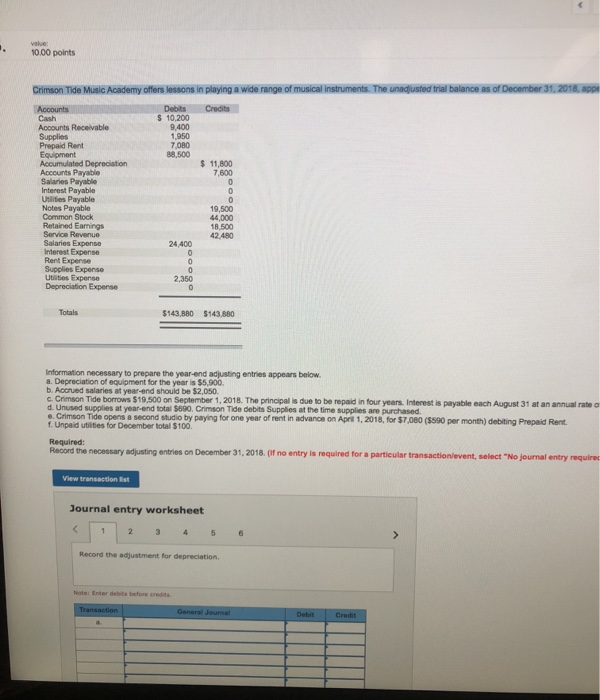

value 10.00 points Crimson Tide Music Academy offers lessons in playing a wide range of musical instruments. The unadjusted trial balance as of December 31, 2018, app Apcounts Cash Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Salaries Payable Interest Payable Uilifies Payable Notes Payable Common Stock Retained Eamings Service Revenue Salaries Expense Interest Expense Rent Expense Supplies Expense Utites Expense Depreciation Expense Debits $ 10,200 9,400 1.950 7,080 Credits 88,500 $ 11.800 7,600 C 19.500 44,000 18.500 42,480 24,400 C C 2,350 C Totals $143,880 $143.880 Information necessary to prepare the year-end adjusting entries appears below. a. Depreciation of equipment for the year is $5,900. b. Accrued salaries at year-end should be $2,050 c. Crimson Tide borrows $19,500 on September 1, 2018. The principal is due to be repaid in four years. Interest is payable each August 31 at an annual rate o d. Unused supplies at year-end total $690. Crimson Tide debits Supplies at the time supplies are purchased. e. Crimson Tide opens a second studio by paying for one year of rent in advancee on April 1, 2018, for $7,080 ($590 per month) debiting Prepaid Rent f. Unpaid utilities for December total $100. Required: Record the necessary adjusting entries on December 31, 2018. (If no entry is required for a particular transaction/event, select "No journal entry requirec View transaction Est Journal entry worksheet 2 3 4 5 Record the adjustment for depreciation. Note: Enter debits before credits Transaction General Journal Debit Credit 1000 pointsa Crimson Tide Music Academy offers lessons in playings wide range of musical instruments. The unadusted tral balance as of December 31, 2018, appears below December 31 is the company's fscal year end Accourts Cash Accounts Recelvable Supplies Prepaid Rent Dects Credts 9,400 1,960 7.080 M.500 uted Depreciation $11800 7,800 Salaies Payable Interest Paysble Ues Payable Niotes Payable Bied 19,500 44000 ngs Service Reven Salaries Expense nteres Expense 24400 Usites Experse Depreciation Expense 3,350 Telas $143M0 $143,80 Information necessary a. Depreciaton of equipment for the yer is 55,900 b. Aconued salies at year-end should be $2,00 nTide borous $19500 on September 1, 2018. The prnipal is due to be epaid in four years Intereat is payable each August 31 at an annual rae of 10 % to prepare the year-end adusting entres appears below e. Crimson T0s o0 tot on fee debts Supplies at the time sugpes ae purchased t Unpaid utates for December t S100dlie d e n April 1, 2014 for S7,080 (5500 per mone) debiing Prepaid Re Required Record he neossary adjusting ees on December 31, 201 no entry is required for a particular transactionevent, select "No journal entry required in the frst account eld) View transation st Journal entry worksheet 20 Record the adjusmen oreprection Nete rdbi before i Gereral Joual Dabi Cred rd entrY Clear entry View generwljurat