Answered step by step

Verified Expert Solution

Question

1 Approved Answer

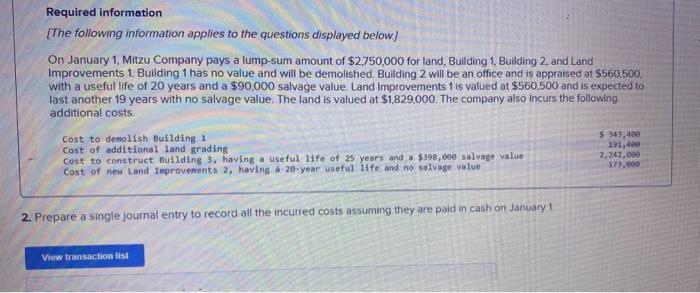

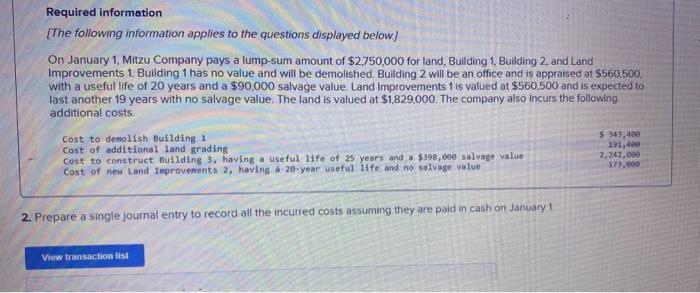

was [The following information applies to the questions displayed below] On January 1, Mitzu Company pays a lump-sum amount of $2,750,000 for land, Building 1,

was

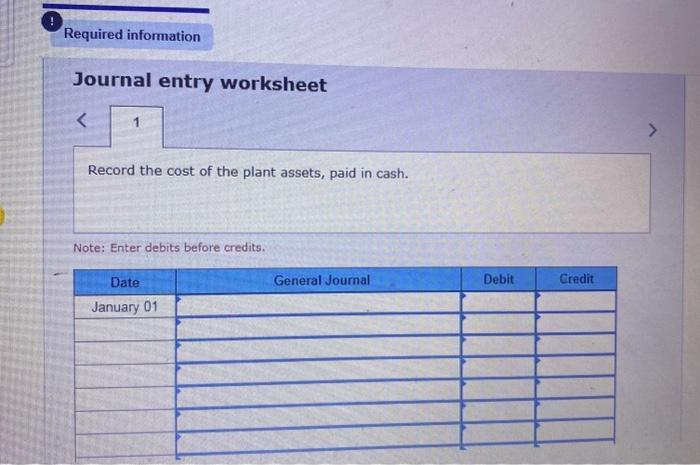

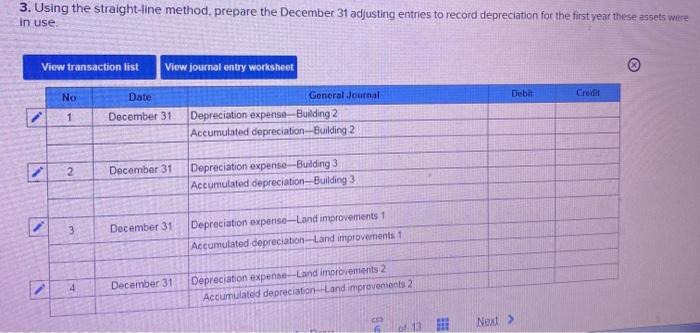

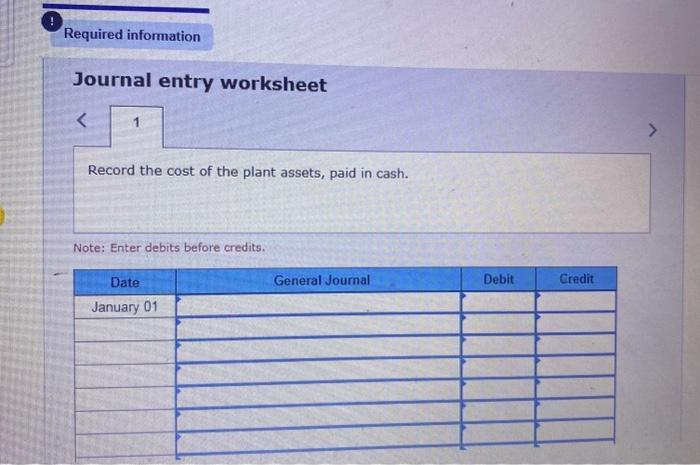

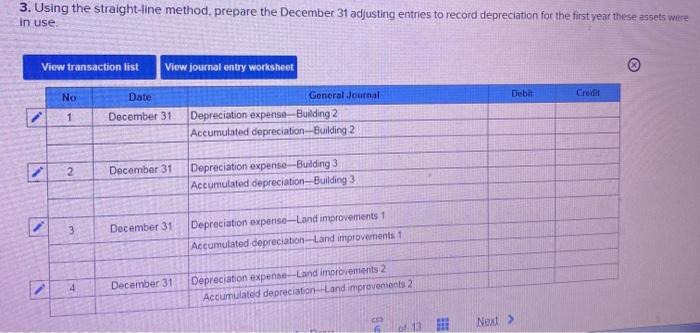

[The following information applies to the questions displayed below] On January 1, Mitzu Company pays a lump-sum amount of $2,750,000 for land, Building 1, Bulding 2, and Land Improvements 1. Building 1 has no value and will be demolished. Bulding 2 will be an office and is appraised at $560,500. with a useful life of 20 years and a $90.000 salvage value. Land Improvements 1 is valued at $560.500 and is expected to last another 19 years with no salvage value. The land is valued at $1,829.000. The company also incurs the following additional costs. Cost to denolish Building 1 Cost of additional land grading cost to construct Eullding 3, having a useful 11fe of 25 years and a 5398,000 salvage value cost of nes Land Inprovements 2 , hoving a 20-year useful life and no salvage value 2. Prepare a single journal entry to record all the incurred costs assuming they are paid in cash on January 1 Journal entry worksheet Record the cost of the plant assets, paid in cash. Note: Enter debits before credits. 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started