Answered step by step

Verified Expert Solution

Question

1 Approved Answer

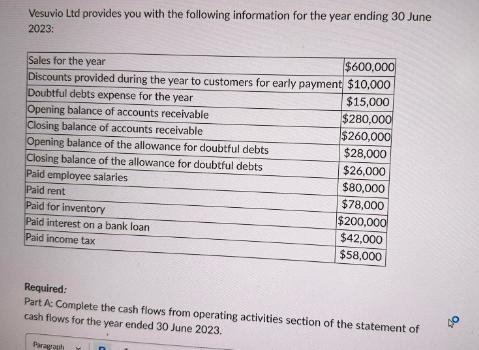

Vesuvio Ltd provides you with the following information for the year ending 30 June 2023: $600,000 Sales for the year Discounts provided during the

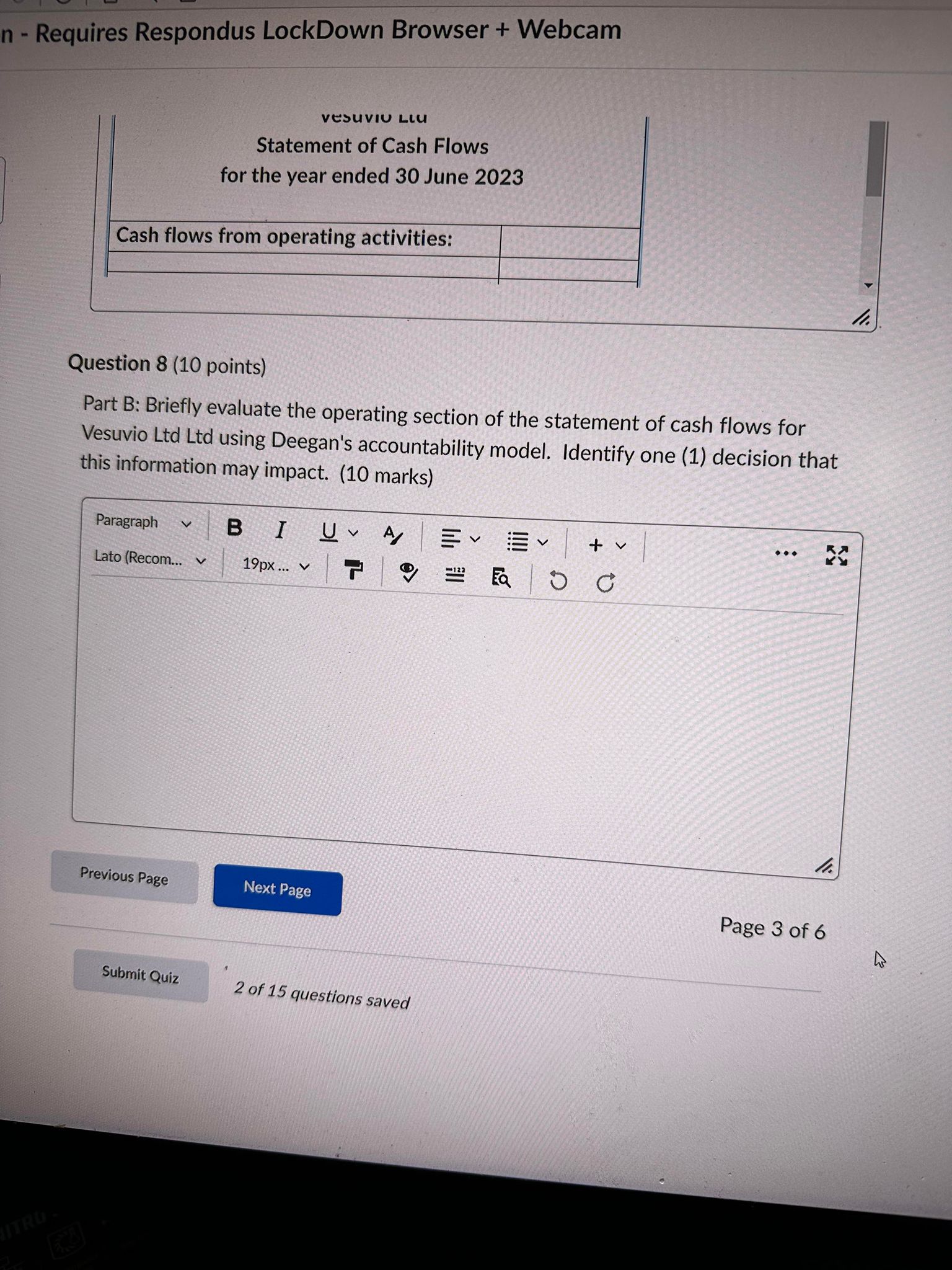

Vesuvio Ltd provides you with the following information for the year ending 30 June 2023: $600,000 Sales for the year Discounts provided during the year to customers for early payment $10,000 Doubtful debts expense for the year $15,000 Opening balance of accounts receivable $280,000 Closing balance of accounts receivable $260,000 Opening balance of the allowance for doubtful debts $28,000 Closing balance of the allowance for doubtful debts $26,000 Paid employee salaries $80,000 Paid rent $78,000 Paid for inventory $200,000 Paid interest on a bank loan $42,000 Paid income tax $58,000 Required: Part A: Complete the cash flows from operating activities section of the statement of cash flows for the year ended 30 June 2023. Paragraph % n-Requires Respondus LockDown Browser + Webcam Vesuvio LIC Statement of Cash Flows for the year ended 30 June 2023 Cash flows from operating activities: Question 8 (10 points) Part B: Briefly evaluate the operating section of the statement of cash flows for Vesuvio Ltd Ltd using Deegan's accountability model. Identify one (1) decision that this information may impact. (10 marks) ITRO Paragraph v BI UA + v Lato (Recom... V 19px... v T Ea Previous Page Submit Quiz Next Page 2 of 15 questions saved 11. Page 3 of 6 11.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started