Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Valmont Company has developed a new industrial piece of equipment called the XP-200. The company is considering two methods of establishing a selling price

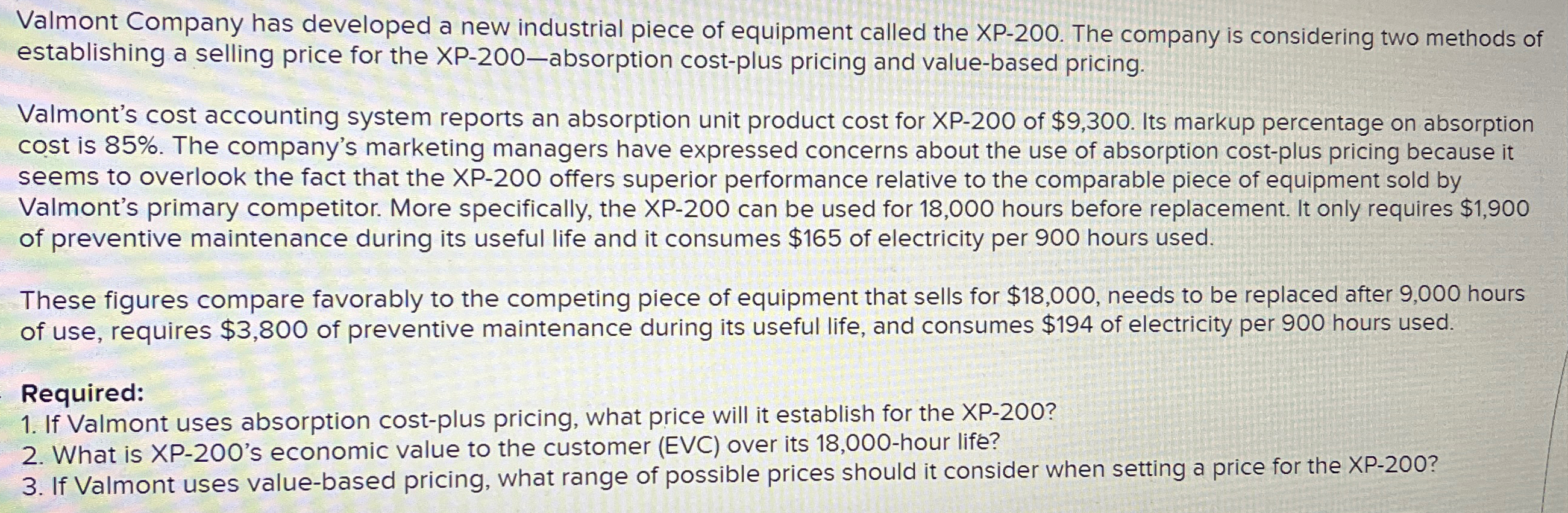

Valmont Company has developed a new industrial piece of equipment called the XP-200. The company is considering two methods of establishing a selling price for the XP-200-absorption cost-plus pricing and value-based pricing. Valmont's cost accounting system reports an absorption unit product cost for XP-200 of $9,300. Its markup percentage on absorption cost is 85%. The company's marketing managers have expressed concerns about the use of absorption cost-plus pricing because it seems to overlook the fact that the XP-200 offers superior performance relative to the comparable piece of equipment sold by Valmont's primary competitor. More specifically, the XP-200 can be used for 18,000 hours before replacement. It only requires $1,900 of preventive maintenance during its useful life and it consumes $165 of electricity per 900 hours used. These figures compare favorably to the competing piece of equipment that sells for $18,000, needs to be replaced after 9,000 hours of use, requires $3,800 of preventive maintenance during its useful life, and consumes $194 of electricity per 900 hours used. Required: 1. If Valmont uses absorption cost-plus pricing, what price will it establish for the XP-200? 2. What is XP-200's economic value to the customer (EVC) over its 18,000-hour life? 3. If Valmont uses value-based pricing, what range of possible prices should it consider when setting a price for the XP-200?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 If Valmont uses absorption costplus pricing Absorption unit product cost for XP200 is 9300 Valmont...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dedefd0612_960966.pdf

180 KBs PDF File

663dedefd0612_960966.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started