Answered step by step

Verified Expert Solution

Question

1 Approved Answer

WACC is .83% There are 3 bonds of Rating of B+ Beta of 1.96 The CEO of Bed, Bath and Beyond (BBBY) is presented with

WACC is .83%

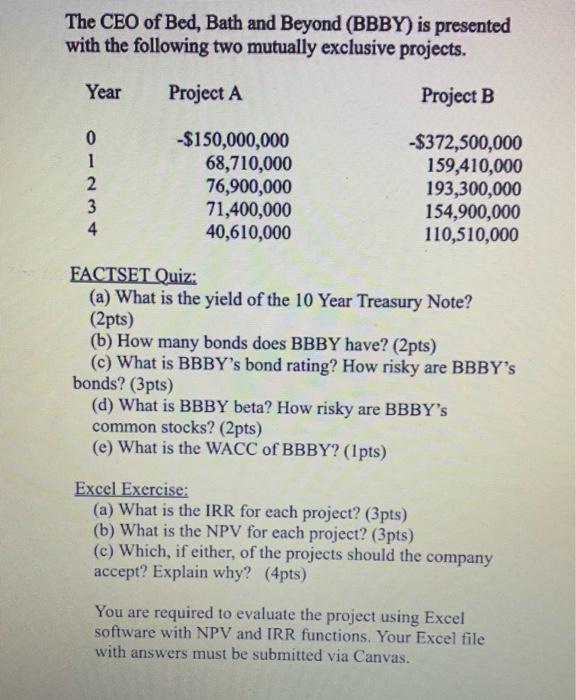

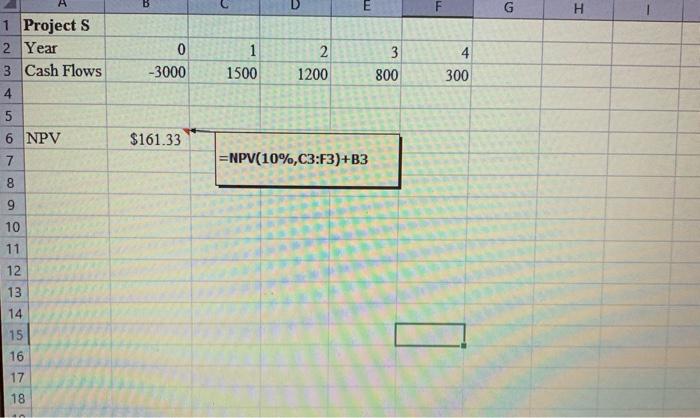

The CEO of Bed, Bath and Beyond (BBBY) is presented with the following two mutually exclusive projects. Year Project A Project B ANO -$150,000,000 68,710,000 76,900,000 71,400,000 40,610,000 -$372,500,000 159,410,000 193,300,000 154,900,000 110,510,000 FACTSET Quiz: (a) What is the yield of the 10 Year Treasury Note? (2pts) (b) How many bonds does BBBY have? (2pts) (c) What is BBBY's bond rating? How risky are BBBY's bonds? (3pts) (d) What is BBBY beta? How risky are BBBY's common stocks? (2pts) (e) What is the WACC of BBBY? (1pts) Excel Exercise: (a) What is the IRR for each project? (3pts) (b) What is the NPV for each project? (3pts) (c) Which, if either, of the projects should the company accept? Explain why? (4pts) You are required to evaluate the project using Excel software with NPV and IRR functions. Your Excel file with answers must be submitted via Canvas. G H 0 -3000 1 1500 2 1200 3 800 4 300 $161.33 =NPV(10%,C3:F3)+B3 1 Projects 2 Year 3 Cash Flows 4 5 6 NPV 7 8 9 10 11 12 13 14 15 16 17 18 There are 3 bonds of Rating of B+

Beta of 1.96

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started