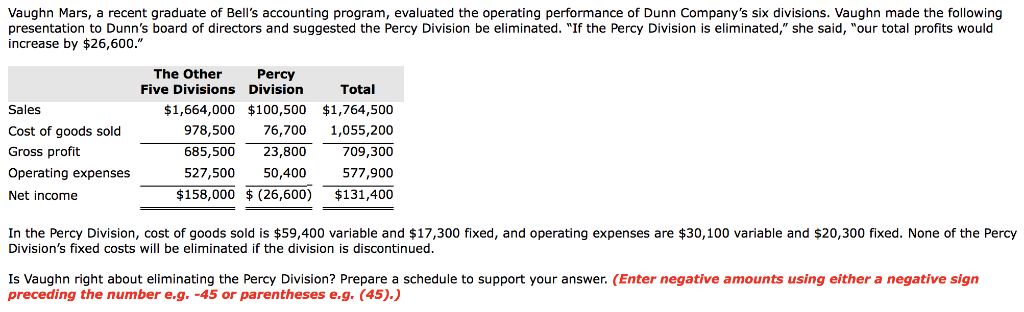

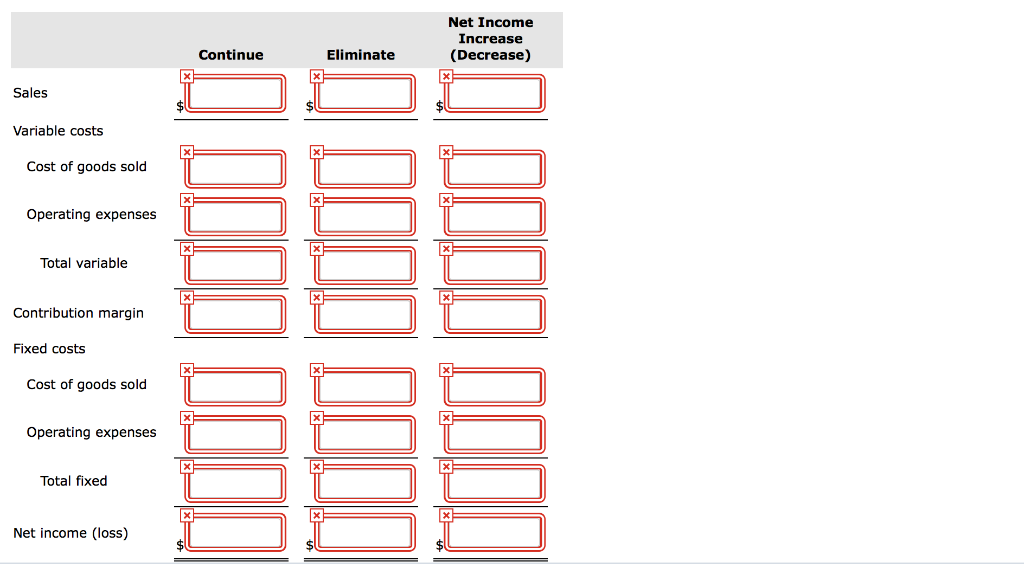

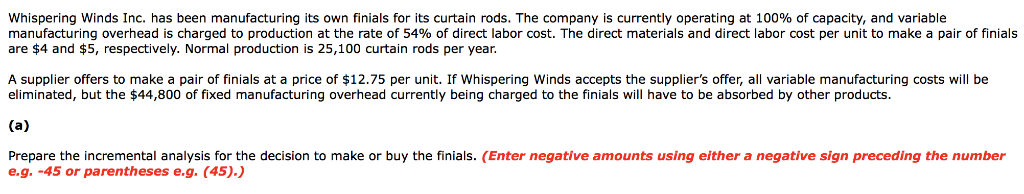

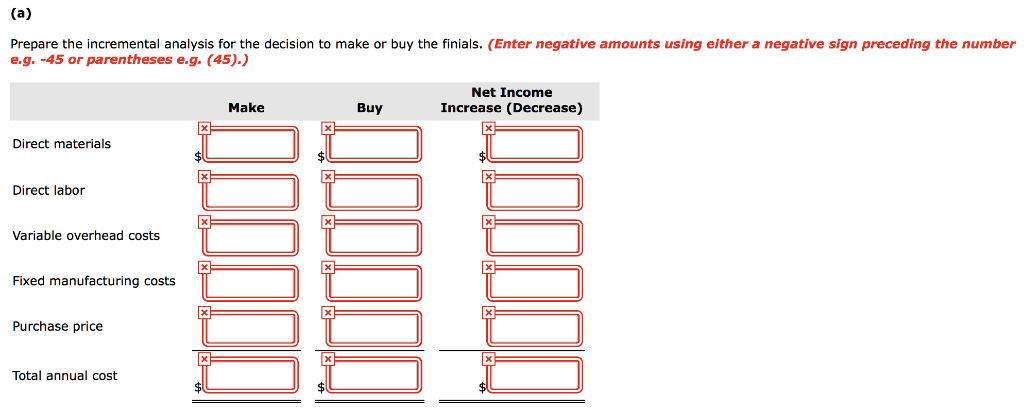

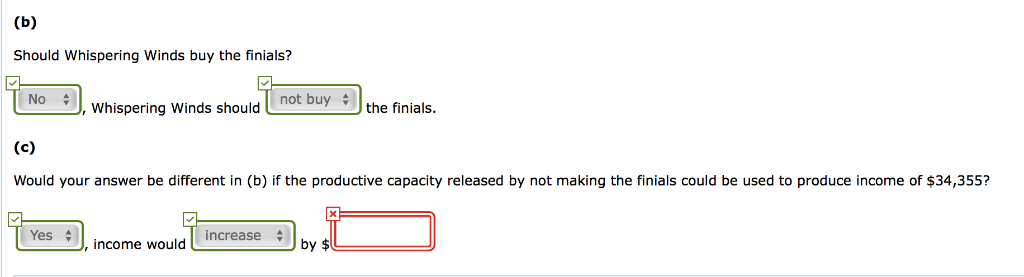

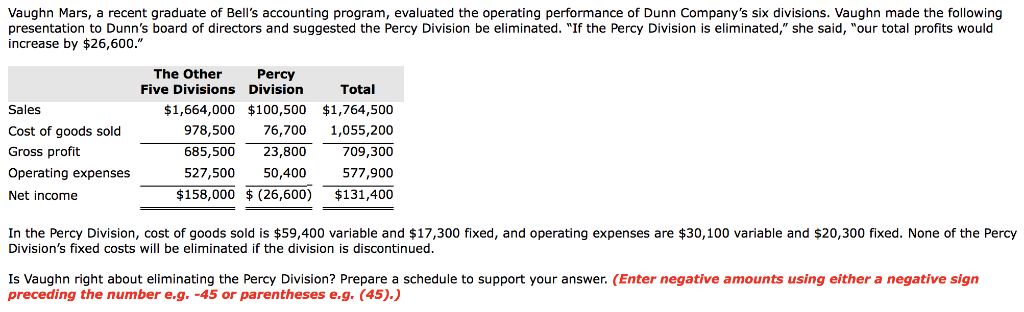

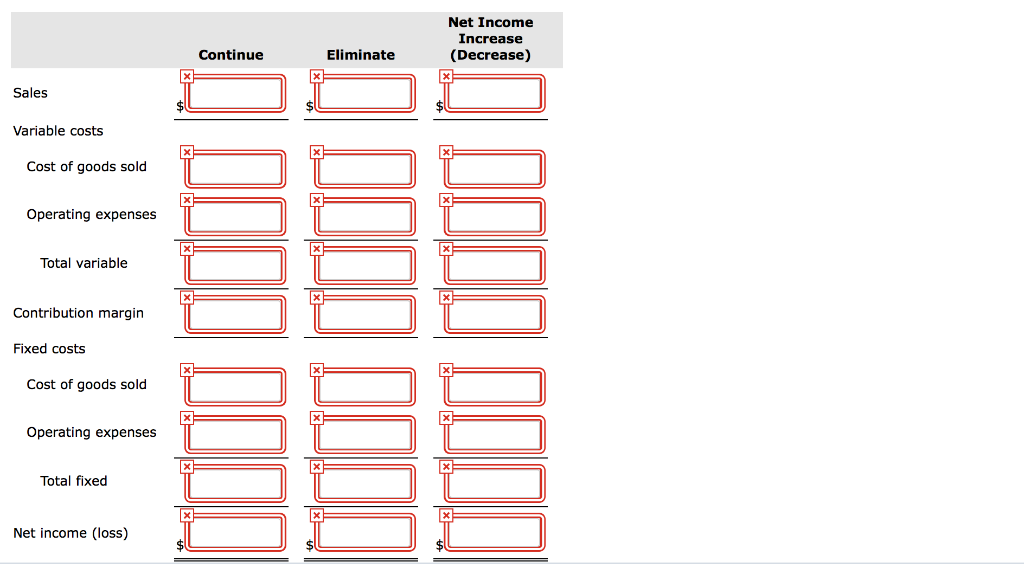

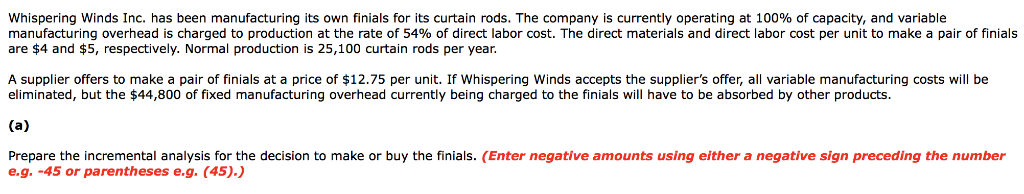

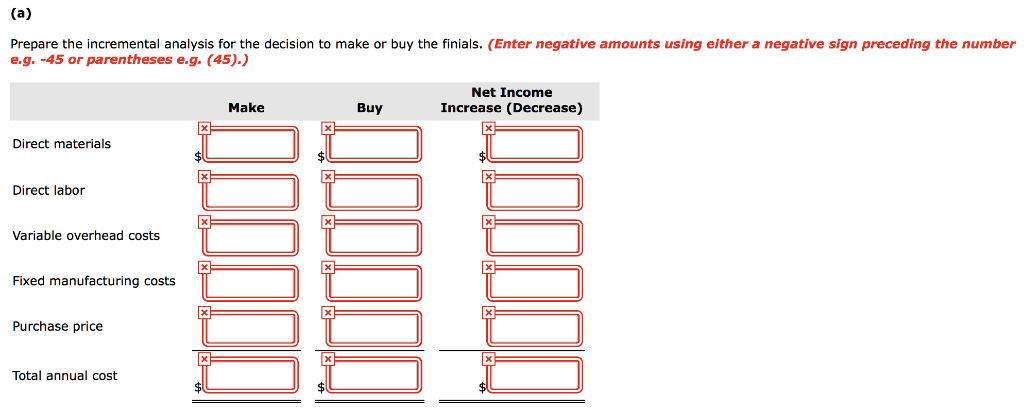

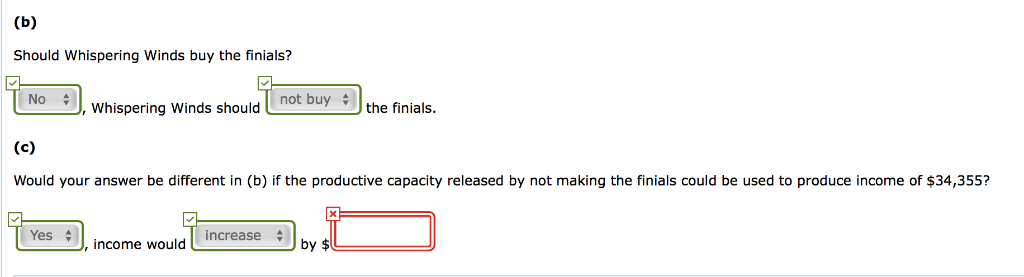

Vaughn Mars, a recent graduate of Bell's accounting program, evaluated the operating performance of Dunn Company's six divisions. Vaughn made the following presentation to Dunn's board of directors and suggested the Percy Division be eliminated. If the Perc Division is eliminated, she said, " rttal profits would increase by $26,600." The Other Percy Five Divisions Division Total Sales Cost of goods sold Gross profit Operating expenses Net income $1,664,000 $100,500 $1,764,500 978,500 76,700 1055,200 709,300 527,500 50,400 577,900 $158,000 (26,600) $131,400 685,500 23,800 In the Percy Division, cost of goods sold is $59,400 variable and $17,300 fixed, and operating expenses are $30,100 variable and $20,300 fixed. None of the Percy Division's fixed costs will be eliminated if the division is discontinued. Is Vaughn right about eliminating the Percy Division? Prepare a schedule to support your answer. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Net Income Increase (Decrease) Continue Eliminate Sales Variable costs Cost of goods sold Operating expenses Total variable Contribution margin Fixed costs Cost of goods sold Operating expenses Total fixed Net income (loss) whispering winds Inc. has been manufacturing its own finials for its curtain rods. The company is currently operating at 100% of capacity, and variable manufacturing overhead is charged to production at the rate of 54% of direct labor cost. The direct materials and direct labor cost per unit to make a pair of finials are $4 and $5, respectively. Normal production is 25,100 curtain rods per year. A supplier offers to make a pair of finials at a price of $12.75 per unit. If Whispering Winds accepts the supplier's offer, all variable manufacturing costs will be eliminated, but the $44,800 of fixed manufacturing overhead currently being charged to the finials will have to be absorbed by other products Prepare the incremental analysis for the decision to make or buy the finials. (Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) Prepare the incremental analysis for the decision to make or buy the finials. (Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) Net Income Increase (Decrease) Make Buy Direct materials Direct labor Variable overhead costs Fixed manufacturing costs Purchase price Total annual cost Should Whispering Winds buy the finials? not buy the finials No , Whispering Winds should Would your answer be different in (b) if the productive capacity released by not making the finials could be used to produce income of $34,355? increaseby income would