Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Van Buren College is a small private liberal arts university. Record the journal entries for the following transactions: 1. $20,000,000 in tuition was charged

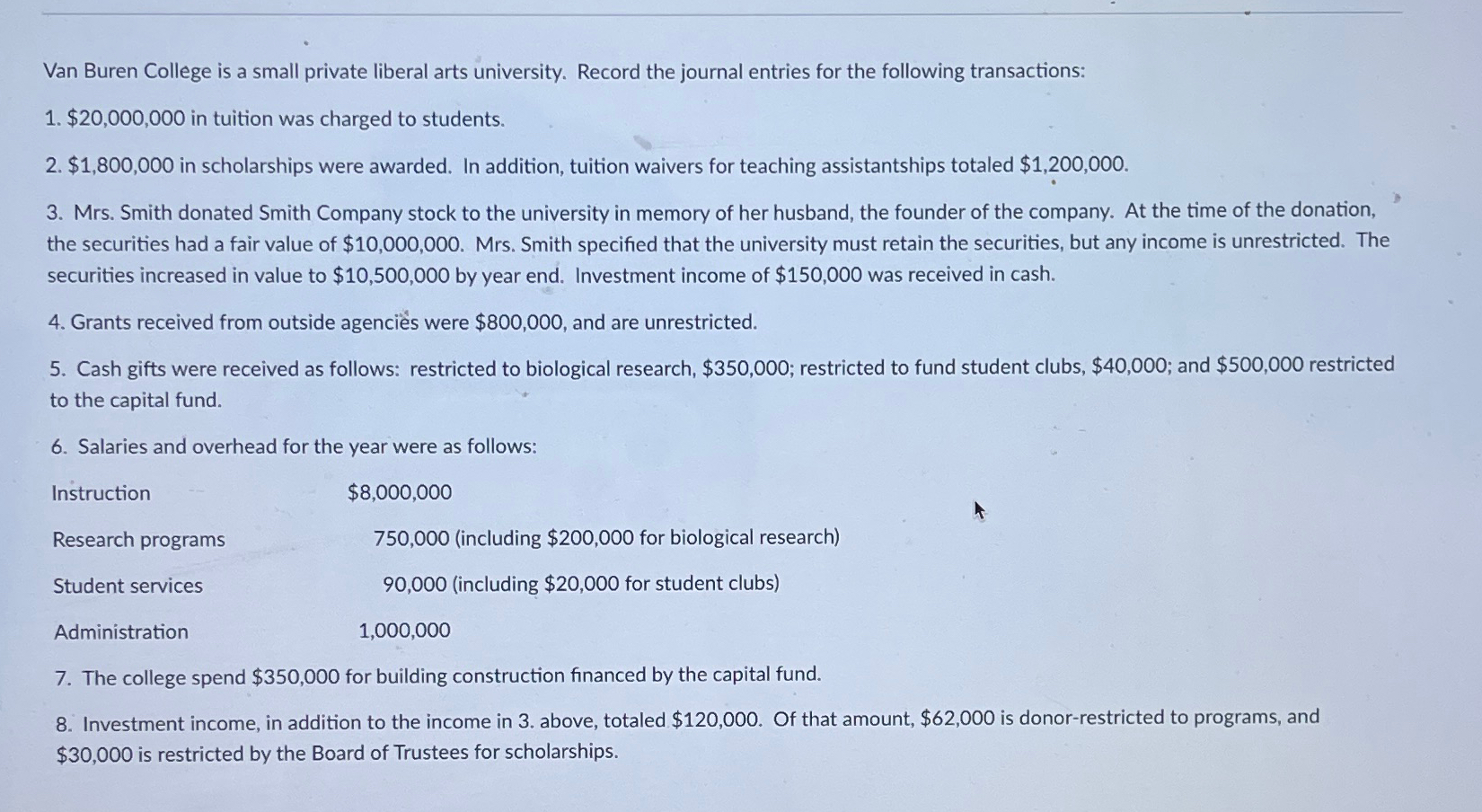

Van Buren College is a small private liberal arts university. Record the journal entries for the following transactions: 1. $20,000,000 in tuition was charged to students. 2. $1,800,000 in scholarships were awarded. In addition, tuition waivers for teaching assistantships totaled $1,200,000. 3. Mrs. Smith donated Smith Company stock to the university in memory of her husband, the founder of the company. At the time of the donation, the securities had a fair value of $10,000,000. Mrs. Smith specified that the university must retain the securities, but any income is unrestricted. The securities increased in value to $10,500,000 by year end. Investment income of $150,000 was received in cash. 4. Grants received from outside agencies were $800,000, and are unrestricted. 5. Cash gifts were received as follows: restricted to biological research, $350,000; restricted to fund student clubs, $40,000; and $500,000 restricted to the capital fund. 6. Salaries and overhead for the year were as follows: Instruction Research programs Student services Administration $8,000,000 750,000 (including $200,000 for biological research) 90,000 (including $20,000 for student clubs) 1,000,000 7. The college spend $350,000 for building construction financed by the capital fund. 8. Investment income, in addition to the income in 3. above, totaled $120,000. Of that amount, $62,000 is donor-restricted to programs, and $30,000 is restricted by the Board of Trustees for scholarships.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the journal entries for the transactions mentioned 1 To record tuition charged to students ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started