . what artiount fhould Novak report as a liakility for unredeemed coupons at Docember 31,2025 ? Liatrity ter uimitecmed coupom an Decomber.21:2025 The following are three independent situations. 1. Sweet Rewards inc, provides rewards services to licensees. Sweet records service revenue related to rewards (granted as reward vouchers, which can be redeemed at a variety of retailers) and recognizes the cost of redemptions in the year vouchers are sold to licensees. Sweet's past experience indicates that only 80% of the vouchers sold to licensees will be redeemed. Sweet's liability for stamp redemptions was $13,362,500 at December 31,2024 . Additional information for 2025 is as follows. If all the vouchers sold in 2025 were presented for redemption in 2026, the redemption cost would be $5,156,100. What amount should Sweet report as a liability for voucher redemptions at December 31, 2025? Liability for stamp redemptions at December 31,2025 $ 2. In packages of its products. Pharoah Inc. includes coupons that may be presented at retail stores to obtain discounts on other Pharoah products. Retailers are reimbursed for the face amount of coupons redeemed plus 1056 of that amount for handling costs. Pharoah honors requests for coupon redemption by retailers up to 3 months after the consumer expiration date. Pharosh estimates that 60% of all coupons issued will ultimately be redeemed. Information relating to coupons issued by Pharoah during 2025 is as follows. What amount should Pharoah report as a liability for unredeemed coupons at December 31,2025 ? Liability for unredeemed coupons $ If all the vouchers sold in 2025 were presented for redemption in 2026 , the redemption cost would be $5,156,100. What amount should Sweet report as a liability for voucher redemptions at December 31,2025 ? Liability for stamp redemptions at December 31,2025$ 2. In packages of its products, Pharoah Inc. includes coupons that may be presented at retail stores to obtain discounts on other Pharoah products. Retailers are reimbursed for the face amount of coupons redeemed plus 10% of that amount for handling costs. Pharoah honors requests for coupon redemption by retailers up to 3 months after the consumer expiration date. Pharoah estimates that 60% of all coupons issued will ultimately be redeemed. Information relating to coupons issued by Pharoah during 2025 is as follows. What amount should Pharoah report as a liability for unredeemed coupons at December 31, 2025? Llability for unredeemed coupons \$ 3. Novak Company sold 754,900 boxes of pie mix under a new sales promotional program. Each box contains one coupon, which submitted with $4.10, entitles the customer to a baking pan. Novak pays $6.10 per pan and $0.60 for handling and shipping. Novak estimates that 70% of the coupons will be redeemed, even though only 245,200 coupons had been processed during 2025 . What amount should Novak report as a liability for unredeemed coupons at December 31,2025