Answered step by step

Verified Expert Solution

Question

1 Approved Answer

W LACE Using l unas Por calcula 17 18 Q3. How much are you willing to pay for one share of Red Snapper stock if

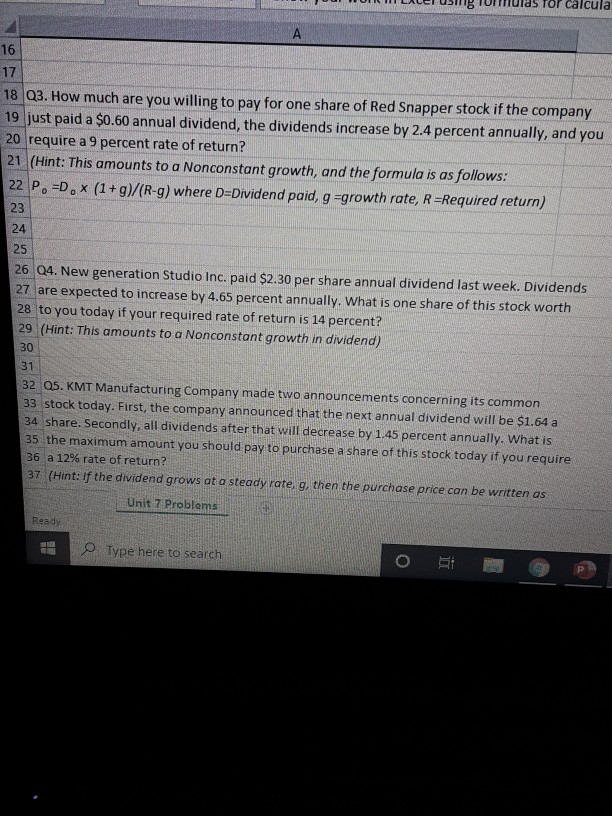

W LACE Using l unas Por calcula 17 18 Q3. How much are you willing to pay for one share of Red Snapper stock if the company 19 just paid a $0.60 annual dividend, the dividends increase by 2.4 percent annually, and you 20 require a 9 percent rate of return? 21 (Hint: This amounts to a Nonconstant growth, and the formula is as follows: 22 P. =D. (1+9)/(R-g) where D=Dividend paid, g =growth rate, R=Required return) 26 Q4. New generation Studio Inc. paid $2.30 per share annual dividend last week. Dividends 27 are expected to increase by 4.65 percent annually. What is one share of this stock worth 28 to you today if your required rate of return is 14 percent? 29 (Hint: This amounts to a Nonconstant growth in dividend) BE 32 QS. KMT Manufacturing Company made two announcements concerning its common 33 stock today. First, the company announced that the next annual dividend will be $1.64 a 34 share. Secondly, all dividends after that will decrease by 1.45 percent annually. What is 35 the maximum amount you should pay to purchase a share of this stock today if you require 36 a 12% rate of return? 37. (Hint: If the dividend grows at a steady rate, g, then the purchase price can be written as Unit 7 Problems Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started