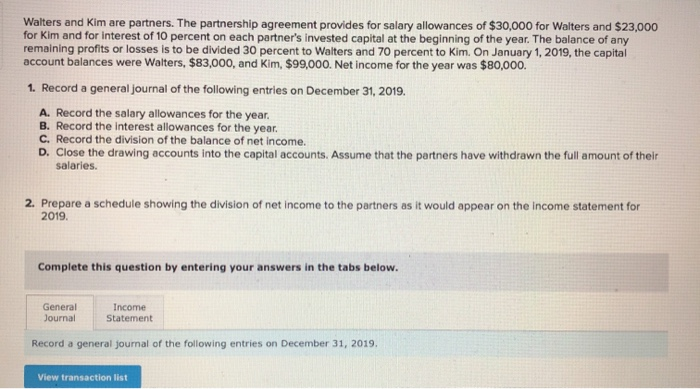

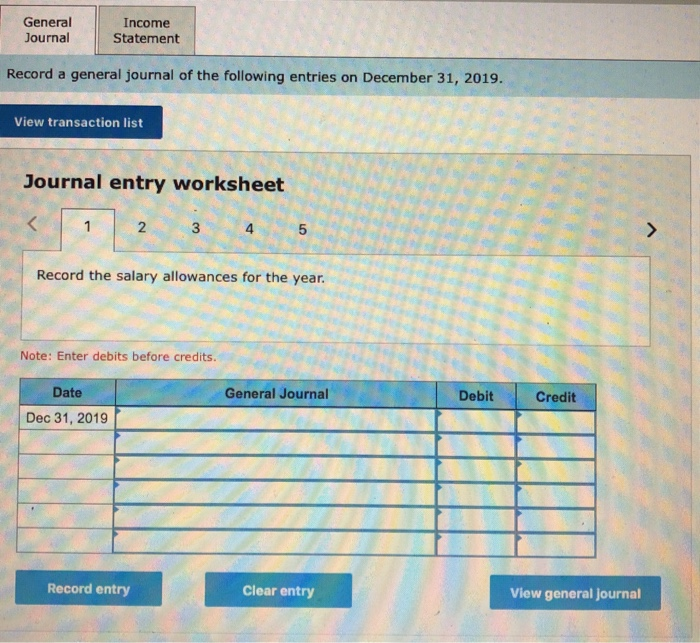

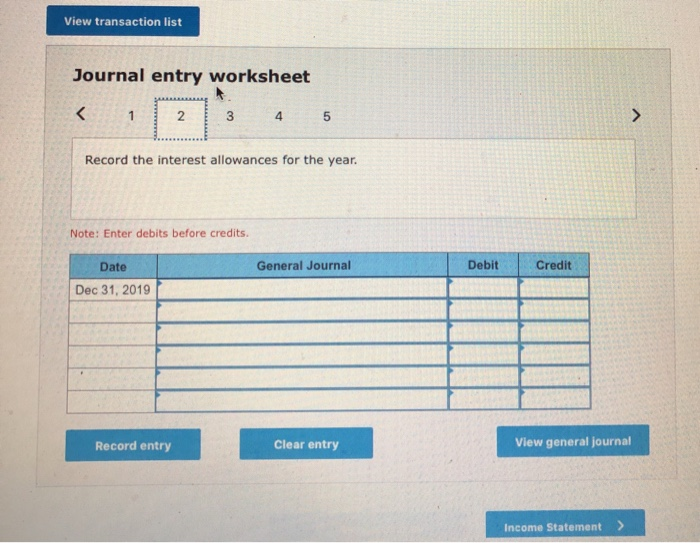

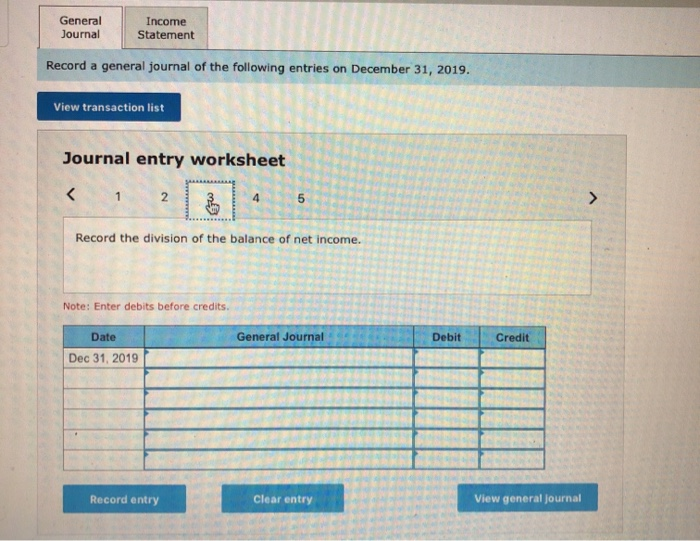

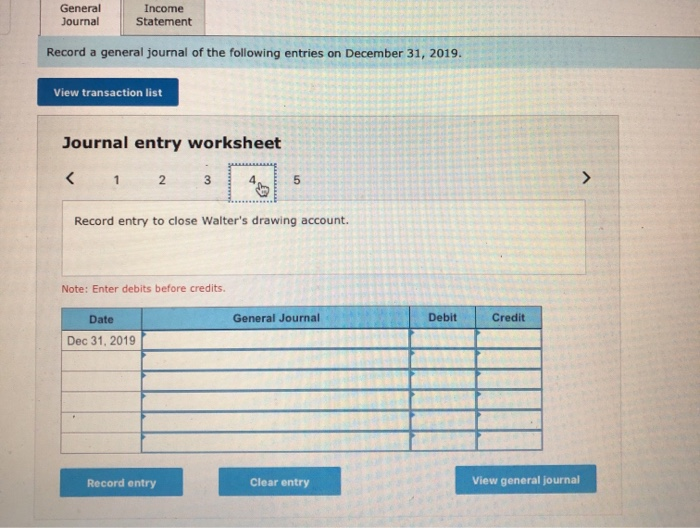

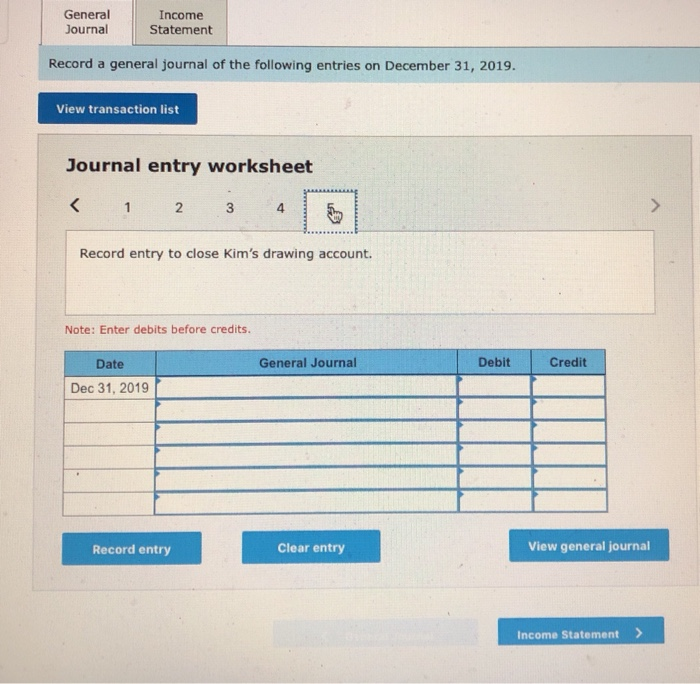

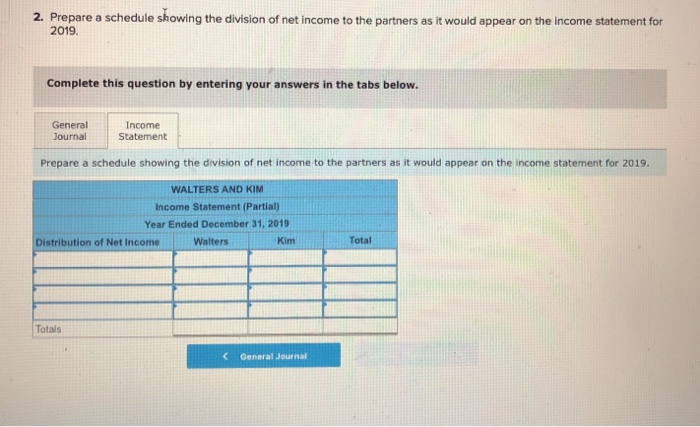

Walters and Kim are partners. The partnership agreement provides for salary allowances of $30,000 for Walters and $23,000 for Kim and for interest of 10 percent on each partner's invested capital at the beginning of the year. The balance of any remaining profits or losses is to be divided 30 percent to Walters and 70 percent to Kim. On January 1, 2019, the capital account balances were Walters, $83,000, and Kim, $99,000. Net income for the year was $80,000. 1. Record a general journal of the following entries on December 31, 2019. A. Record the salary allowances for the year. B. Record the interest allowances for the year. C. Record the division of the balance of net income. D. Close the drawing accounts into the capital accounts. Assume that the partners have withdrawn the full amount of their salaries. 2. Prepare a schedule showing the division of net income to the partners as it would appear on the income statement for 2019 Complete this question by entering your answers in the tabs below. General Income Journal Statement Record a general journal of the following entries on December 31, 2019. View transaction list General Journal Income Statement Record a general journal of the following entries on December 31, 2019. View transaction list Journal entry worksheet 1 2 3 4 5 > Record the salary allowances for the year. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2019 Record entry Clear entry View general Journal View transaction list Journal entry worksheet Record the interest allowances for the year. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2019 Record entry Clear entry View general journal Income Statement General Journal Income Statement Record a general journal of the following entries on December 31, 2019. View transaction list Journal entry worksheet Record the division of the balance of net income. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2019 Record entry Clear entry View general journal General Journal Income Statement Record a general journal of the following entries on December 31, 2019. View transaction list Journal entry worksheet Record entry to close Walter's drawing account. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2019 Record entry Clear entry View general journal General Journal Income Statement Record a general journal of the following entries on December 31, 2019. View transaction list Journal entry worksheet