Answered step by step

Verified Expert Solution

Question

1 Approved Answer

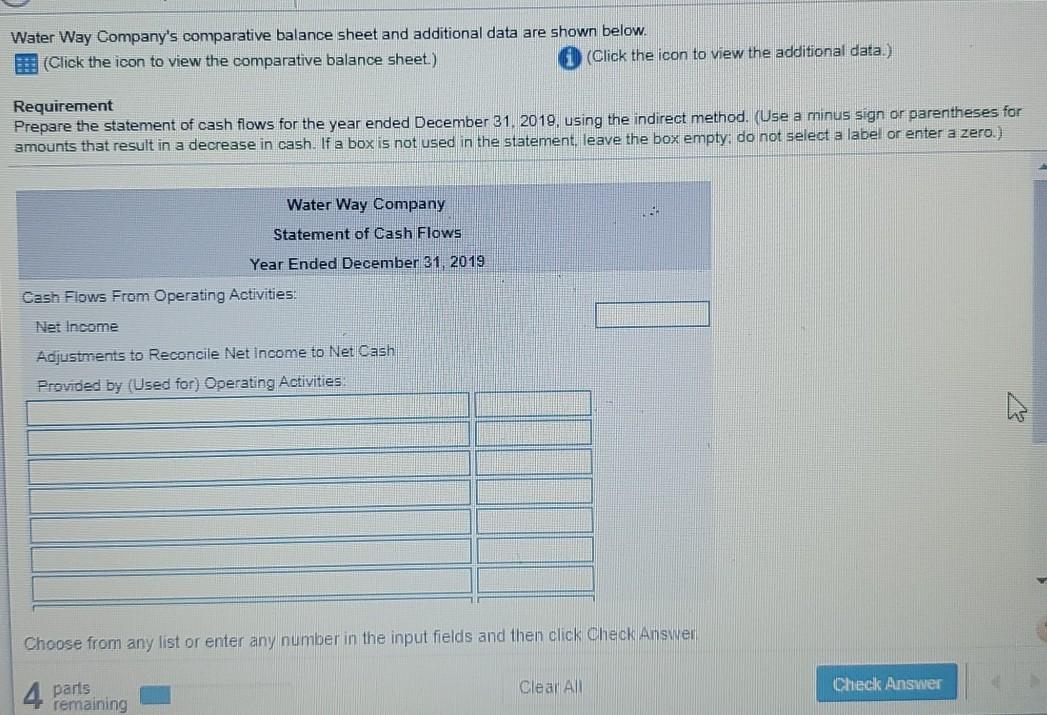

Water Way Company's comparative balance sheet and additional data are shown below. (Click the icon to view the comparative balance sheet.) (Click the icon to

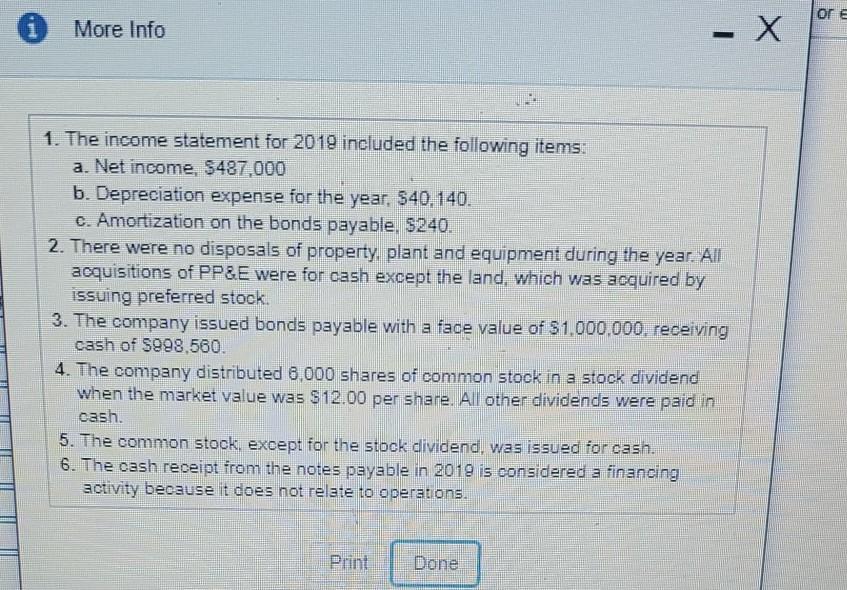

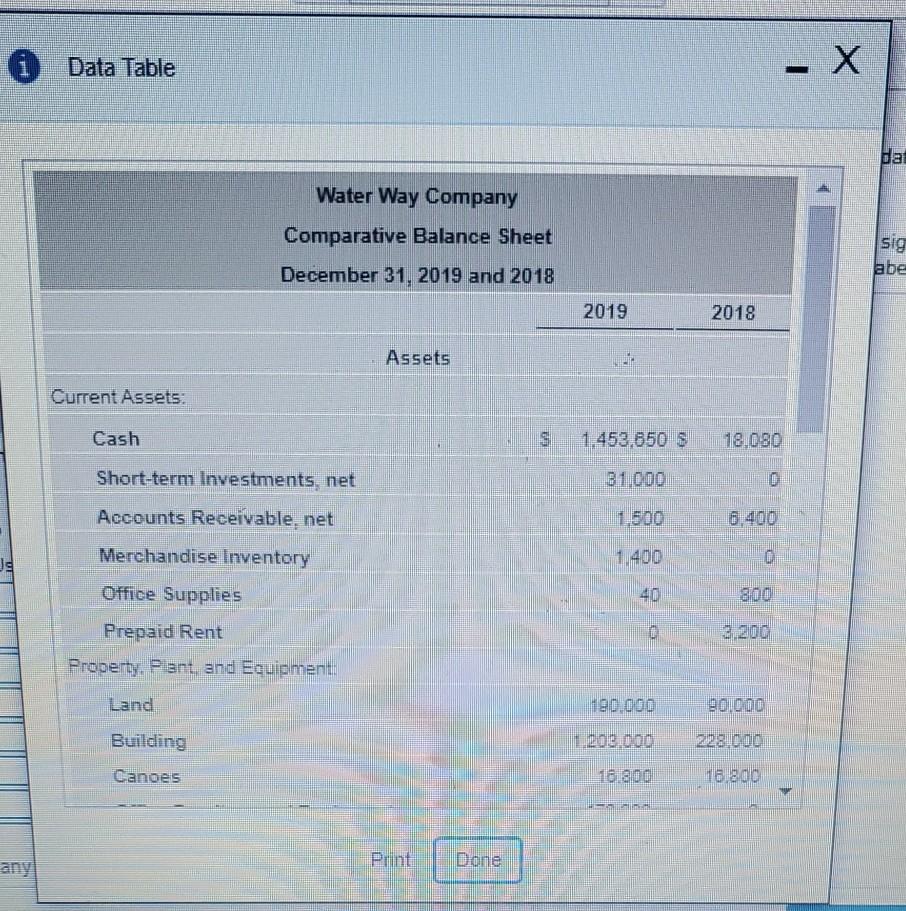

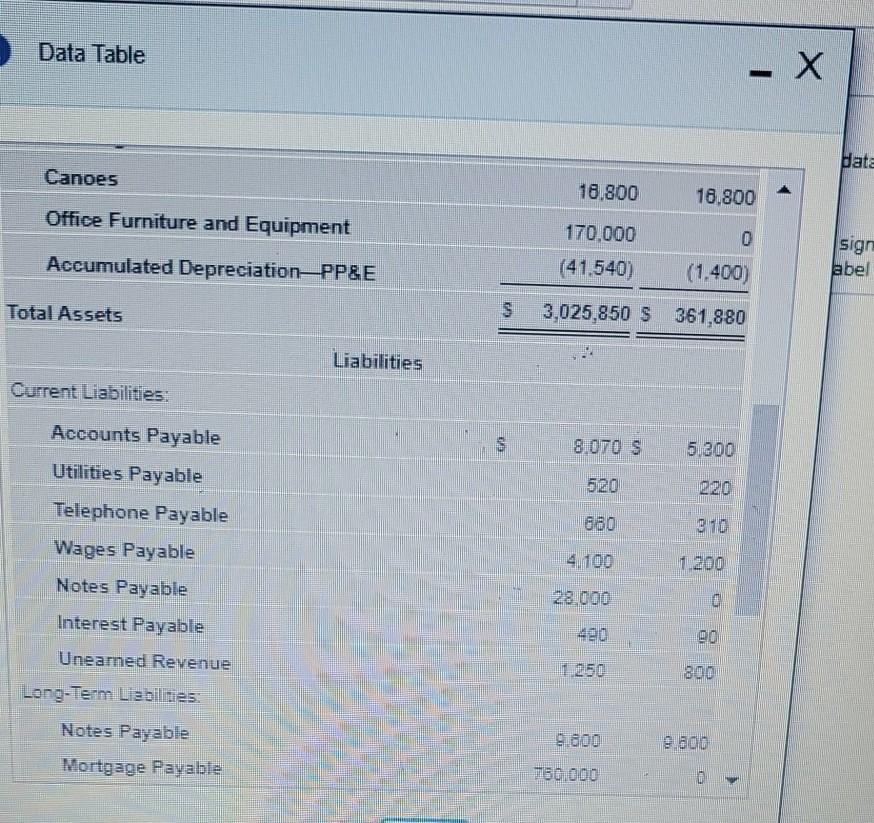

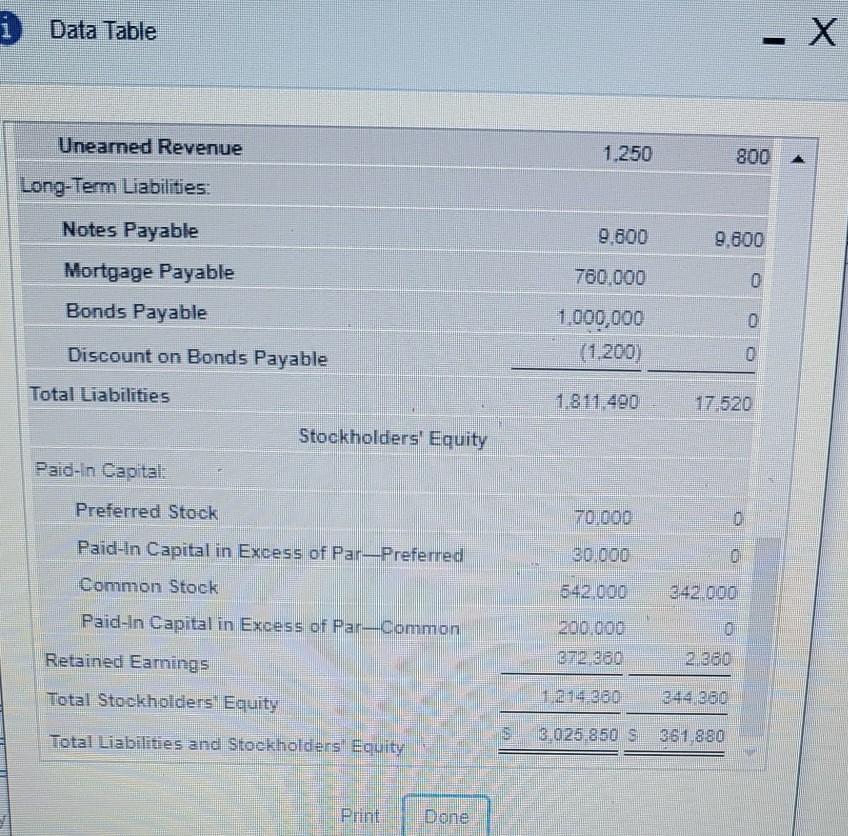

Water Way Company's comparative balance sheet and additional data are shown below. (Click the icon to view the comparative balance sheet.) (Click the icon to view the additional data.) Requirement Prepare the statement of cash flows for the year ended December 31, 2019, using the indirect method. (Use a minus sign or parentheses for amounts that result in a decrease in cash. If a box is not used in the statement, leave the box empty: do not select a label or enter a zero.) Water Way Company Statement of Cash Flows Year Ended December 31, 2019 Cash Flows From Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by (Used for) Operating Activities Choose from any list or enter any number in the input fields and then click Check Answer Clear All Check Answer 4 parts remaining Data Table - X m Water Way Company Comparative Balance Sheet sig abe December 31, 2019 and 2018 2019 2018 Assets Current Assets: Cash 1.453,650 $ 18.080 Short-term Investments, net 31,000 1.500 6.400 Js 0 Accounts Receivable, net Merchandise Inventory Office Supplies Prepaid Rent Property. Plant and Equipment: 40 Land 180.000 00:00 Building 1.200.000 228.000 Canoeis 16.2100 "76.800 . any Done Data Table - X Hata Canoes 18.800 16.800 Office Furniture and Equipment 0 170,000 (41.540) Accumulated Depreciation PP&E sign abel (1.400) Total Assets S 3,025,850 S 361,880 Liabilities Current Liabilities: TO 8.OTOS 51200 020 Accounts Payable Utilities Payable Telephone Payable Wages Payable Notes Payable Interest Payable 680 4.100 1 200 28.000 00 800 Uneamed Revenue Long-Term Liabilizes: Notes Payable Mortgage Payable 9000 e 500 150.000 i Data Table -X Unearned Revenue 1.250 800 Long-Term Liabilities: Notes Payable 2.600 9.800 700.000 0 Mortgage Payable Bonds Payable O 1,000,000 (1 200) Discount on Bonds Payable 0 Total Liabilities 1.811.490 17.520 Stockholders' Equity Paid In Capital Preferred Stock 70,000 Paid-In Capital in Excess of Par-Preferred 80.000 a Common Stock 642.000 342.000 Paid-in Capital in Excess of Par-Common Retained Earnings 2.380 Total Stockholders Equity 644 350 Total Liabilities and Stockholders Equity 3.025.850 S 361880 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started