Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Want to have this from ASPE perspective plz Ultra Incorporated (UI), a private company, is leasing a vehicle for the first time. You are the

Want to have this from ASPE perspective plz

Want to have this from ASPE perspective plz

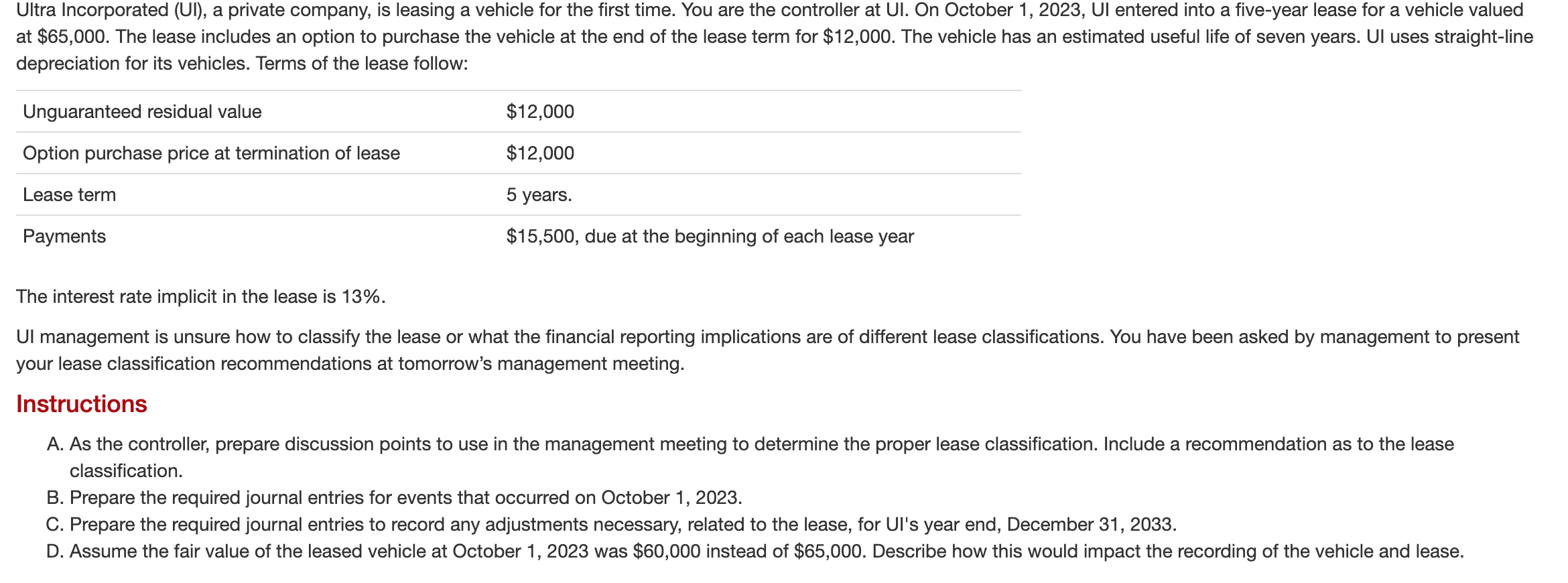

Ultra Incorporated (UI), a private company, is leasing a vehicle for the first time. You are the controller at UI. On October 1,2023 , UI entered into a five-year lease for a vehicle valued at $65,000. The lease includes an option to purchase the vehicle at the end of the lease term for $12,000. The vehicle has an estimated useful life of seven years. UI uses straight-line depreciation for its vehicles. Terms of the lease follow: The interest rate implicit in the lease is 13%. UI management is unsure how to classify the lease or what the financial reporting implications are of different lease classifications. You have been asked by management to present your lease classification recommendations at tomorrow's management meeting. Instructions A. As the controller, prepare discussion points to use in the management meeting to determine the proper lease classification. Include a recommendation as to the lease classification. B. Prepare the required journal entries for events that occurred on October 1, 2023. C. Prepare the required journal entries to record any adjustments necessary, related to the lease, for UI's year end, December 31,2033. D. Assume the fair value of the leased vehicle at October 1,2023 was $60,000 instead of $65,000. Describe how this would impact the recording of the vehicle and lease. Ultra Incorporated (UI), a private company, is leasing a vehicle for the first time. You are the controller at UI. On October 1,2023 , UI entered into a five-year lease for a vehicle valued at $65,000. The lease includes an option to purchase the vehicle at the end of the lease term for $12,000. The vehicle has an estimated useful life of seven years. UI uses straight-line depreciation for its vehicles. Terms of the lease follow: The interest rate implicit in the lease is 13%. UI management is unsure how to classify the lease or what the financial reporting implications are of different lease classifications. You have been asked by management to present your lease classification recommendations at tomorrow's management meeting. Instructions A. As the controller, prepare discussion points to use in the management meeting to determine the proper lease classification. Include a recommendation as to the lease classification. B. Prepare the required journal entries for events that occurred on October 1, 2023. C. Prepare the required journal entries to record any adjustments necessary, related to the lease, for UI's year end, December 31,2033. D. Assume the fair value of the leased vehicle at October 1,2023 was $60,000 instead of $65,000. Describe how this would impact the recording of the vehicle and lease

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started