Question

Victoria Corporation acquires 100% of the shares of Island Inc. on December 31, 2016 for $2,850,000. At that time, Island Inc. owned one non-depreciable

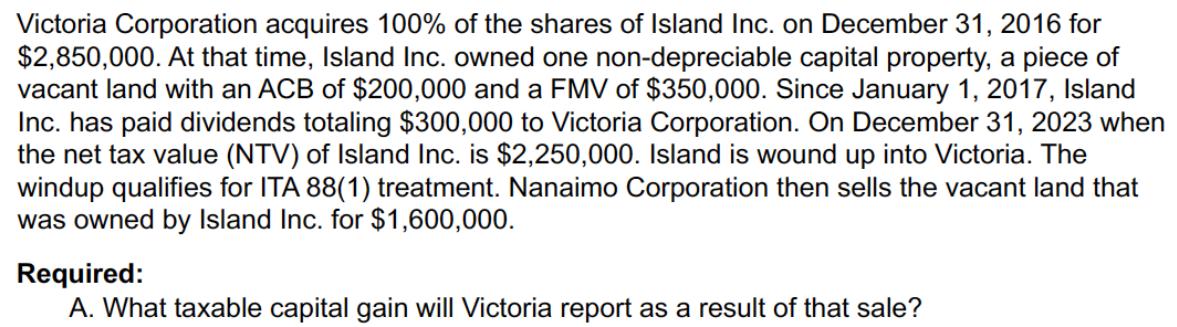

Victoria Corporation acquires 100% of the shares of Island Inc. on December 31, 2016 for $2,850,000. At that time, Island Inc. owned one non-depreciable capital property, a piece of vacant land with an ACB of $200,000 and a FMV of $350,000. Since January 1, 2017, Island Inc. has paid dividends totaling $300,000 to Victoria Corporation. On December 31, 2023 when the net tax value (NTV) of Island Inc. is $2,250,000. Island is wound up into Victoria. The windup qualifies for ITA 88(1) treatment. Nanaimo Corporation then sells the vacant land that was owned by Island Inc. for $1,600,000. Required: A. What taxable capital gain will Victoria report as a result of that sale?

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The proceeds of disposition is given as 1600000 Th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting Chapters 1-30

Authors: John Price, M. David Haddock, Michael Farina

14th edition

978-1259284861, 1259284867, 77862392, 978-0077862398

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App