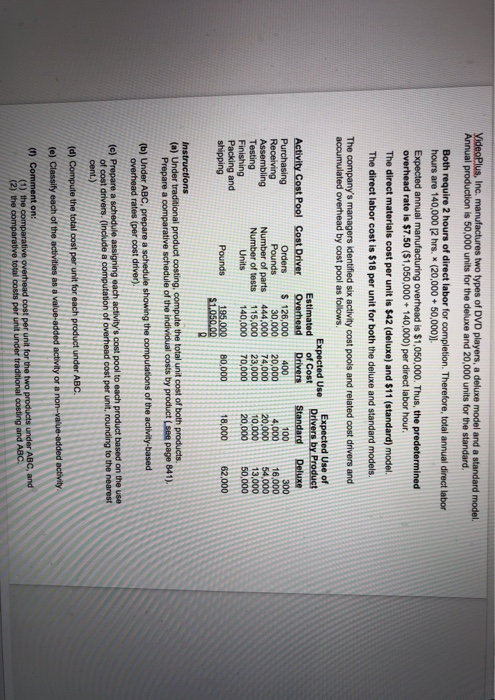

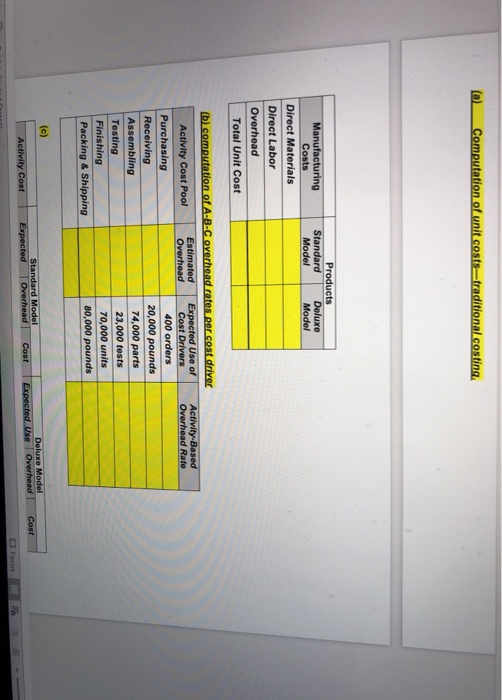

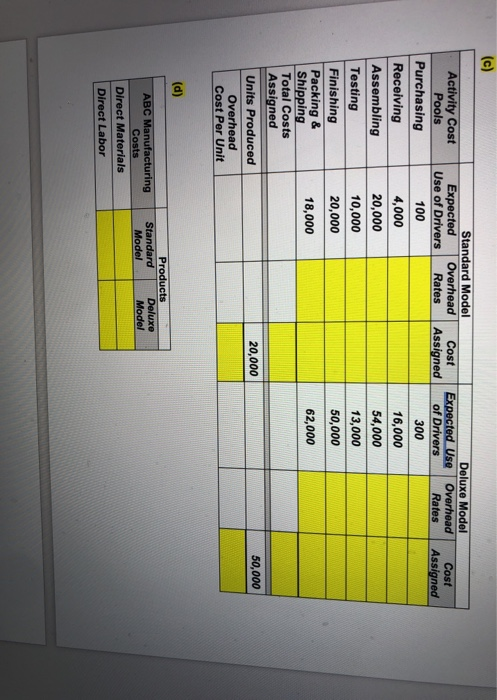

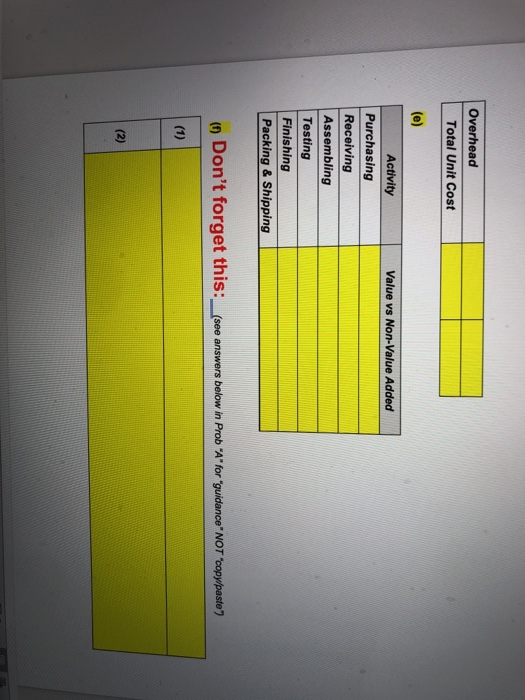

VideoPlus, Inc. manufactures two types of DVD players, a deluxe model and a standard model. Annual production is 50,000 units for the deluxe and 20,000 units for the standard, Both require 2 hours of direct labor for completion. Therefore, total annual direct labor hours are 140,000 12 hrs. * (20,000 + 50,000)). Expected annual manufacturing overhead is $1,050,000. Thus, the predetermined overhead rate is $7.50 ($1,050,000 + 140,000) per direct labor hour. The direct materials cost per unit is $42 (deluxe) and $11 (standard) model The direct labor cost is $18 per unit for both the deluxe and standard models The company's managers identified six activity cost pools and related cost drivers and accumulated overhead by cost pool as follows Expected Use Expected Use of Estimated of Cost Drivers by Product Activity Cost Pool Cost Driver Overhead Drivers Standard Deluxe Purchasing Orders $ 126,000 400 100 300 Receiving Pounds 30.000 20,000 4,000 16.000 Assembling Number of parts 444,000 74,000 20,000 54,000 Testing Number of tests 115,000 23,000 10.000 13,000 Finishing Units 140,000 70,000 20.000 50,000 Packing and shipping Pounds 195.000 80,000 18,000 62,000 $1.050.00 Q Instructions (a) Under traditional product costing, compute the total unit cost of both products, Prepare a comparative schedule of the individual costs by product see page 841). (b) Under ABC, prepare a schedule showing the computations of the activity-based overhead rates (per cost driver). (c) Prepare a schedule assigning each activity's cost pool to each product based on the use of cost drivers. (Include a computation of overhead cost per unit, rounding to the nearest cent.) (d) Compute the total cost per unit for each product under ABC (e) Classify each of the activities as a value-added activity or a non-value-added activity (1) Comment on: (1) the comparative overhead cost per unit for the two products under ABC, and (2) the comparative total costs per unit under traditional costing and ABC Computation of unit costs-traditional costing Products Standard Deluxe Model Model Manufacturing Costs Direct Materials Direct Labor Overhead Total Unit Cost Activity-Based Overhead Rato (b) computation of A-B-C overhead rates per cost driver Estimated Activity Cost Pool Expected Use of Overhead Cost Drivers Purchasing 400 orders Receiving 20,000 pounds Assembling 74,000 parts Testing 23,000 tests Finishing 70,000 units Packing & Shipping 80,000 pounds (c) Standard Model Expected Overhead Cost Deluxe Model Expected Use Overhead Cost Activity Cost Focus (c) Cost Assigned Activity Cost Pools Purchasing Receiving Assembling Testing Finishing Packing & Shipping Total Costs Assigned Units Produced Overhead Cost Per Unit Standard Model Expected Overhead Cost Use of Drivers Rates Assigned 100 4,000 20,000 10,000 20,000 Deluxe Model Expected Use Overhead of Drivers Rates 300 16,000 54,000 13,000 50,000 62,000 18,000 20,000 50,000 (d) Products Standard Deluxe Model Model ABC Manufacturing Costs Direct Materials Direct Labor Overhead Total Unit Cost (e) Value vs Non-Value Added Activity Purchasing Receiving Assembling Testing Finishing Packing & Shipping (1) Don't forget this:_(see answers below in Prob "A" for "guidance" NOT "copypaste") (1) (2)