Answered step by step

Verified Expert Solution

Question

1 Approved Answer

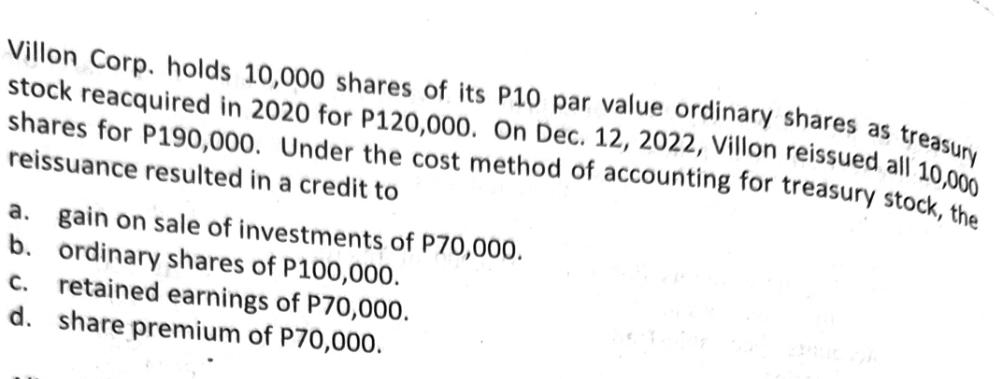

Villon Corp. holds 10,000 shares of its P10 par value ordinary shares as treasury stock reacquired in 2020 for P120,000. On Dec. 12, 2022,

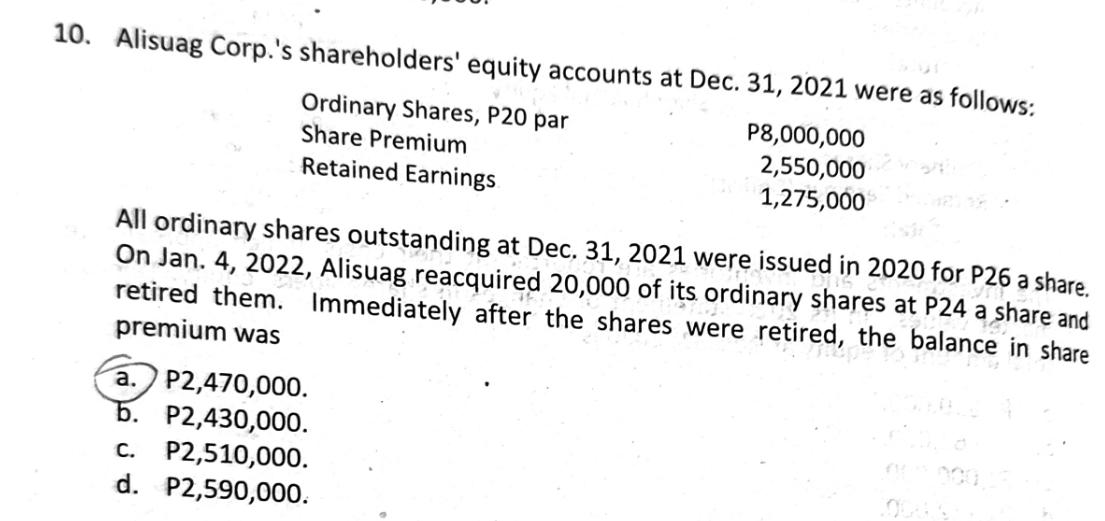

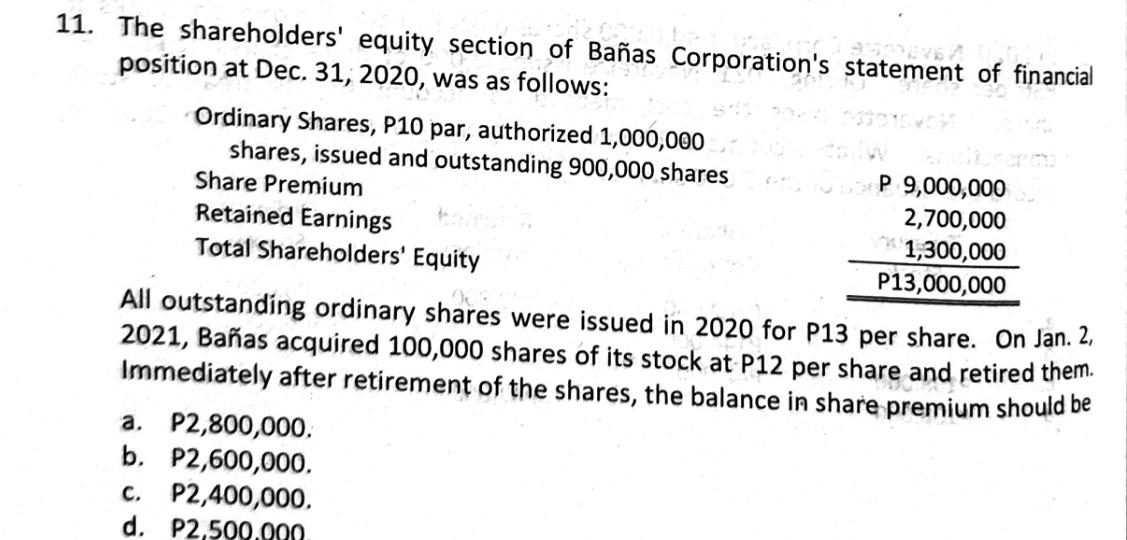

Villon Corp. holds 10,000 shares of its P10 par value ordinary shares as treasury stock reacquired in 2020 for P120,000. On Dec. 12, 2022, Villon reissued all 10,000 shares for P190,000. Under the cost method of accounting for treasury stock, the reissuance resulted in a credit to a. gain on sale of investments of P70,000. b. ordinary shares of P100,000. C. retained earnings of P70,000. d. share premium of P70,000. 10. Alisuag Corp.'s shareholders' equity accounts at Dec. 31, 2021 were as follows: Ordinary Shares, P20 par Share Premium Retained Earnings P8,000,000 2,550,000 1,275,000 All ordinary shares outstanding at Dec. 31, 2021 were issued in 2020 for P26 a share. On Jan. 4, 2022, Alisuag reacquired 20,000 of its ordinary shares at P24 a share and retired them. Immediately after the shares were retired, the balance in share premium was a. P2,470,000. b. P2,430,000. c. P2,510,000. d. P2,590,000. 11. The shareholders' equity section of Baas Corporation's statement of financial position at Dec. 31, 2020, was as follows: Ordinary Shares, P10 par, authorized 1,000,000 shares, issued and outstanding 900,000 shares Share Premium Retained Earnings Total Shareholders' Equity SOP 9,000,000 2,700,000 1,300,000 P13,000,000 All outstanding ordinary shares were issued in 2020 for P13 per share. On Jan. 2, 2021, Baas acquired 100,000 shares of its stock at P12 per share and retired them. Immediately after retirement of the shares, the balance in share premium should be a. P2,800,000. b. P2,600,000. c. P2,400,000. d. P2,500.000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Under the cost method of accounting for treasury stock the reissuance of treasury shares results i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started